Tech industry

fromAxios

19 hours agoTrump teases AI electricity pledge. Here's when tech giants will sign it

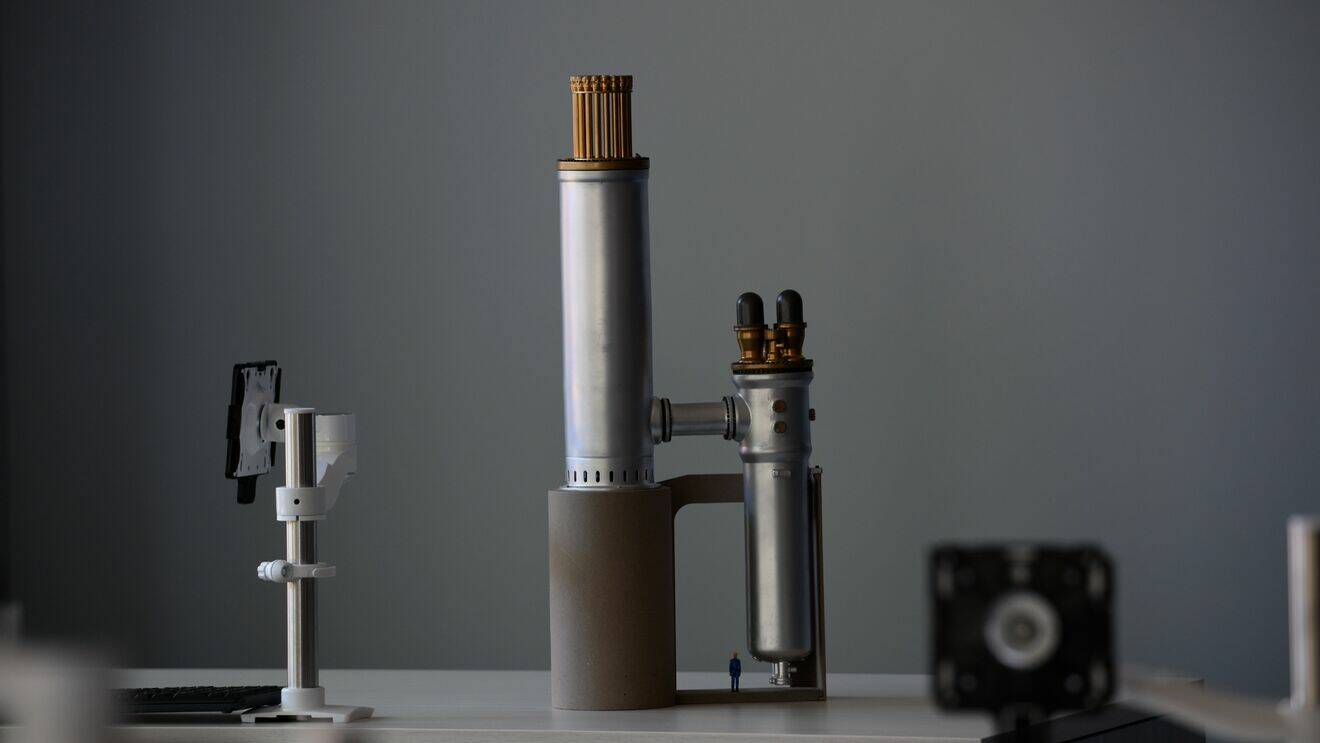

Major tech companies pledge to fund their own power infrastructure for AI operations, preventing consumers from bearing energy costs through a Trump-negotiated ratepayer protection agreement.