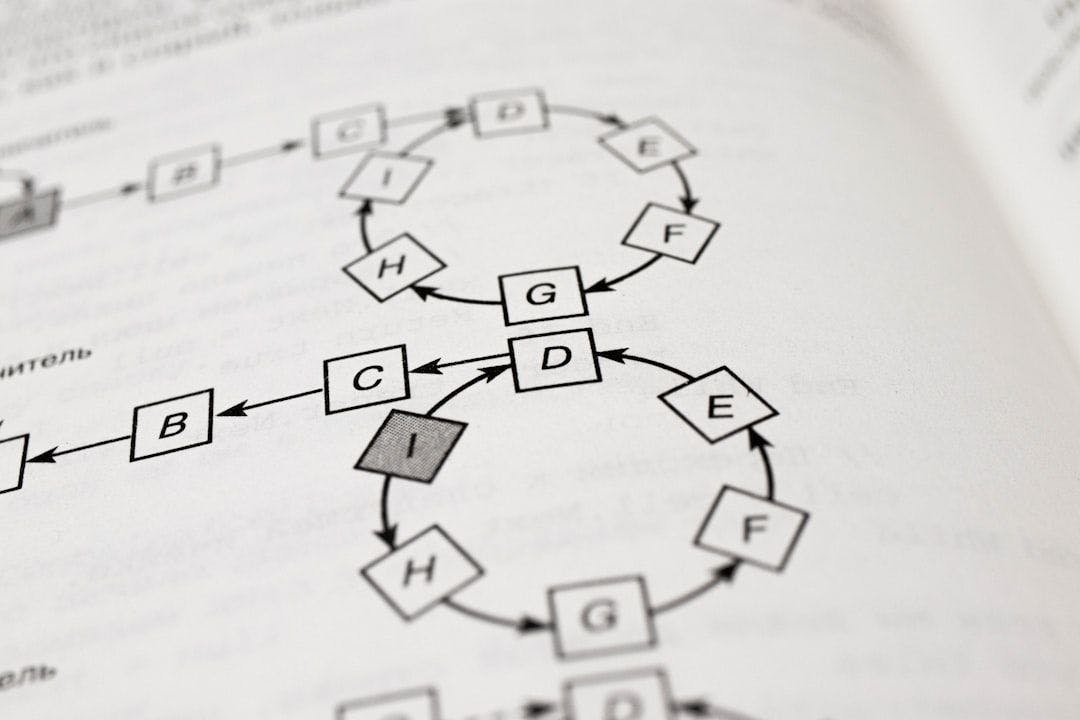

"Zhou et al. provide an approach utilizing a greedy cycle detection algorithm paired with a gradual increment-based input searching. They achieve sub-block time runtime, but the algorithm is not optimized for efficiently finding an input."

"Wang et al. focus solely on constant-product markets on UniswapV2 and show the consistent existence of greater than 1 ETH opportunities across blocks. They emphasize the profitable potential within this framework."

"McLaughlin et al. conducted a larger scale study incorporating further market invariants, resulting in approximately 4.5 billion potential opportunities, but found that only 0.51% of over 20.6 million arbitrages yielding more than 1 ETH were successfully executable."

"Carillo and Hu analyze arbitrage MEV extraction on Terra Classic, identifying more than 188,000 arbitrages. They highlight the success of spamming strategies by MEV searchers to gain latency advantage."

Profitable opportunity discovery in blockchain networks encompasses cyclic arbitrage and strategies such as sandwiching and imitation attacks. Zhou et al.'s algorithm achieves sub-block runtime but lacks optimization. Wang et al. discovered consistent greater than 1 ETH arbitrage opportunities on UniswapV2, while McLaughlin et al. found many potential opportunities, yet with only a small execution success rate. MEV extraction on FCFS networks, as examined by Carillo and Hu, reveals the effectiveness of spamming strategies for latency advantage in transaction processing, identifying a significant number of arbitrages.

Read at Hackernoon

Unable to calculate read time

Collection

[

|

...

]