"Novacap will buy all outstanding IAS shares for $10.30 per share, around 22% higher than IAS's roughly $8 share price as of Tuesday. The deal is expected to close this year pending regulatory approval. The infusion of PE cash will help IAS invest in artificial intelligence, IAS CEO Lisa Utzschneider says in the . Once the deal is complete, Novacap will take IAS private."

"The company has been publicly traded since 2021 when it IPO'd under Vista Equity Partners. Vista acquired IAS in 2018 and reportedly still owned 40% of IAS's stock as of June. Vista - whose stewardship of IAS hasn't been without its ups and downs - will conclude its investment in IAS after the deal closes. Although IAS traded as high as $25 per share in the months following its IPO, its stock has been on a rocky decline since late 2021."

"Bear in mind, though, that referrals are only a sliver of the total pie, representing less than 5% of total traffic. They fall into the same bucket as affiliate publishers and blog links and exclude search engines, any paid media and direct visitors. Still, ChatGPT - and, to a lesser degree, other startup LLM operators like Perplexity - face an awkward situation where they now drive meaningful, attributable traffic to many sites and marketplaces for which they take essentially no cut."

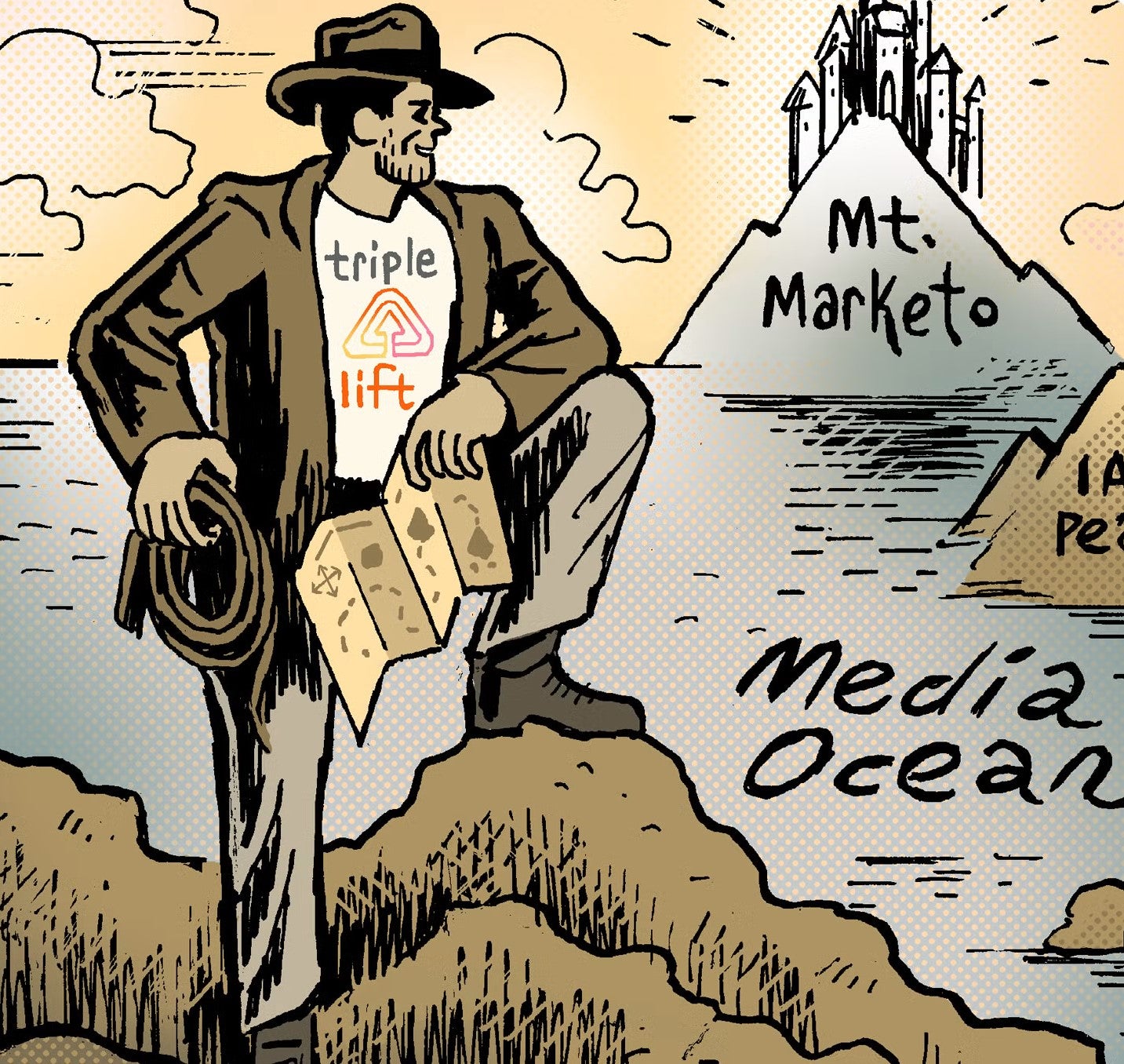

Novacap agreed to acquire verification provider IAS for $1.9 billion, paying $10.30 per share, roughly 22% above IAS's $8 price, with the deal expected to close this year pending regulatory approval. The infusion of private equity cash will help IAS invest in artificial intelligence. Once complete, Novacap will take IAS private; the company had been publicly traded since a 2021 IPO under Vista Equity Partners, which acquired IAS in 2018 and reportedly still held about 40% as of June. IAS stock peaked near $25 after the IPO but declined since late 2021. Referrals represent less than 5% of traffic, while ChatGPT and other LLMs now drive meaningful attributable traffic without taking a cut. The IAB reduced ad-spend growth expectations to 5.7% for the year amid tariff-related marketer uncertainty.

Read at AdExchanger

Unable to calculate read time

Collection

[

|

...

]