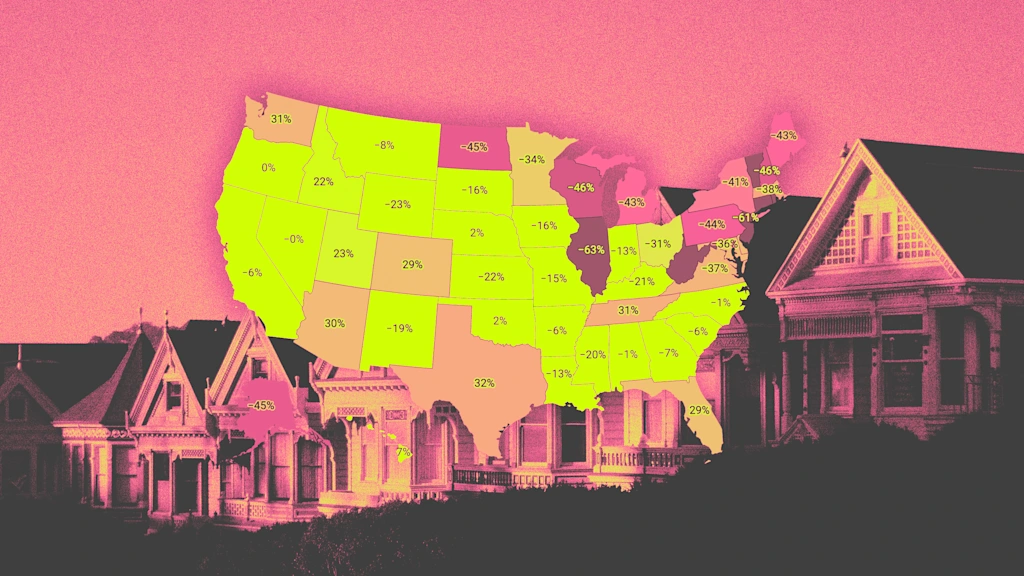

"An increase in active listings alongside longer market durations may signal pricing softness, while a rapid decline suggests a heated market. The national shift from sellers to buyers since the Pandemic Housing Boom has varied significantly across local markets."

"Local housing markets with an increase in active inventory above pre-pandemic levels have experienced either slower home price growth or outright declines. Those with active inventory remaining below pre-pandemic levels have generally enjoyed more resilient price growth."

"National active listings are projected to rise by 25% between July 2024 and July 2025, indicating that homebuyers are gaining leverage in numerous parts of the country, transitioning some sellers' markets to balanced or buyers’ markets."

"Despite national inventory increasing, it is still 11% below pre-pandemic levels. Some key resale markets, especially in the Midwest and Northeast, remain tight, although recent growth has slowed more than typical seasonal patterns."

Home price momentum can be assessed by monitoring active listings and months of supply. An increase in active listings along with extended market times reveals potential pricing softness, while a decrease can indicate a heating market. Since the Pandemic Housing Boom ended in 2022, the market is shifting from sellers to buyers, with variations across local markets. Inventory levels above pre-pandemic figures often lead to softer price growth, while lower levels correlate with robust growth. National active listings are projected to rise by 25%, but still lag behind pre-pandemic levels, notably affecting certain regions.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]