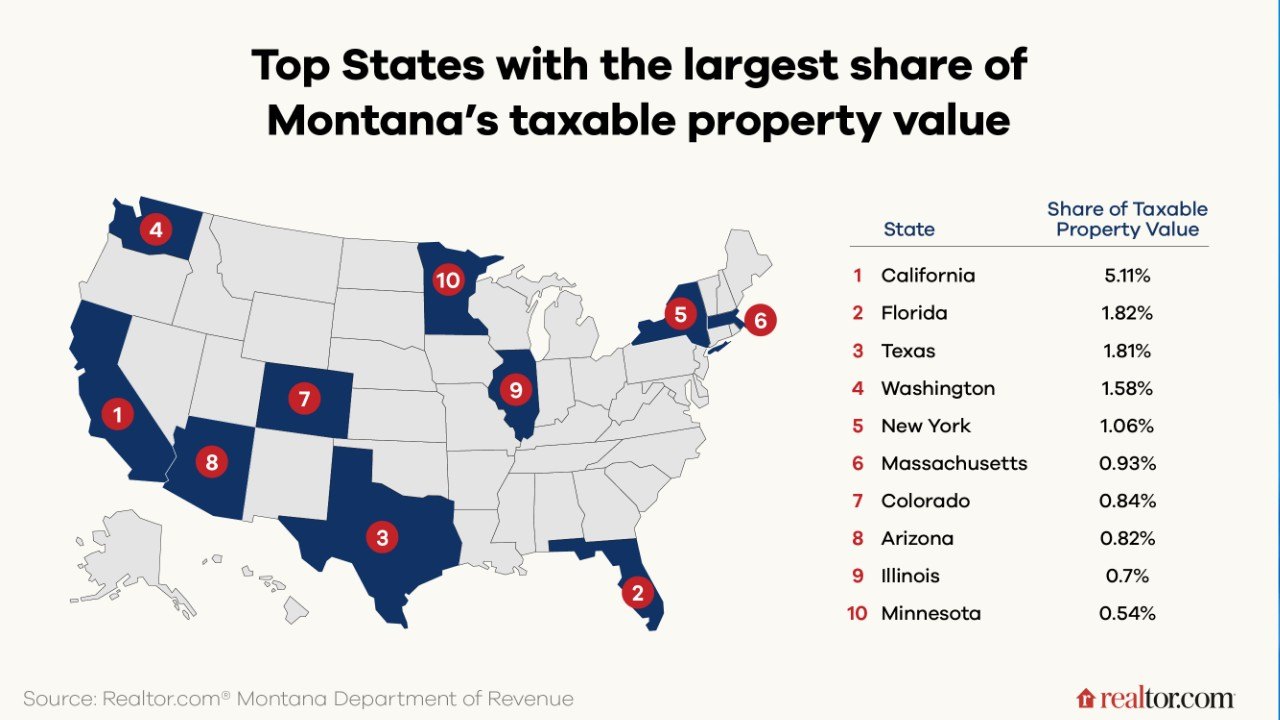

"The imbalance between Californian property ownership and tax contributions has sparked a major property tax reform in Montana, aiming to shift the tax burden to second-home owners."

"With high out-of-state purchases, especially from California, Montana has seen a boom in vacation homes, driving up property prices and affecting local residents' affordability."

Californian buyers have increasingly invested in Montana real estate, owning over $9.5 billion in residential properties, yet their tax contributions account for only 3.54% of the total residential property tax revenue. This imbalance has led to significant property tax reforms aimed at redistributing tax burdens from full-time residents to second-home owners, particularly those with expensive properties. While the influx of out-of-state buyers boosted Montana's housing market during the pandemic, property prices have since become unaffordable for many locals, raising concerns about housing stability and accessibility for permanent residents.

Read at SFGATE

Unable to calculate read time

Collection

[

|

...

]