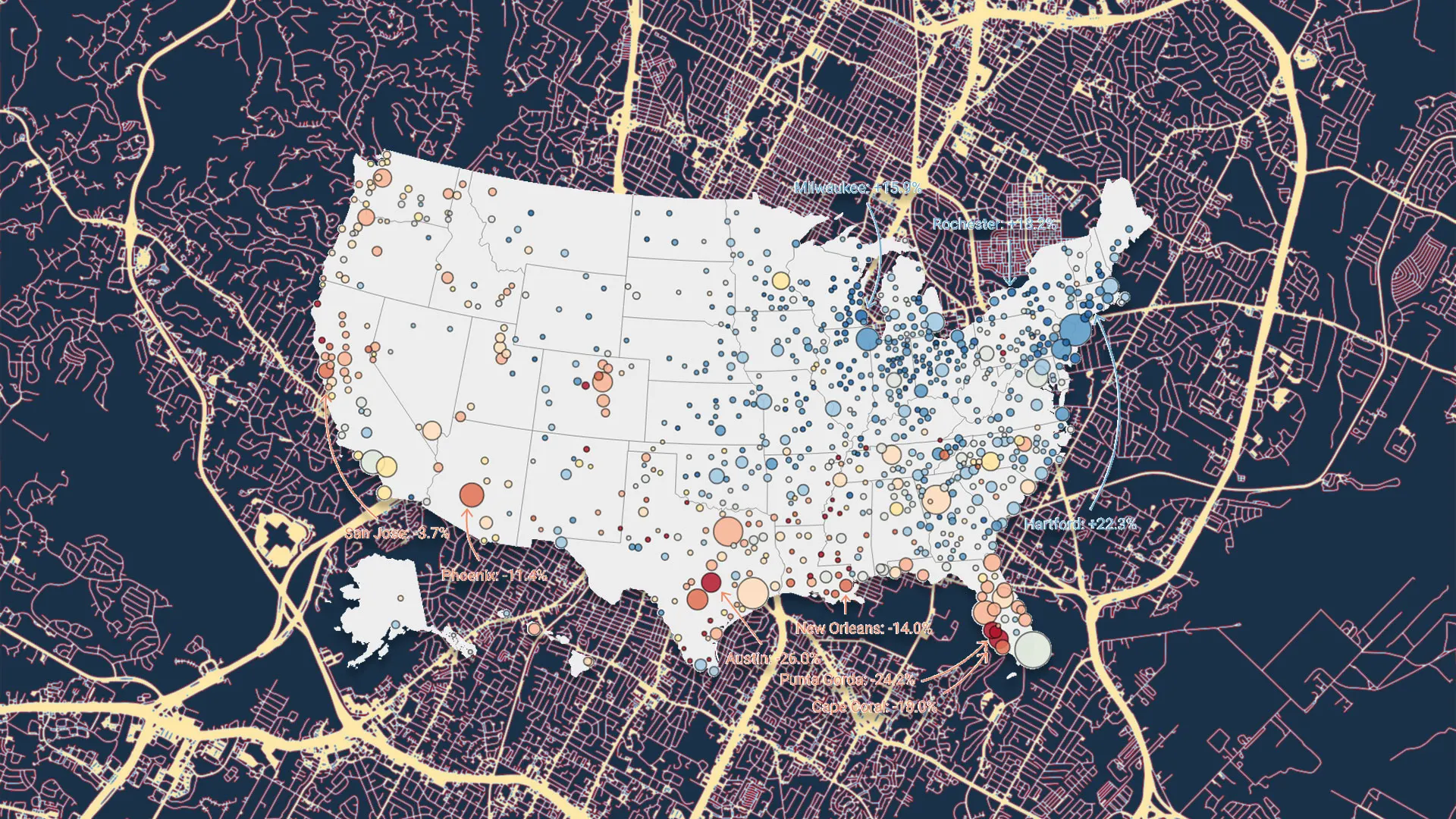

"Among the nation's 100 largest metro area housing markets, no major market saw greater home price appreciation during the Pandemic Housing Boom than Austin, TX-where home prices surged a staggering 72.5% between March 2020 and June 2022. Since the boom fizzled out three years ago, Austin has also experienced the largest home price correction (-26.0%) among those same 100 major markets."

"We looked at just the nation's 100 largest metro areas by population. The finding? There's a moderate statistical correlation (R² = 0.37) between home price shift between March 2020 and June 2022 and the change in home prices from their 2022 peak through the end of October 2025. If the New Orleans metro-the largest outlier-is excluded, that correlation strengthens slightly (R² = 0.44)."

"Austin being among the hardest-hit markets isn't surprising. Back in May 2022, I wrote an article for Fortune outlining Austin's heightened downside risk this cycle, driven in part by the fact that the market had significantly overheated and become markedly overvalued relative to underlying fundamentals, including local incomes. Put simply: The bigger the local boom, the greater the potential for a local bust. Three years on, that rule of thumb has proven to be a useful guide for the post-Pandemic Housing Boom period."

Home prices in Austin surged 72.5% between March 2020 and June 2022 and subsequently corrected about 26.0% from the 2022 peak through October 2025. Analysis covered the 100 largest U.S. metro areas and measured boom-period gains against post-2022 price changes. The analysis found a moderate correlation (R² = 0.37) between boom gains and later declines; excluding the New Orleans outlier raises R² to 0.44. The results indicate a partial mean-reversion pattern: markets that overshot fundamentals most during 2020–2022 tended to give back more ground afterward, increasing downside risk where booms were largest.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]