"All of the markets we operate in experienced some level of softening [this quarter]. Even in our strongest performing markets, buyers needed the assistance of incentives."

"In Q2 2025, Lennar-America's second-largest homebuilder-spent an average of 13.3% of the final sales price on sales incentives, such as mortgage rate buydowns."

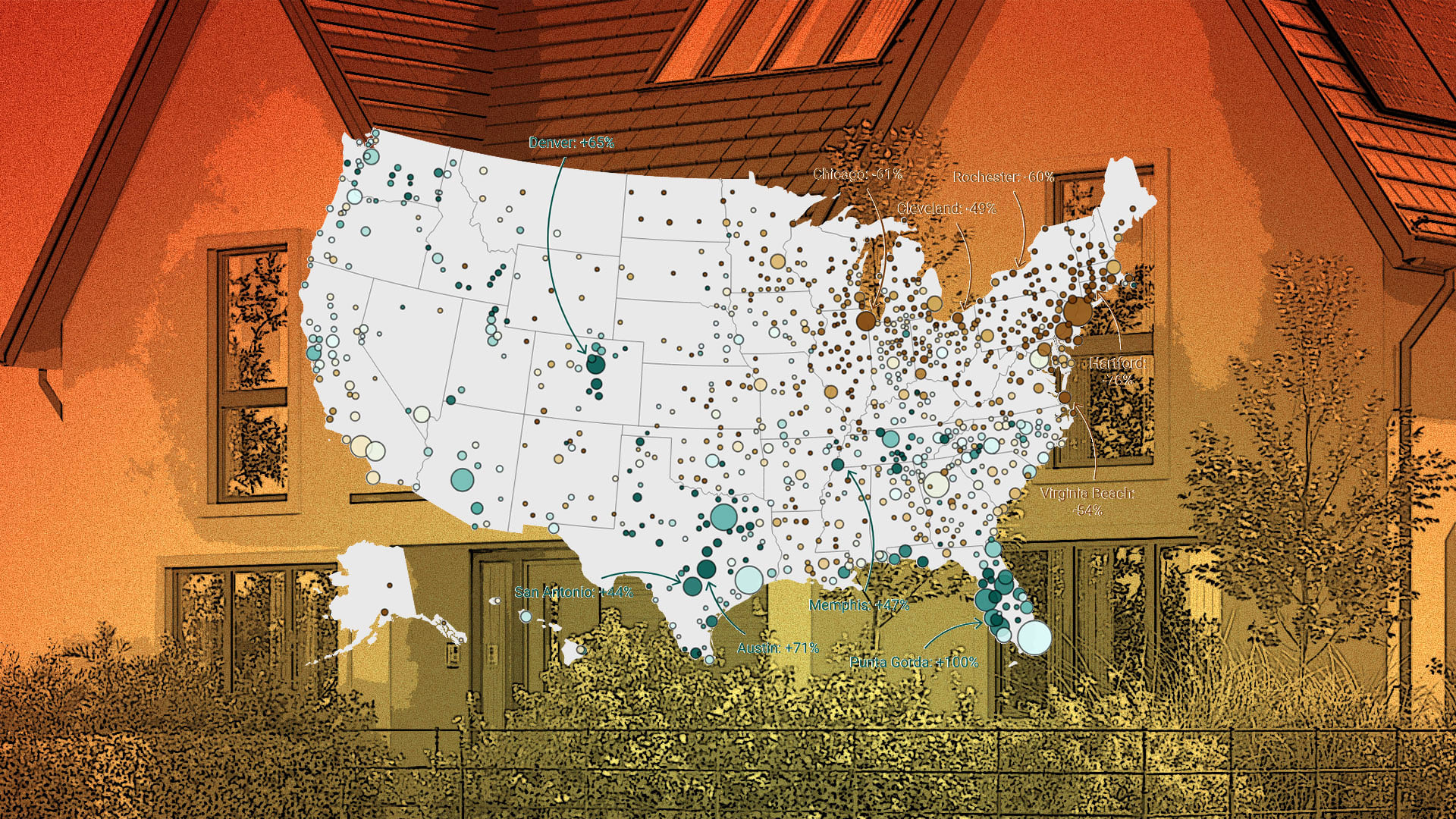

"Since the pandemic housing boom fizzled out, the number of unsold, completed new single-family homes in the U.S. has been rising."

"The markets that experienced more challenging conditions [for Lennar] during the quarter were the Pacific Northwest markets of Seattle and Portland."

Lennar co-CEO Jon Jaffe indicated a notable softening in the housing market, requiring homebuilders to offer incentives, mainly mortgage rate buydowns. The company's spending on incentives in Q2 2025 averaged 13.3% of the final sales price, significantly higher than previous years, indicating their response to buyer reluctance. The unsold inventory of new single-family homes has increased since the pandemic boom ended, with various markets experiencing challenges, particularly in the Pacific Northwest and some Eastern and Southwestern markets. The overall demand for housing has remained weak since the spike in mortgage rates.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]