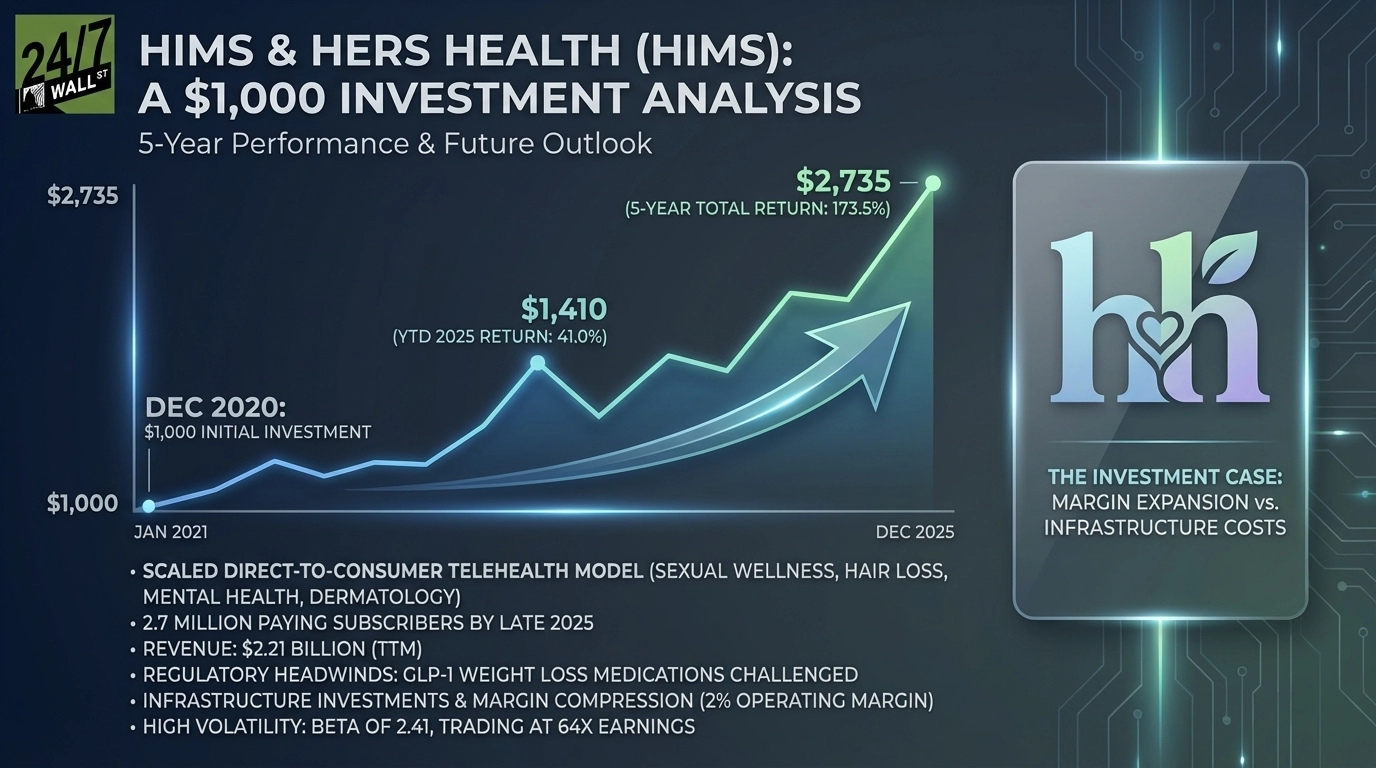

"Hims & Hers Health ( NYSE: HIMS) went public in January 2021 through a SPAC merger, positioning itself as a multi-specialty telehealth platform offering prescription medications, mental health support, and personal care products. The timing proved fortuitous: pandemic-era demand for virtual healthcare was surging, and the company's direct-to-consumer model for sensitive health issues (sexual wellness, hair loss, dermatology) resonated with consumers seeking privacy and convenience."

"The business scaled aggressively. Revenue jumped to $2.21 billion over the trailing twelve months, driven by subscriber growth that reached 2.7 million paying customers by late 2025. The company added roughly 700,000 subscribers in 2024 alone, though that pace slowed to around 480,000 in 2025 as regulatory headwinds hit its fastest-growing segment: GLP-1 weight loss medications. That slowdown reflects real operational challenges. The FDA removed semaglutide from its drug shortage list, limiting Hims' ability to sell compounded versions."

Hims & Hers launched publicly via a SPAC in January 2021 and built a multi-specialty telehealth platform selling prescriptions, mental health services, and personal care products. Pandemic-driven demand and a direct-to-consumer model for sensitive conditions drove rapid adoption and brand recognition. Trailing twelve-month revenue reached $2.21 billion with 2.7 million paying customers by late 2025. Subscriber additions slowed from ~700,000 in 2024 to ~480,000 in 2025 as GLP-1 regulatory changes and intensified competition raised acquisition costs. Capital was deployed into manufacturing, labs, compounding capacity, and logistics while operating margins compressed amid continued high revenue growth.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]