"Paramount Skydance's tender offer for Warner Bros. Discovery emerged from months of fitful courtship, a shifting media landscape, and a high‑stakes bidding war that ultimately pitted the studio behind "Top Gun: Maverick" against streaming giant Netflix for control of one of Hollywood's crown jewels. The company's tender offer regulatory filing with the Securities and Exchange Commission, filed hours after Paramount launched a hostile bid worth $108 billion (or $77.9 billion in equity),"

"It would be the honor of a lifetime to be your partner and to be the owner of these iconic assets. If we have the privilege to work together you will see that my father and I are the people you had dinner with. We are always loyal and honorable to our partners and hope we have the opportunity to prove that to you. Best, David."

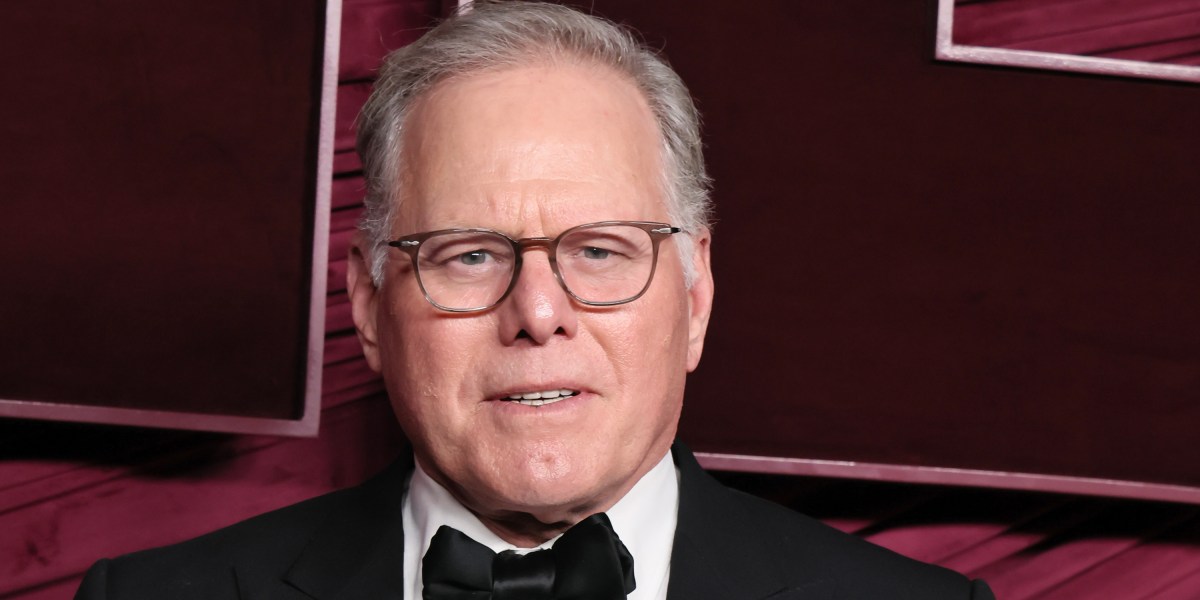

Paramount Skydance pursued Warner Bros. Discovery through months of courtship amid a changing media landscape and a bidding war with Netflix. Paramount filed a regulatory disclosure with the SEC after launching a hostile $108 billion ($77.9 billion equity) bid, detailing repeated approaches to Warner Bros. Discovery. Netflix and Warner agreed to a deal valued at nearly $83 billion ($72 billion equity). Paramount CEO David Ellison sent a December 4 text to WBD CEO David Zaslav offering a package and expressing respect and a desire to partner. Paramount later criticized the sale process as "tainted" and told investors it felt not taken seriously.

Read at Fortune

Unable to calculate read time

Collection

[

|

...

]