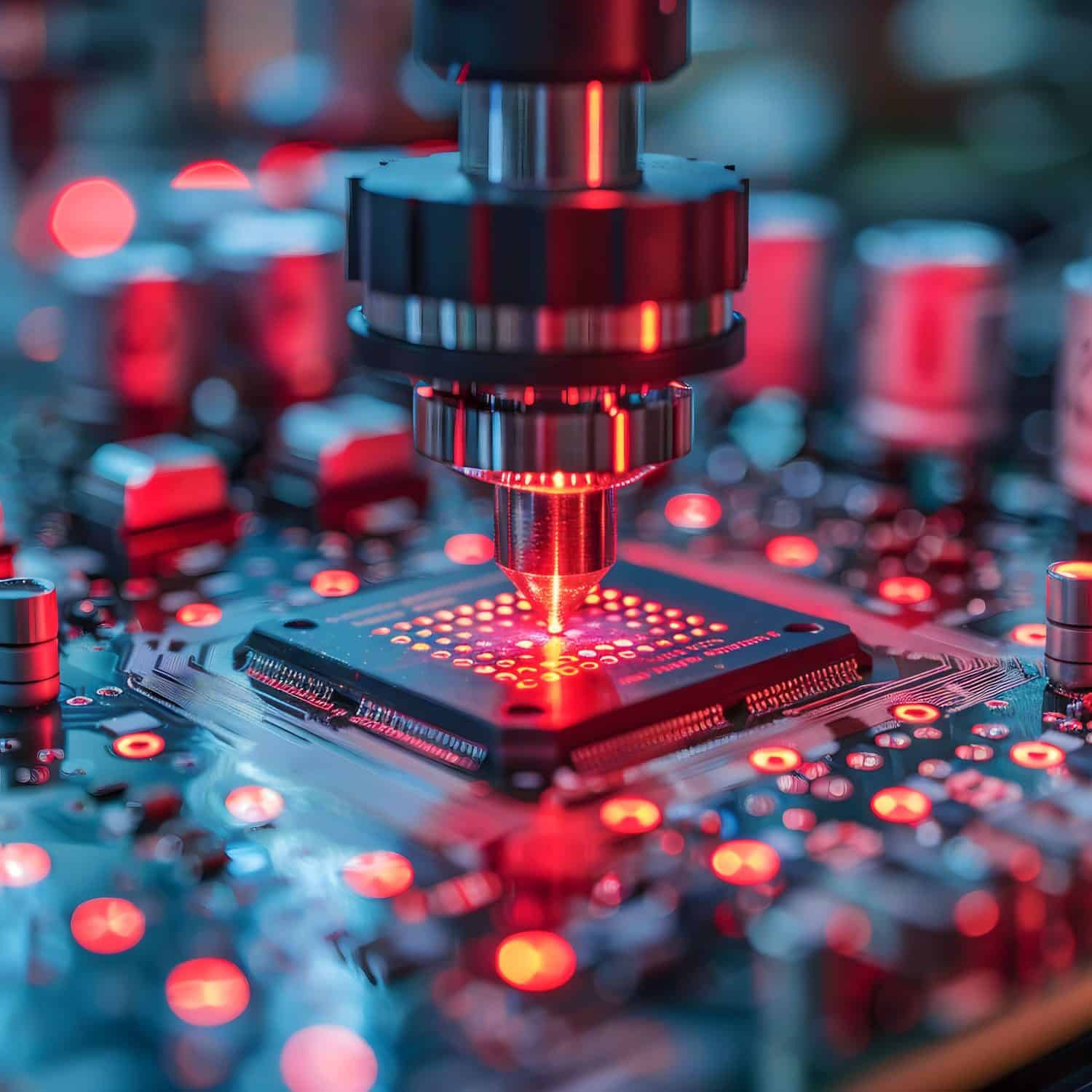

"ASML Holding (NASDAQ:ASML) just delivered the numbers Wall Street has been waiting for. The Dutch semiconductor equipment maker reported Q4 2025 orders that smashed analyst estimates, driven by insatiable demand for the advanced lithography systems that make cutting-edge AI chips possible. This isn't just a beat on expectations. It's confirmation that the AI infrastructure buildout is accelerating, not slowing down."

"ASML holds a near-monopoly on extreme ultraviolet (EUV) lithography machines-the only tools capable of printing the microscopic circuitry required for AI chips from NVIDIA (NASDAQ:NVDA), AMD (), and others. When Taiwan Semiconductor Manufacturing Company (), Samsung, and SK Hynix ramp up production, they have one supplier for the most critical equipment: ASML. The company's Q4 orders signal that chipmakers are betting big on sustained AI demand through 2027."

"Morgan Stanley (NYSE:MS) projects ASML's earnings could nearly double by 2027 compared to 2025 levels, fueled by massive capital expenditure increases from major semiconductor manufacturers. Bernstein raised its price target to $1,642, citing structural upside through 2029. The stock has surged 114% over the past year, but with a forward P/E of 46x, investors are paying a premium for growth that hasn't fully materialized yet. 2025 EPS of $17.38 was down 9.7% year-over-year despite strong quarterly beats."

ASML reported Q4 2025 orders that far exceeded analyst estimates, driven by strong demand for advanced lithography systems used in AI chip production. ASML maintains a near-monopoly on extreme ultraviolet (EUV) lithography machines, the only tools capable of printing the microscopic circuitry for leading AI chips. Major foundries and memory makers are increasing production capacity, relying on ASML as the single supplier for critical equipment. Analysts forecast substantial earnings upside through 2027–2029 as chipmaker capital expenditures rise. The record orders represent future revenue because long equipment lead times push deliveries into 2026–2027. Current valuation prices in sustained AI-driven capex, creating execution and timing risk.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]