""Overall, the typical U.S. household earned roughly 46% less than what's recommended to afford a $439,950 home, the median list price for July.""

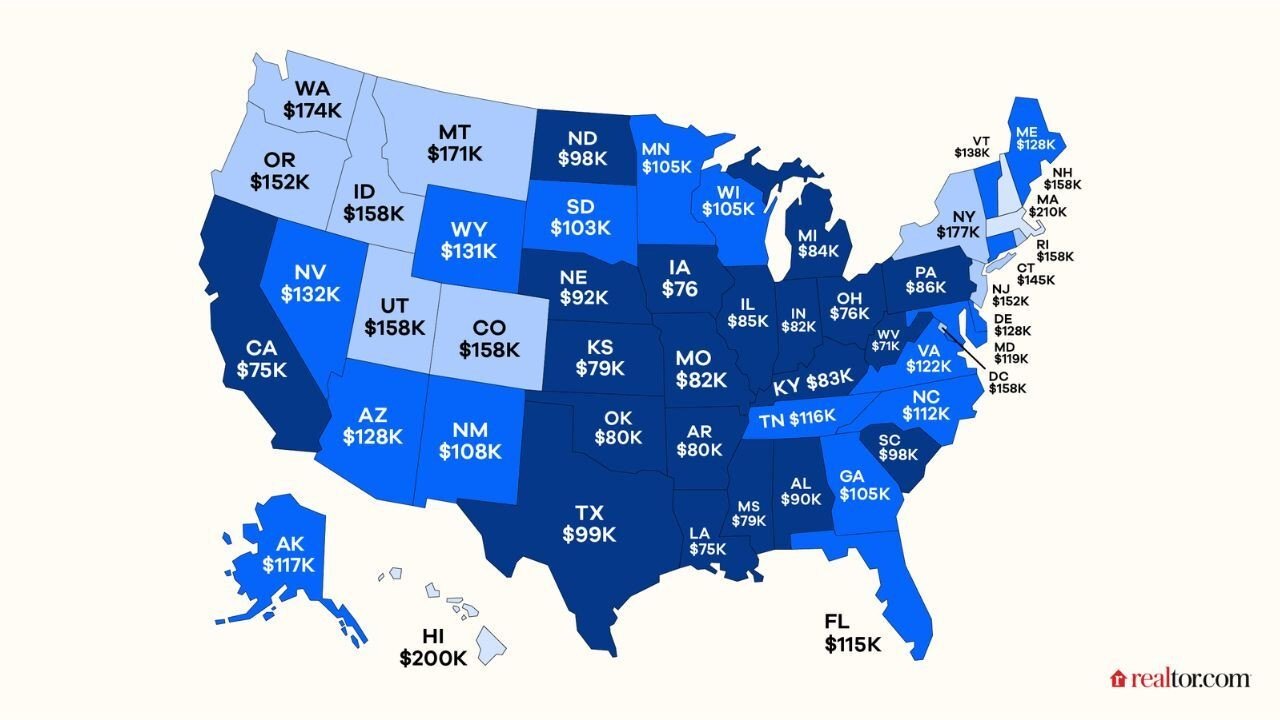

""An analysis of July data from all 50 states and the District of Columbia shows that the minimum recommended income to afford a median-priced home exceeds the state-level median income by anywhere from just under 0.6% to a staggering 138%.""

The typical American household struggles to meet monthly mortgage payments, earning 46% less than needed for a $439,950 home. The affordability gap varies by state, with minimum recommended incomes exceeding state median incomes by 0.6% to 138%. The 30% rule indicates households should not allocate more than 30% of income on housing. Although some states, like Iowa, have become more affordable, overall improvement in housing affordability remains limited as home prices and mortgage rates stabilize compared to last year.

Read at SFGATE

Unable to calculate read time

Collection

[

|

...

]