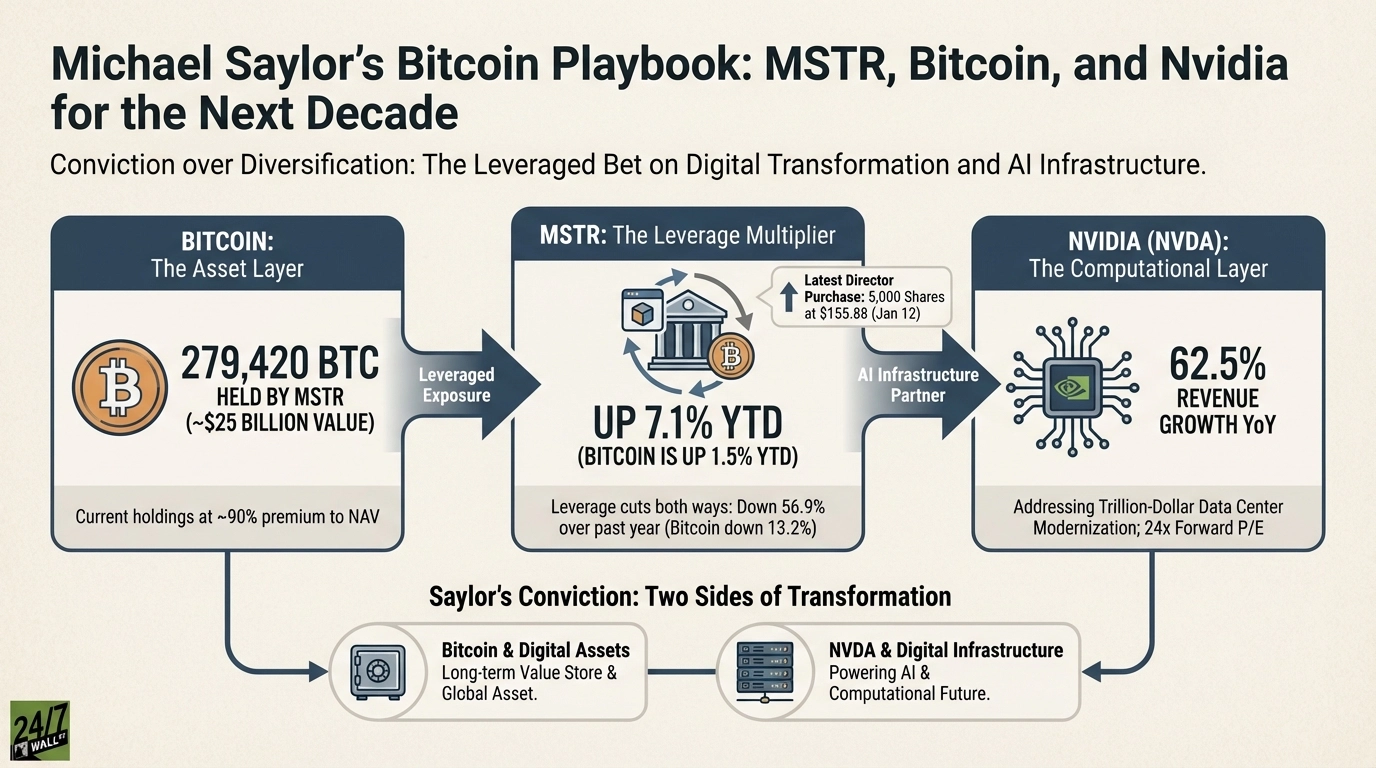

"When the world's most vocal Bitcoin maximalist names a stock alongside BTC as a "best performing asset of the decade," you pay attention. Michael Saylor doesn't do diversification. He does conviction. His two bets for the next ten years are Bitcoin and Nvidia ( NASDAQ:NVDA). That pairing reveals how he sees digital transformation playing out. A MicroStrategy ( NASDAQ:MSTR) director just bought 5,000 shares at $155.88 on January 12."

"Saylor transformed MicroStrategy from a struggling enterprise software company into a Bitcoin Treasury Company. The playbook: issue stock and debt, buy Bitcoin, repeat. MSTR now holds $73.2 billion in Bitcoin against $8.2 billion in long-term debt. That's not a hedge. That's a leveraged bet. The pairing of NVDA with Bitcoin isn't random. Saylor sees digital assets and digital infrastructure as two sides of the same transformation. Bitcoin is the asset layer."

Michael Saylor concentrates his convictions into two bets for the next decade: Bitcoin and Nvidia. MicroStrategy shifted from enterprise software to a Bitcoin Treasury Company by issuing stock and debt to acquire Bitcoin, now holding $73.2 billion versus $8.2 billion in long-term debt. Insider activity changed when a director bought 5,000 shares at $155.88 after months of executive selling. MicroStrategy offers leveraged exposure: small Bitcoin moves amplify MSTR returns; Bitcoin down 13.2% while MSTR fell 56.9% over the past year. The market values MSTR at a roughly 90% premium to net Bitcoin asset value, making P/E irrelevant.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]