"Warren Buffett's failure to capitalize on the economy's digital shift over the last two decades has hurt his otherwise enviable track record as an investor. His blind spot regarding tech didn't stop at the stock market: It bled into how he ran Berkshire Hathaway's operating companies as well. Across many of his wholly owned businesses, Buffett neglected technological upgrades, and Berkshire's business value has suffered as a result."

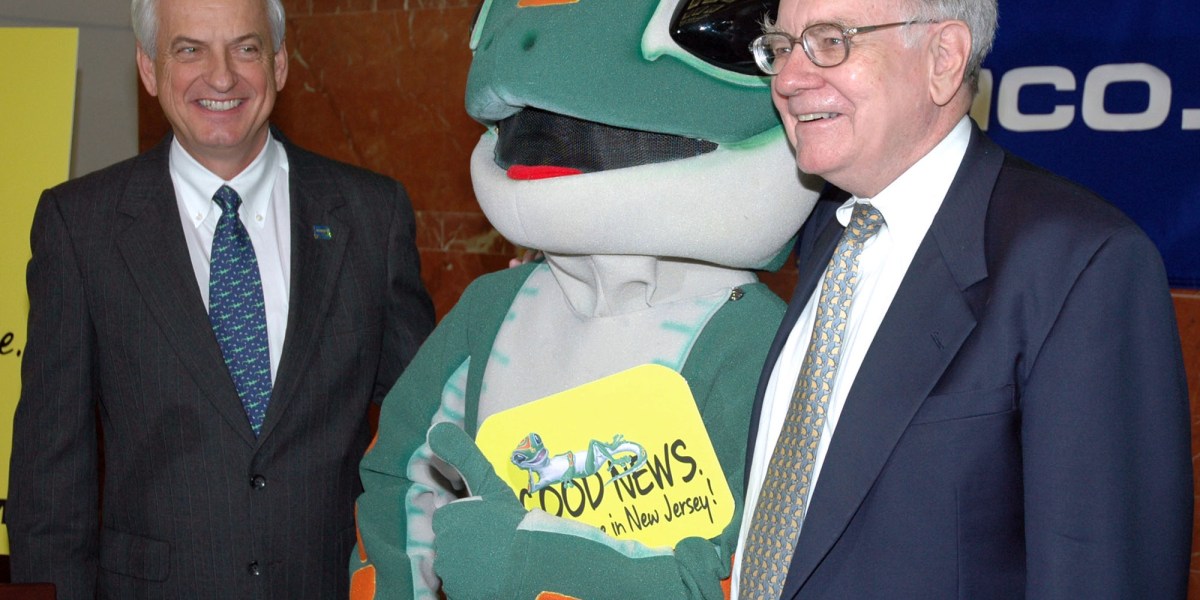

"Since it began in the 1930s, the auto insurer has used a direct-sales model to keep operating costs the lowest in the industry. In a commodity business like insurance, that's a major competitive advantage. In the 1990s, after he bought all of Geico, Buffett found a second moat when he began to brand Geico as a trusted, even beloved American company."

Warren Buffett failed to capitalize on the economy's digital shift over the past two decades, harming his track record and Berkshire Hathaway's operating subsidiaries. Many wholly owned businesses received insufficient technological upgrades, reducing their business value. The majority of Berkshire's assets are held in operating subsidiaries like Burlington Northern Santa Fe Railroad, Berkshire Hathaway Energy, and Geico. Buffett favored extracting cash from these businesses over reinvesting for the digital era, with wind energy investments driven largely by tax incentives. Geico suffered from underinvestment in IT, allowing rivals such as Progressive to surpass it despite heavy marketing and a low-cost direct-sales model.

Read at Fortune

Unable to calculate read time

Collection

[

|

...

]