"The AI revolution has a power problem. Training GPT-4 required as much electricity as 10,000 U.S. homes use in a year. Multiply that by thousands of models being trained simultaneously, plus billions of daily queries. The result? A data center energy boom reshaping power generation. Facilities drawing 100+ megawatts each, with some hyperscale campuses approaching 1 gigawatt (the equivalent of small cities)."

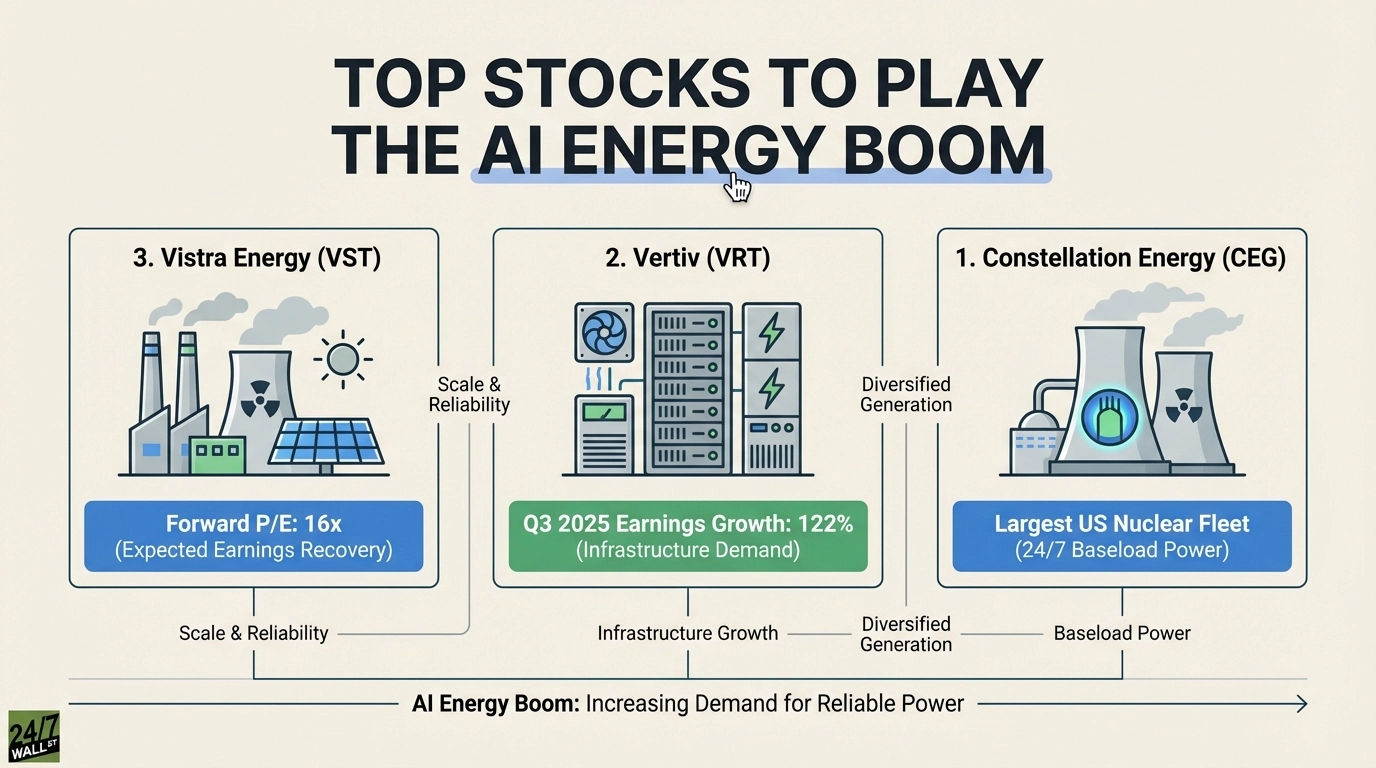

"Vistra Energy (NYSE:VST) brings $54.2 billion in market cap and a diversified generation portfolio spanning natural gas, nuclear, and renewable assets. Q3 2025 revenue hit $4.97 billion with 21% operating margin, demonstrating efficient operations critical for competing on cost with data centers. Five-year price performance: up 695% since 2021. But recent volatility shows the stock down 19% over the past six months and down 4% year-to-date, suggesting investors question whether the AI energy thesis can sustain premium valuations."

"Vistra's 58x trailing P/E looks stretched until you see the forward P/E of 16x. Earnings are expected to jump 49% this year, which helps drive that compression. The company generated $5.21 billion in EBITDA over the trailing twelve months with $3.99 billion in operating cash flow. The challenge? Recent quarterly earnings dropped 66.7% year-over-year, and revenue fell 20.9%. These declines reflect cyclical pressures in power markets, but forward-looking metrics suggest the AI demand wave will reverse these trends."

AI model training and inference consume massive electricity, with GPT-4 using as much power as 10,000 U.S. homes in a year. Tens of thousands of models and billions of daily queries are driving a data center energy boom that demands hundreds of megawatts per facility and brings hyperscale campuses close to one gigawatt. Suppliers of reliable, scalable power infrastructure are experiencing strong demand. Vistra Energy, with natural gas, nuclear, and renewables, posted strong revenue and margins but showed recent quarterly earnings and revenue declines. Forward P/E, earnings growth expectations, institutional ownership, and price targets indicate potential upside, while execution risk remains.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]