#wealth-building

#wealth-building

[ follow ]

#investing #personal-finance #financial-planning #dividend-stocks #investment-strategies #passive-income

fromSilicon Canals

2 weeks agoThe quiet morning ritual that separates millionaires from everyone else - Silicon Canals

The first light hasn't broken yet, but somewhere in London, New York, or Silicon Valley, a millionaire is already awake. The coffee is brewing, steam curling up in the darkness. Outside, the streets are empty except for the occasional delivery truck. Inside, there's just the quiet hum of possibility-those precious hours before the world starts demanding attention. I discovered this myself when I started running my own company.

Startup companies

fromSubstack

1 month agoIs It Possible to Invest Ethically?

"Ethical investing" often serves more as a form of virtue signaling than as a mechanism for actual change. It feels good. It sounds good. It gives you the sense that you're doing something. But feeling aligned and making an impact are not the same thing. Socially Responsible Investing has gotten more sophisticated over the years. Known by many names like ESG, Impact Investing, Mission-driven investing, what we're talking about is deliberately excluding companies from your investment strategy

Retirement

from24/7 Wall St.

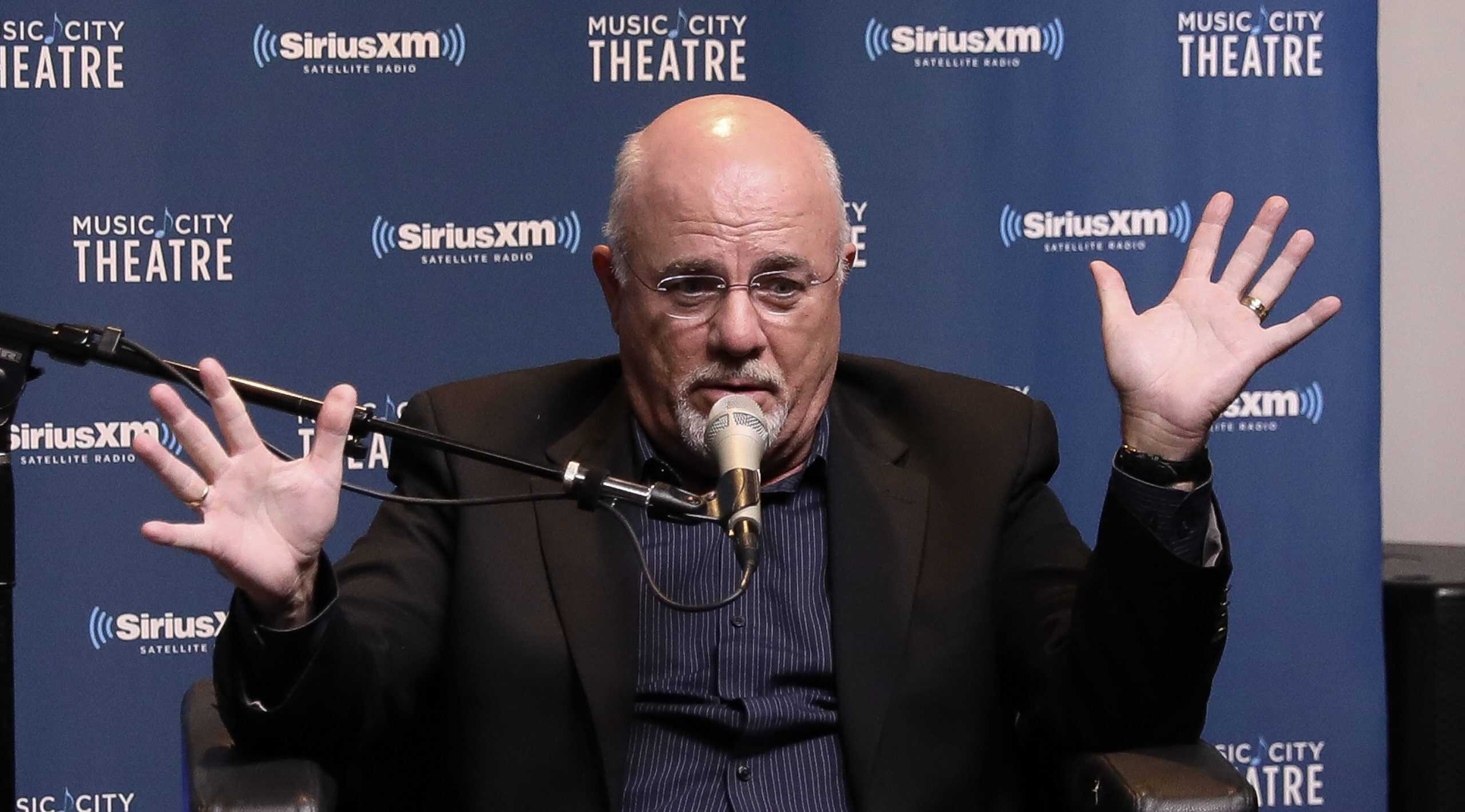

2 months agoDave Ramsey Reveals the Mindset Shift Behind Building Wealth

He says wealthy people consistently focus on solutions, improvement, and long term opportunity. People who struggle financially often ask limiting questions that keep them stuck. Ramsey believes mindset is a core part of building wealth. According to Ramsey, successful people regularly ask how they can grow, what skills they can learn, and how they can move forward even when times are tough. These questions push them toward action and responsibility. By focusing on what they can control, they create habits that steadily build financial stability.

Business

fromMedium

2 months ago5 Books to Read This Winter (Designers Edition)

Winter is the perfect time to curl up with a good book, sip on some hot cocoa (or coffee, if you're me), and get smarter. But hey, let's not limit ourselves to design books alone. As a designer, growth isn't just about mastering tools, it's about mastering life and the skills that can help you elevate your work and your hustle. So, here's a list of books that will level up your game in ways you didn't see coming.

Books

Social justice

fromNon Profit News | Nonprofit Quarterly

3 months agoDefending Black Land in the South: A Conversation Between Steve Dubb and Jennie Stephens - Non Profit News | Nonprofit Quarterly

Heirs' property and fractionated ownership created vulnerabilities and practical challenges for Black families who acquired land as wealth and homesteads after emancipation.

fromFortune

5 months agoMillennial investor behind Deliveroo, Scale AI and Figma made millions in his 20s-he shares how Gen Z can spot a startup that'll make them rich too

Back when Deliveroo was a tiny London-based platform, with just a few restaurants in its repertoire, there was one man who believed it'd go on to become the multi-billion-dollar brand it is today: Martin Mignot. "They had eight employees. They were in three London boroughs. Overall, they had a few 1000 users to date, so it was very, very early,"

Venture

fromFortune

7 months agoPenny Pennington of investment advice firm Edward Jones: 'We're a health and wellbeing company'

Diane Brady highlights how the U.S. economy remains resilient despite the ongoing tariff wars. Market reactions indicate mixed sentiments about future leadership, like fears surrounding President Trump's potential actions against Federal Reserve Chair Jerome Powell.

Business

fromYahoo Finance

7 months agoSomeone Asked, 'How Hard Would It Actually Be For A Millionaire To Start From 0 Again?' No Access To Old Networks, No LinkedIn, Nothing

The biggest assets are your contact list and your reputation. If I know people, I can ask them for work, get credit, find buyers. Without that, you're just another person.

Wearables

Startup companies

from24/7 Wall St.

7 months ago3 Stocks to 3X in 3 Years

Long-term investing outperforms short-term trading through compounding returns and stable growth.

Quality companies are essential, resonating with Buffett’s strategy of long-term holding.

High-risk stocks can yield significant rewards, but require careful evaluation to mitigate risks.

Wellness

fromBusiness Insider

8 months agoI've been a financial planner for over 10 years. Here are the 6 most useful lessons I've learned from my wealthiest clients.

Generosity, reliance on others, and healthy habits are key strategies for wealth-building.

Wealthy clients share common financial behaviors that anyone can adopt.

Retirement

from24/7 Wall St.

9 months agoI want to retire soon and own a single stock is worth millions - should I cash it all out or hold on for my kids' step-up basis?

Stocks can build wealth without management burdens.

Heavy concentration in a single stock poses risks.

Community advice includes tax-saving strategies.

The Redditor is in a strong financial position for retirement.

Retirement

from24/7 Wall St.

10 months agoMy dream has been to retire and spend $125,000 per year on the lifestyle my family wants - have we saved enough?

One must carefully assess financial readiness before retiring, particularly for a lifestyle full of travel and luxury.

Creating multiple budget scenarios helps in evaluating retirement viability.

[ Load more ]