Artificial intelligence

fromEngadget

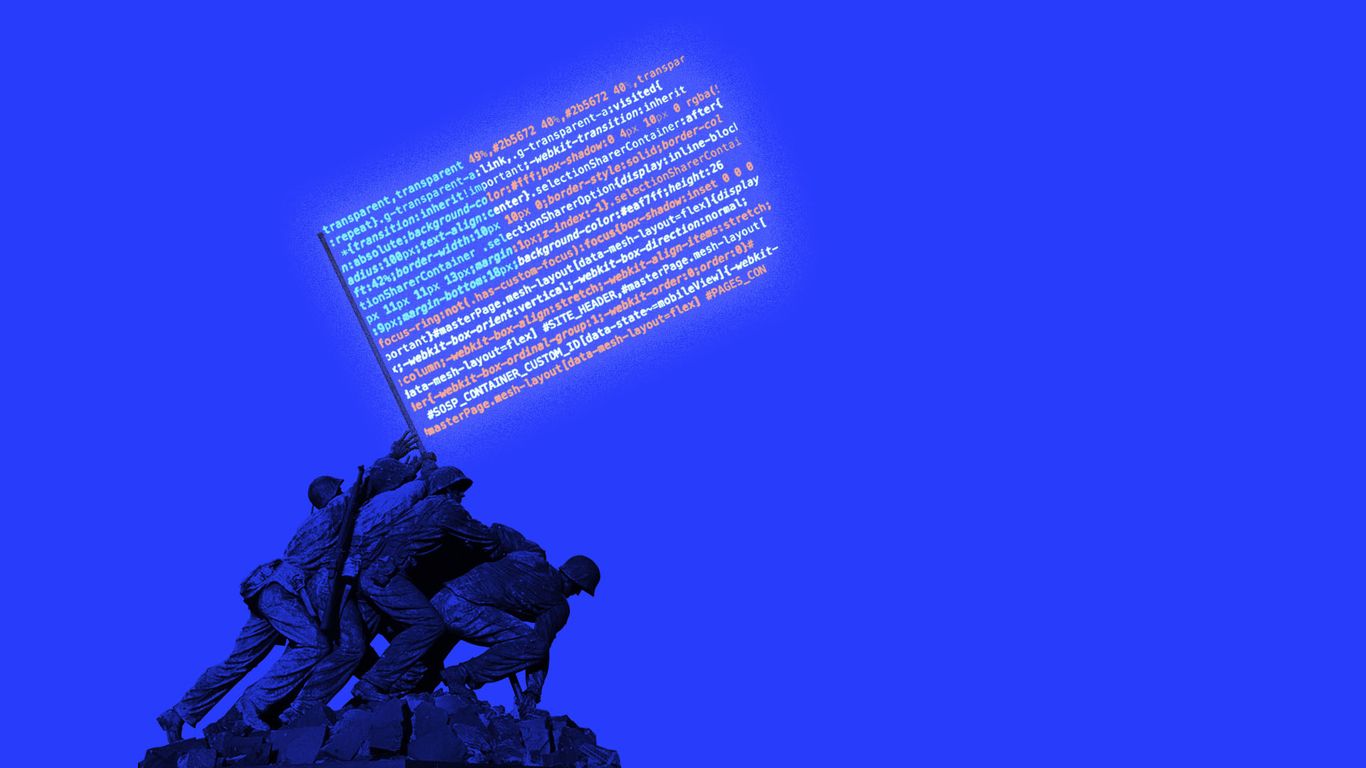

2 days agoThe US will send Tech Corps members to foreign countries in its latest push for AI dominance

The Peace Corps launched Tech Corps to deploy AI-skilled volunteers abroad to support agriculture, education, health, and economic development while advancing U.S. AI influence.