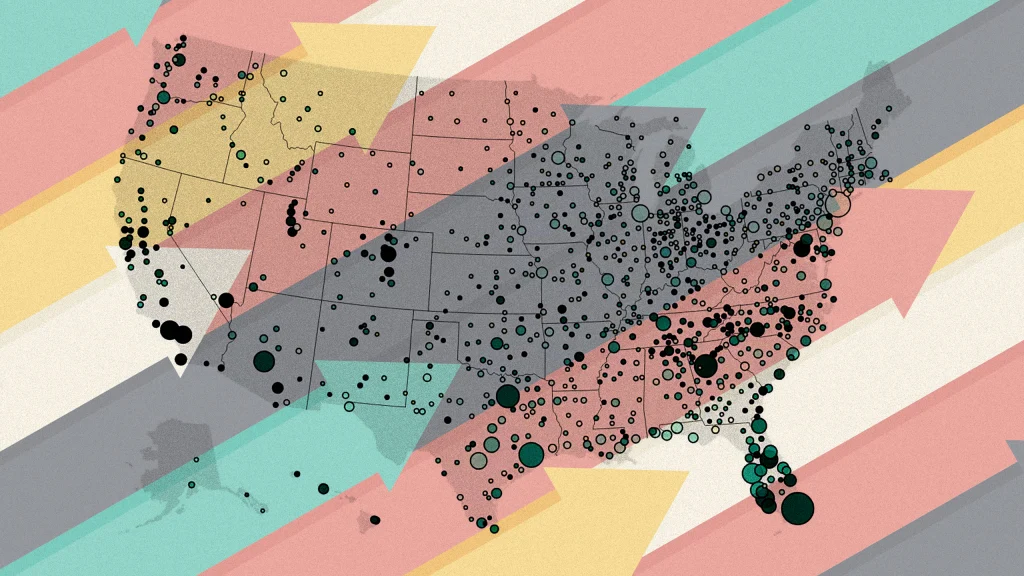

"By late 2025, itâs projected that nearly half of U.S. metro area housing markets could exceed pre-pandemic active inventory levels, revealing significant shifts."

"Current national active housing inventory is still 20% below pre-pandemic levels, but rising listings are granting homebuyers more negotiating power than before."

"Regions where inventory has rebounded to pre-pandemic levels have faced weaker home price growth, while those with lower inventory continue to see stronger prices."

"Gulf Coast and Mountain West markets, which saw pandemic-induced price spikes, are now among the softest due to increased buyer leverage."

As of March 2025, national active housing inventory for sale has increased by 28.5% year-over-year, providing more leverage for homebuyers. This shift indicates a transition in many housing markets; some previously considered seller's markets are now balanced, and others are becoming buyer's markets. Notably, while inventory is rising, it remains 20% below March 2019 levels nationally. By late 2025, many metro areas may exceed pre-pandemic inventory, which is associated with weaker home price growth. Areas previously experiencing high price growth during the pandemic now face softening as inventory increases.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]