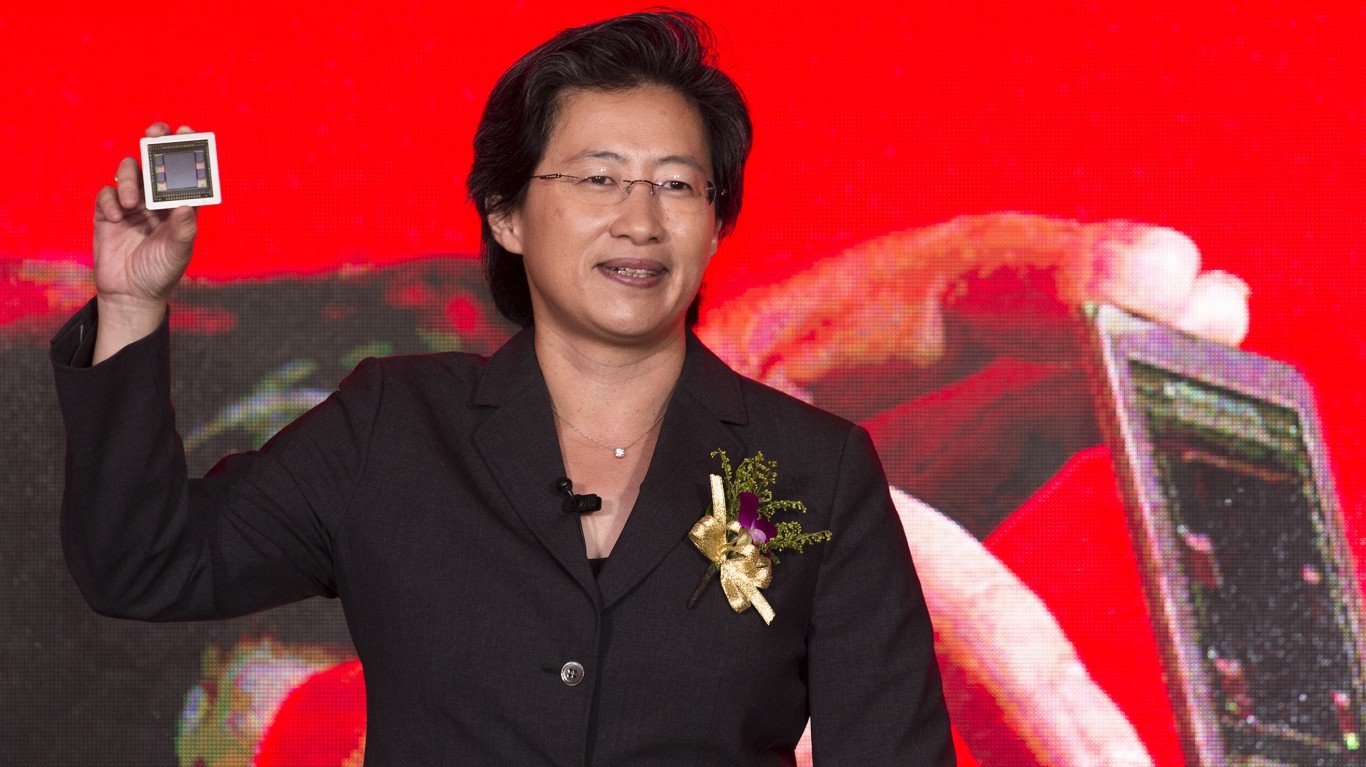

"As to whether Advanced Micro Devices will be able to clock in 35% in annualized revenue growth over the next five years (on the high end) remains the big question mark. If the next generation of MI300 accelerators sells well and corporate adoption of AI accelerates further, I think there's still a chance that sales will surprise to the upside."

"In short, the company is firing on all cylinders, but the valuation, at least in my view, has had ample opportunity to catch up, with shares of Advanced Micro Devices currently going for a rather lofty 126 times trailing price-to-earnings (P/E) multiple at the time of this writing. Looking ahead, the shares go for 40 times forward P/E, making them seem cheaper, but, at this juncture, I think there are better deals to be had in the AI scene"

Advanced Micro Devices is positioned as a major AI chip competitor with potential to challenge Nvidia. Company leadership characterizes AI as the "right gamble," and the next-generation MI300 accelerators could drive significant demand and revenue upside. Achieving 35% annualized revenue growth over five years is uncertain and depends on MI300 adoption and broader corporate AI spending. Current valuation is elevated at about 126 times trailing P/E and roughly 40 times forward P/E, reducing near-term upside. Portfolio strategy can include both Advanced Micro Devices and Nvidia, though rotational market dynamics may create better opportunities in more defensive names.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]