"An international accord on these issues seems eminently desirable and is probably necessary to achieve any rebalancing of global trade and capital flows."

"Although the second Trump administration seems especially inclined to pursue what Bessent calls "Bretton Woods realignments," interest in new international monetary agreements has been growing for some time across the political spectrum."

"In fact, President Bill Clinton advocated for a new "international financial architecture" as early as 1998, in the wake of the Asian Financial Crisis."

"It is not clear whether the interests of other countries are sufficiently aligned to secure such an arrangement, or whether the United States is capable of executing a larger strategy of reindustrialization."

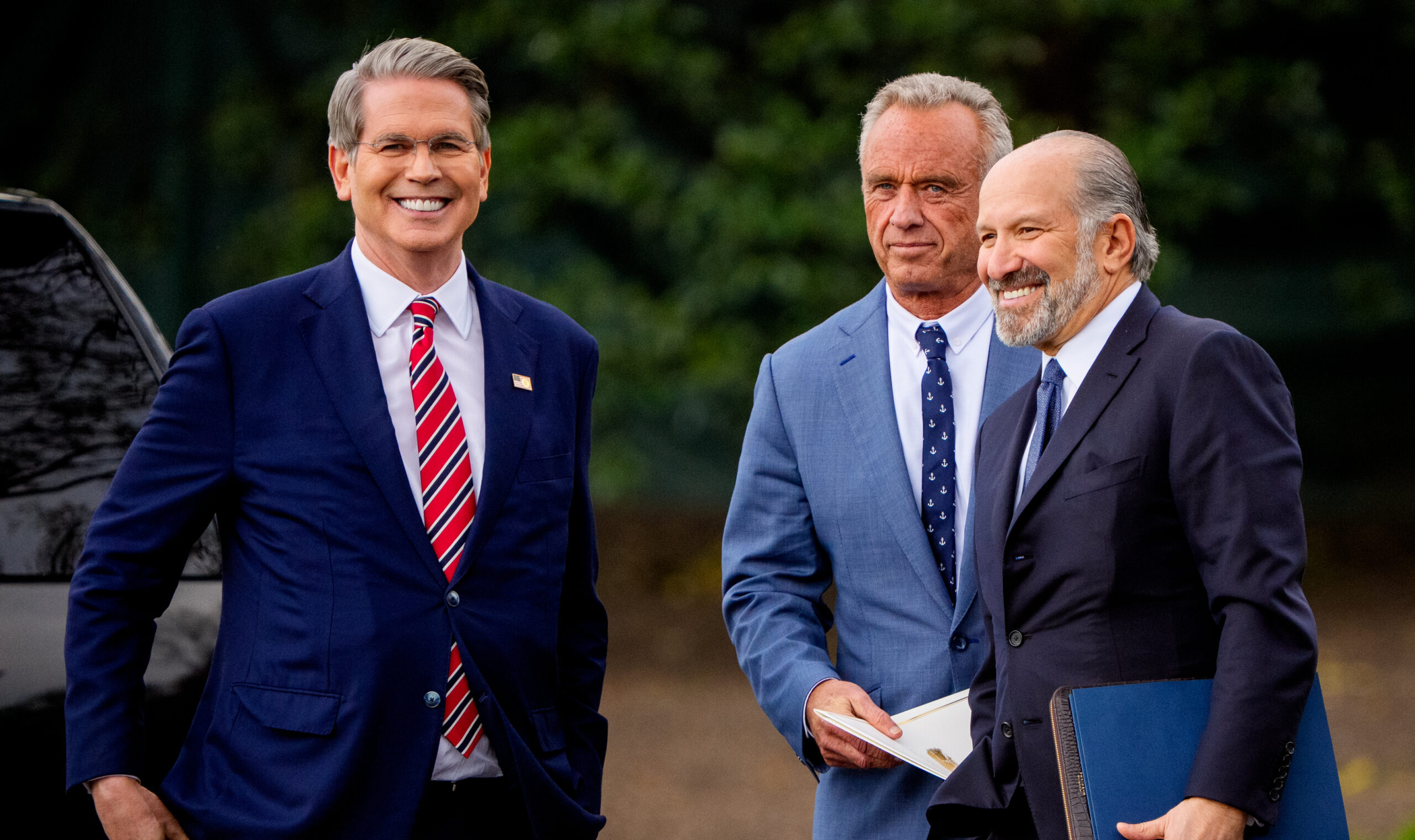

The Trump administration is exploring proposals for a "Mar-a-Lago Accord", an international currency agreement akin to past accords like Bretton Woods and Plaza. With growing bipartisan interest in reforming international monetary systems, notable figures such as Stephen Miran and Scott Bessent advocate for rebalancing trade. Historical context reveals a long-standing call for a new monetary framework, dating back to Bill Clinton's 1998 recommendations following the Asian Financial Crisis. However, challenges persist in aligning international interests and executing a comprehensive U.S. strategy for reindustrialization.

Read at The American Conservative

Unable to calculate read time

Collection

[

|

...

]