"The main financial implication for cross-border CBDCs exchange involves understanding the total cost, which breaks down into gas fees, explicit fees, and implicit fees."

"The significant components contributing to DeFi service costs include gas fees paid for executing transactions, explicit fees charged by DeFi protocols, and implicit fees arising from market dynamics."

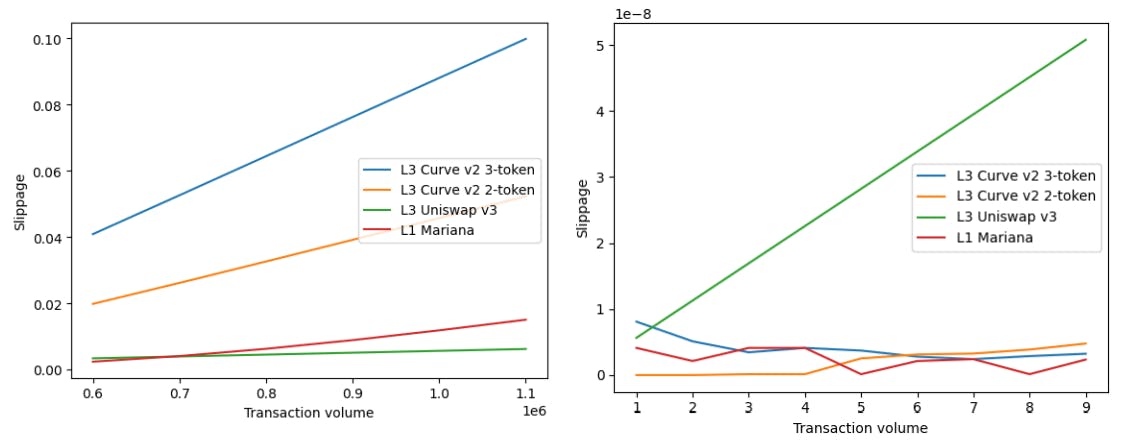

"Price impact and slippage are critical implicit fees that influence the cost of swapping tokens on Automated Market Makers, affecting traders' returns and transaction efficiency."

"Different types of Automated Market Makers utilize various price impact calculation methods, highlighting the complexity and variability in the cost structures of DeFi services."

The article examines the cost structure associated with cross-border Central Bank Digital Currency (CBDC) exchanges, emphasizing three primary cost components: gas fees, DeFi explicit fees, and DeFi implicit fees. Gas fees compensate blockchain operators, while explicit fees are charged by DeFi protocols, notably including liquidity provider fees. Additionally, implicit fees stem from market behaviors like price impact and slippage during token swaps at Automated Market Makers (AMMs). The article also discusses different AMM types and their unique price impact calculation methods, accentuating the complexity of DeFi transactions.

Read at Hackernoon

Unable to calculate read time

Collection

[

|

...

]