"UK Savings Week is a timely reminder of the importance of setting money aside for a rainy day. But building long-term wealth goes far beyond simply squirrelling away cash. It requires a strategic approach, a focus on growth, and a willingness to think long-term, especially in today's volatile and often uncertain economic environment. By combining disciplined savings habits with smart investing principles, you can turn short-term discipline into long-lasting financial security."

"The old adage still holds true: the best day to invest was yesterday; the second-best day is today. Time is one of the most powerful tools available to investors. The earlier you start, the more opportunity your money has to grow through compounding, where earnings generate further earnings. Even small, consistent contributions made over decades can have a profound impact. It's also important to focus on long-term objectives rather than short-term market fluctuations."

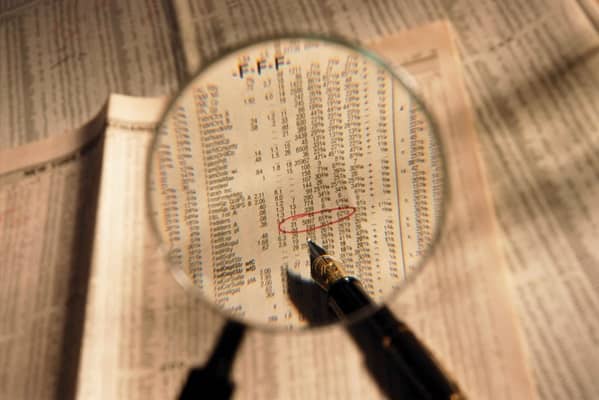

"Cash may feel safe, but over time it can lose value in real terms due to inflation. At Saxo, we compared returns from a basic FTSE tracker fund with cash over the past decade. The iShares Core FTSE 100 UCITS ETF nearly doubled in value, around a 100% gain, while cash returns were just 22-28%. Investing, even in a simple index fund, can significantly outperform leaving money idle."

Start early to maximize the power of compound growth, since time allows earnings to generate further earnings and small regular contributions accumulate significantly over decades. Maintain a long-term focus and avoid impulsive reactions to short-term market volatility, enabling investments to weather downturns and benefit from historical upward trends. Allocate savings beyond cash into diversified growth assets such as index funds or ETFs to combat inflation and enhance returns. Simple, low-cost, diversified investments can substantially outperform holding cash. Discipline in saving, combined with strategic investing, converts short-term habits into enduring financial security.

Read at London Business News | Londonlovesbusiness.com

Unable to calculate read time

Collection

[

|

...

]