"Linear TV continues to falter Between comparisons to the Summer Olympics and the US presidential race last year, 2025 was always going to feel like a letdown, especially during Q3. But it's still surprising to see just how much margins have dropped. It seems like double digits across the board. For Paramount Skydance, advertising revenue declines led the company to fall 12% in its TV revenue year over year."

"Warner Bros. Discovery, which hosted the Olympics in international territories on HBO Max, faced an even bigger decline of 22% in linear TV. And Disney, which starts its fiscal calendar a quarter early (and, thus, already lives in the future), posted a 16% YOY decline in linear network revenue for Q3 and a 12% decline for the entirety of 2025."

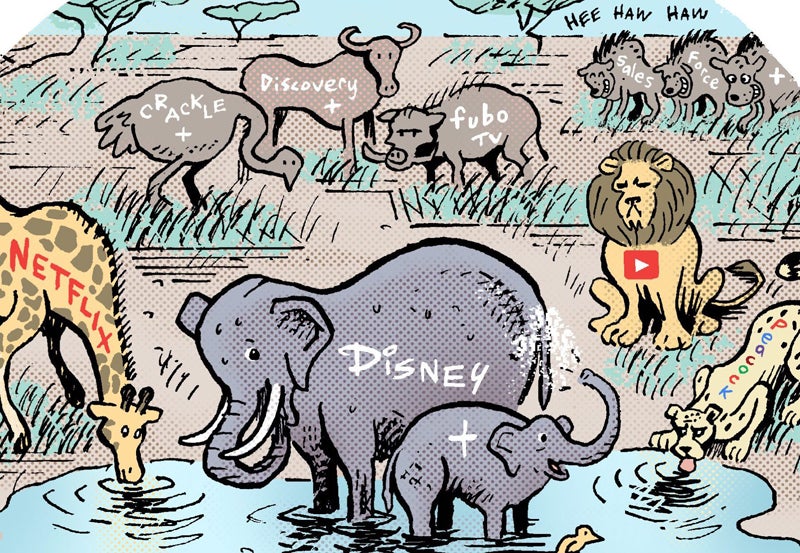

Third-quarter financial disclosures often feel liminal because they are released near year-end without actual end-of-year insights. Linear television advertising revenues dropped sharply in Q3, with margins falling into double digits across major broadcasters. Paramount Skydance's TV advertising revenue declined 12% year over year, Warner Bros. Discovery saw a 22% decline in linear TV, and Disney reported a 16% year-over-year drop in linear network revenue for Q3 and a 12% decline for all of 2025. Streaming revenue growth, including AVOD and direct-to-consumer platforms, is offsetting some linear declines. Disney's direct-to-consumer revenue is about three times its global linear network revenue.

Read at AdExchanger

Unable to calculate read time

Collection

[

|

...

]