"To put the number of unsold completed new single-family homes into historic context, we have ResiClub's Finished Homes Supply Index. The index is one simple calculation: The number of unsold completed U.S. new single-family homes divided by the annualized rate of U.S. single-family housing starts. A higher index score indicates a softer national new construction market with greater supply slack, while a lower index score signifies a tighter new construction market with less supply slack."

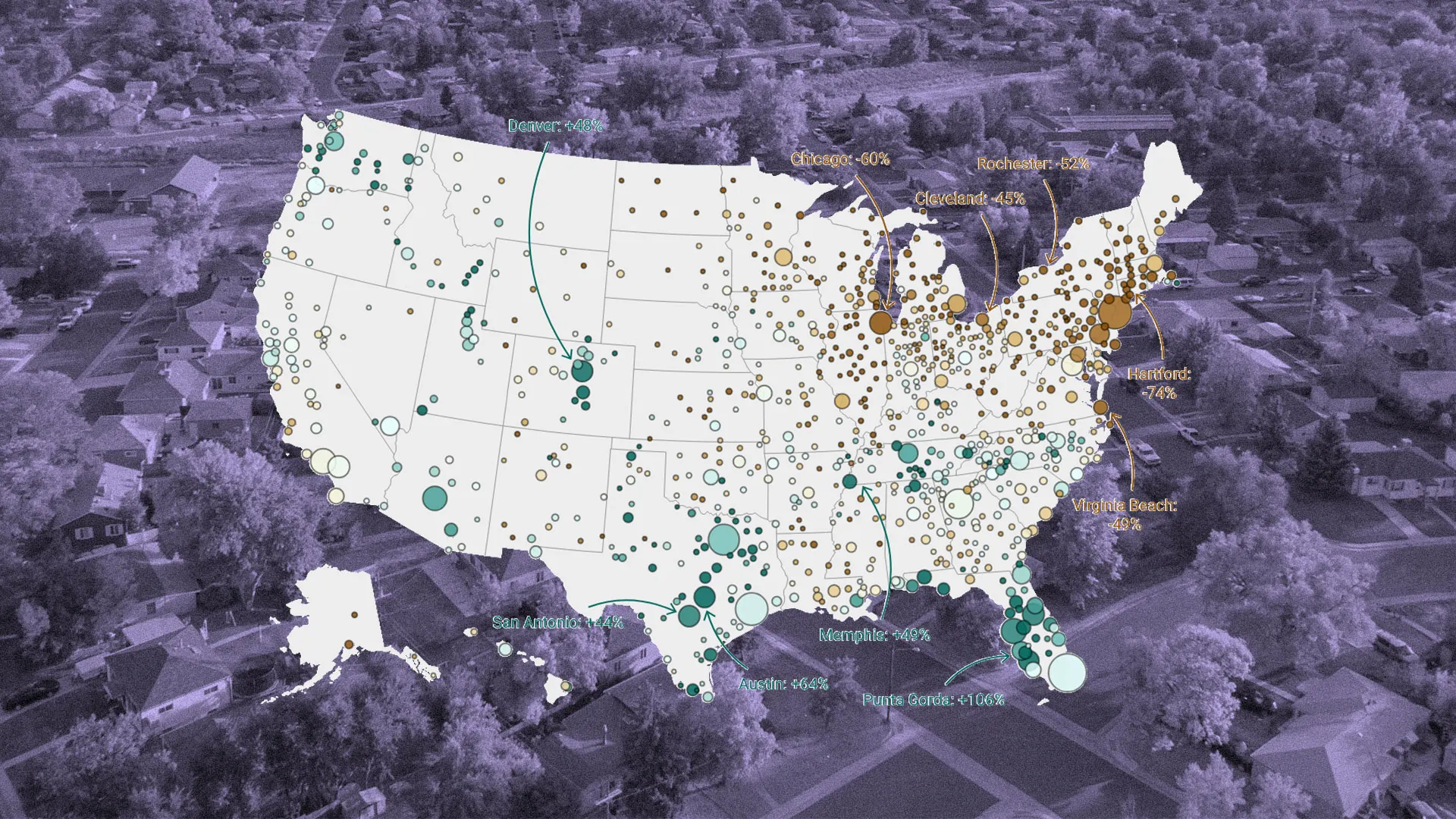

"While the U.S. Census Bureau doesn't give us a greater market-by-market breakdown on these unsold new builds, we have a good idea where they are, based on total active inventory homes for sale (including existing)-likely much of it is in the Mountain West and Sun Belt, particularly around the Gulf."

Several of America's largest homebuilders report softer-than-expected buyer demand for 2025, with the pullback most pronounced in key Sun Belt metros where affordability pressures are biting. Unsold completed U.S. new single-family homes have increased, reaching 121,000 in July—the highest since July 2009. The ResiClub Finished Homes Supply Index measures unsold completed homes divided by the annualized rate of single-family starts to indicate market slack. Nationally, the share of unsold new builds has grown relative to pre-pandemic 2019 but remains far below the 2007–2008 weakening. Inventory concentration appears highest in the Mountain West and Sun Belt, with pricing pressure in Florida and Texas.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]