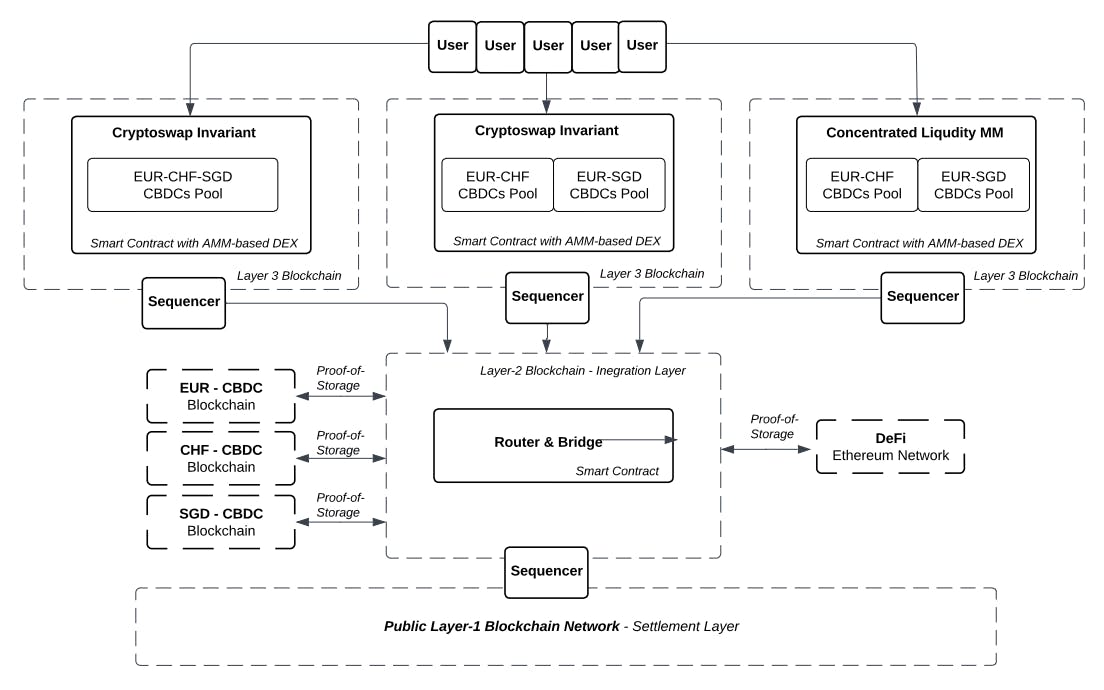

"The findings indicate that a multi-AMM setup on L2 for CBDCs exchange proves to be more cost-efficient compared to a single L1 AMM, even with liquidity fragmentation."

"The proposed design for a multi-AMM system utilizes private L2 architectures to combine the benefits of security and operational efficiency while minimizing costs."

"Decision-making regarding blockchain architecture and allowance arbitrage is crucial in cross-border CBDCs, influencing transaction efficiency and operational control."

"Latency and finality metrics play a significant role in evaluating the performance and reliability of CBDC systems in conjunction with underlying L1 networks."

The article explores the importance of blockchain architecture selection in cross-border Central Bank Digital Currencies (CBDCs) exchange, emphasizing a shift from private L1s to a combination of public L2 networks. While private L1s offer control, they require extensive infrastructure investments. Public blockchains, however, leverage decentralization and robust consensus mechanisms. It proposes a hybrid approach that merges benefits of both types. Through analysis of metrics such as latency and finality, the study concludes that a multi-AMM system on L2 is more cost-effective than a single AMM on L1, despite issues of liquidity fragmentation.

Read at Hackernoon

Unable to calculate read time

Collection

[

|

...

]