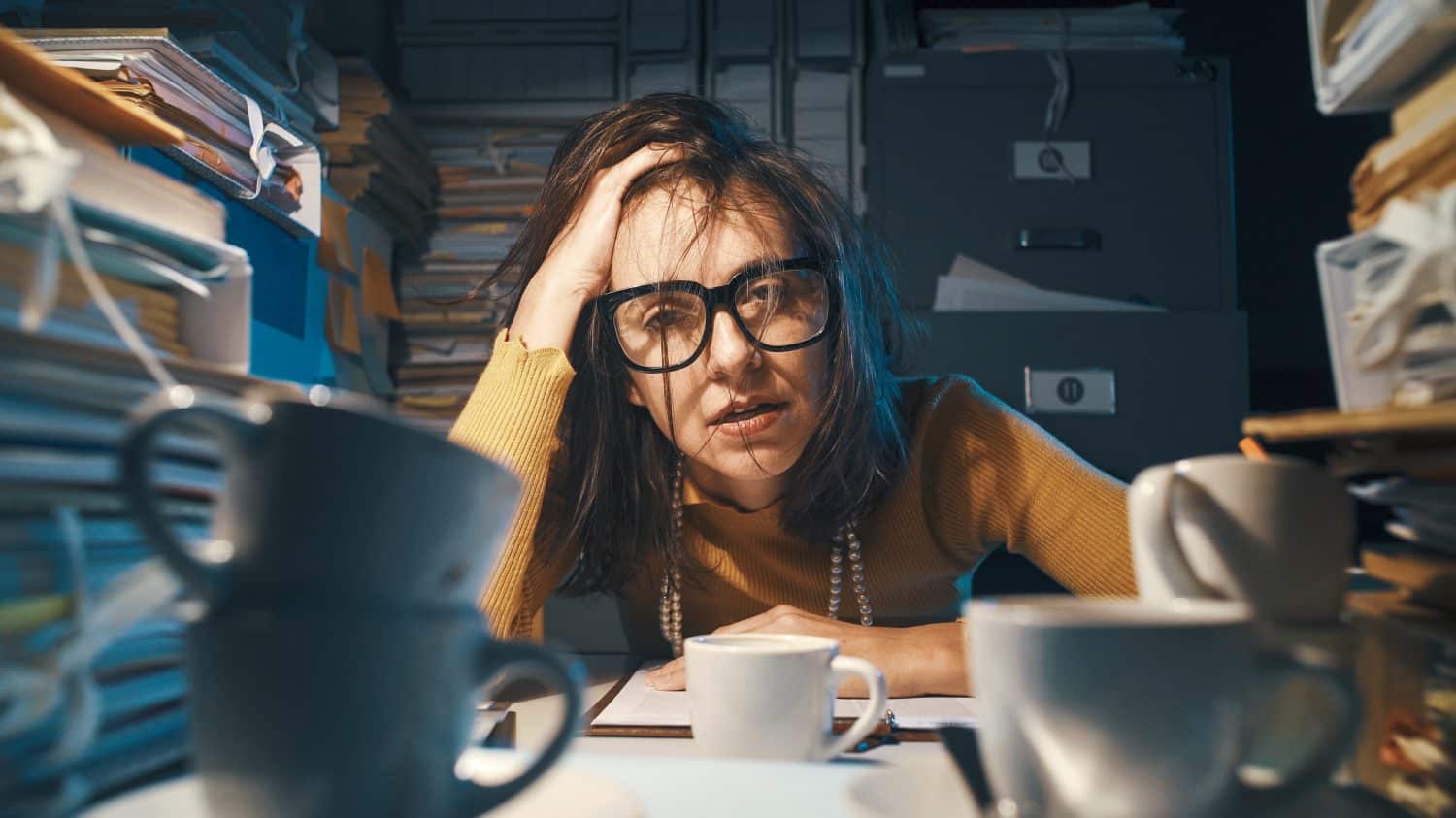

"Dealing with added financial liabilities upon the passing of a loved one can feel like a few ounces of salt poured into one's deep wound."

"A big, fat debt won't suddenly land in your lap if you're not getting any assets from the estate of a loved one."

"If you are an heir, there could be a big chunk coming out of the inheritance if it wasn't properly dealt with."

"It's on the estate, rather than on anyone in particular; it effectively reduces the value of the estate for all heirs."

Dealing with financial liabilities after the death of a loved one can amplify the emotional stress experienced in grief. However, it's important to understand that individuals are typically not responsible for debts unless they inherit assets. If an estate has outstanding debts but no assets, those debts are often written off. Heirs may experience a smaller inheritance due to debts associated with tax-advantaged accounts like 401(k)s, which must be responsibly managed by the estate to protect beneficiaries.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]