#wage-growth

#wage-growth

[ follow ]

#unemployment #inflation #labor-market #bank-of-england #labour-market #uk-economy #uk-labour-market #job-market

fromFortune

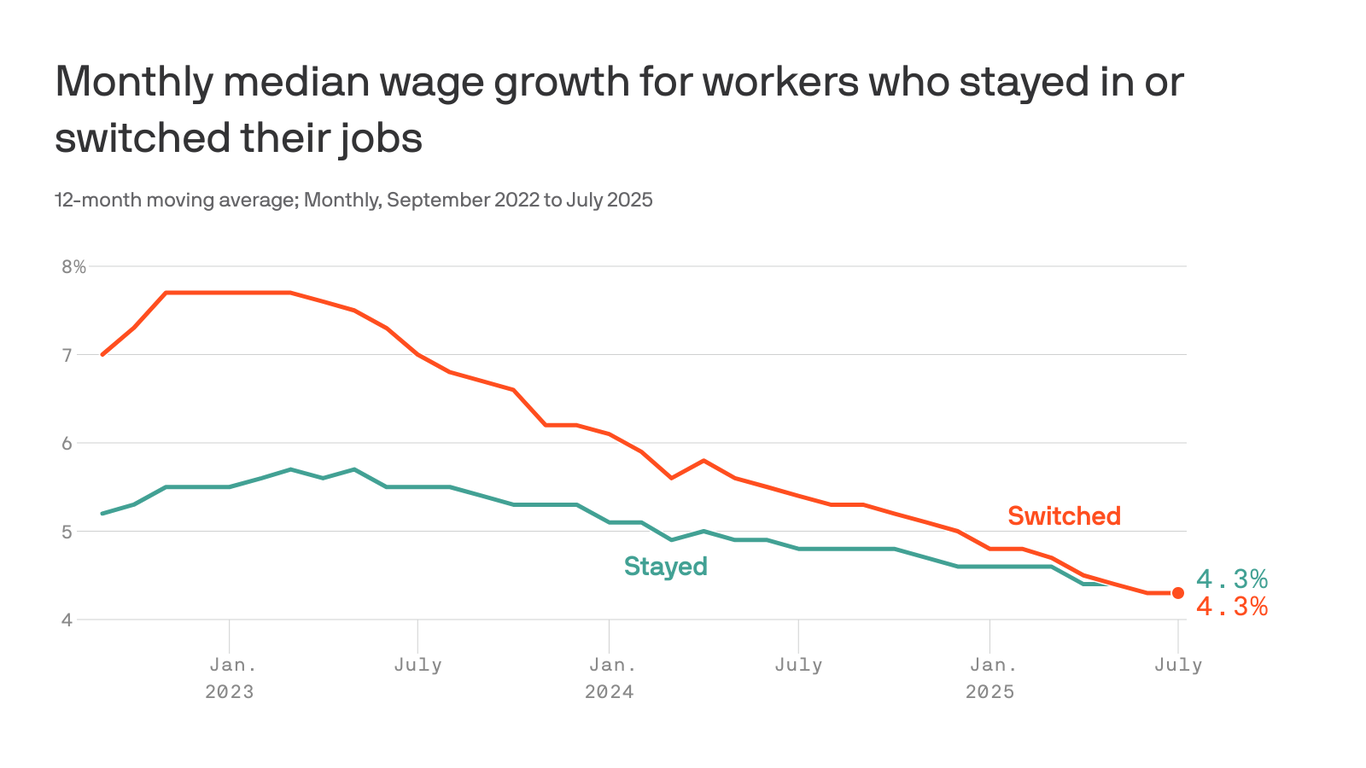

1 week agoJob hopping isn't really worth it anymore, finds new data from ADP-unless you're a miner or builder | Fortune

and it appears that the job-hopping hack is unwinding.ADP's latest data suggests that there are now only a couple of industries where competition between employers results in better pay: industries where demand for skilled labor outweighs supply. A pay trends report shared with Fortune yesterday from the private payroll company showed that in January, year-over-year pay growth for job-hoppers slowed to 6.4%, down from 6.6% in December.

Business

UK news

fromLondon Business News | Londonlovesbusiness.com

1 month agoUK vacancies fall for sixth straight month - London Business News | Londonlovesbusiness.com

UK job vacancies fell for the sixth consecutive month in December 2025, raising competition to 2.3 jobseekers per vacancy while average pay continued rising.

fromBusiness Insider

1 month agoNvidia's Jensen Huang says it's a good time to be a plumber - and not just because it's an AI-proof job

Is AI coming for your job? If you work in construction or plumbing, that's perhaps not a question you need to worry about. Speaking at the World Economic Forum on Wednesday, Nvidia CEO Jensen Huang said it was a great time to be a tradesperson because the AI boom is creating demand for manual labor to build data centers. "It's wonderful that the jobs are related to tradecraft and we're going to have plumbers and electricians and construction and steelworkers," he said in a conversation with BlackRock CEO Larry Fink in Davos, Switzerland.

Artificial intelligence

fromwww.npr.org

2 months agoEconomic analyst says consumer spending has been resilient despite uncertainty

Slower job growth. Just look at the November employment report - very soft if you average the last couple of months. But real earnings growth, average hourly earnings growth, up 3.7% on a year-on-year basis. And that helps to weather a little bit of this inflation pressure that we are feeling right now. And I think that's the true storyline.

US news

fromwww.independent.co.uk

2 months agoUnemployment rate rises to 5.1% to hit ten-year high outside of Covid

Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging. At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

UK news

fromwww.cbc.ca

2 months agoCanadian unemployment rate falls to 6.5% | CBC News

Canada's unemployment rate dropped to 6.5 per cent and the economy gained 54,000 jobs in November, Statistics Canada said on Friday. The jobless rate ticked down several points from October's 6.9 per cent after trending upwards for most of the year, even hitting 7.1 per cent in September. Most of the jobs added to the economy in November were part time and largely driven by employment gains among young people between the ages of 15 to 24.

Canada news

UK news

fromLondon Business News | Londonlovesbusiness.com

3 months agoHiring falls back further ahead of Reeves Budget - London Business News | Londonlovesbusiness.com

London's labour market showed tentative stabilisation in October with reduced permanent placements, milder temp billings contraction, increased candidate supply, and softer pay growth.

fromLondon Business News | Londonlovesbusiness.com

4 months agoVacancies hit lowest level as employers wait for Budget next month - London Business News | Londonlovesbusiness.com

The UK jobs market showed further signs of cooling in September as advertised vacancies dropped -2.4% month-on-month to 826,205 jobs, echoing ONS data that highlights a 39th consecutive period of vacancy decline, according to the latest UK Job Market Report by job matching platform Adzuna. This means open roles are now -4.1% lower than a year ago, and alarmingly, September records the lowest vacancy level this year, suggesting employers are continuing to scale back hiring plans after a strong start to the year.

UK news

UK politics

fromLondon Business News | Londonlovesbusiness.com

4 months agoPressure mounts on Reeves ahead of the Autumn Budget - London Business News | Londonlovesbusiness.com

A softening labour market with rising unemployment and cooling wage growth weakens hiring, especially for young workers, and complicates fiscal policy.

UK news

fromLondon Business News | Londonlovesbusiness.com

4 months agoLondon workers show cautious optimism despite cracks in the jobs market - London Business News | Londonlovesbusiness.com

London workers show resilience and confidence in their skills despite perceptions of a worsening, highly competitive labour market and mixed employment and wage changes.

fromAxios

5 months agoMarion County worker wages increase

By the numbers: Marion County's paycheck increase brought Indy's average weekly wages to $1,779, or around $137 more a week than last year's average pay, per BLS' preliminary numbers. In Hamilton County, average weekly wages rose 2.6%, or around $38, to $1,476. Hendricks County wages rose 2.2%, or around $35, to $1,083. Caveat: The data tracks where people earn their money, not where they live.

Business

fromLondon Business News | Londonlovesbusiness.com

5 months agoBank of England keeps rates on hold as inflation proves sticky - London Business News | Londonlovesbusiness.com

In a move that comes as no surprise, the Bank of England's Monetary Policy Committee (MPC) has voted to keep interest rates unchanged at 4%. The decision reflects the MPC's concern that inflation, which held steady at 3.8% in August, remains too far above the 2% target to justify an early easing. Persistent wage growth and services inflation are the key reasons for this cautious stance, with underlying price pressures proving slow to unwind.

UK news

fromFortune

5 months agoADP says job growth was 'whipsawed' in August, with rare warning on AI and consumer jitters

"The year started with strong job growth, but that momentum has been whipsawed by uncertainty," Nela Richardson, ADP's chief economist, said in the press release.She cited a mix of factors that are weighing on hiring decisions, "including labor shortages, skittish consumers, and AI disruptions."ADP's August report is among the first to namecheck AI disruptions, a rare admission that artificial intelligence is now beginning to reshape hiring sentiment.

Business

#california

Silicon Valley real estate

fromThe Mercury News

8 months agoWhere are Californians getting the biggest pay raises?

California's wage growth varies significantly with certain counties experiencing much higher pay hikes, notably in the Bay Area.

Economic conditions show a disparity in wage increases across California counties, influenced by the tech sector's dynamics.

[ Load more ]