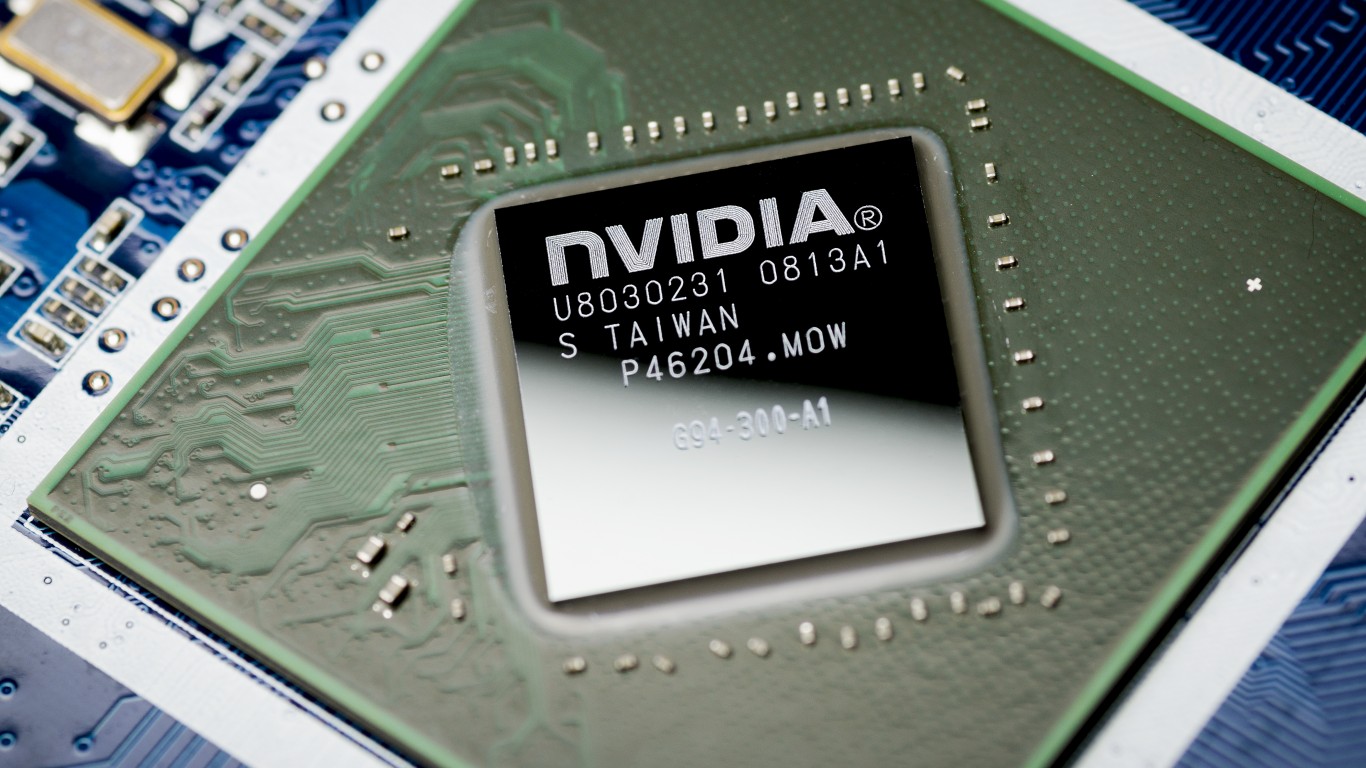

"Today it's all about Nvidia ( Nasdaq: NVDA) stock, and that has put the wind at the sails of the markets. The leading AI chip stock is tacking on 1.3% this morning as the markets await what is highly expected to be another blowout quarter led by CEO Jensen Huang. Markets will be watching and waiting for those results coupled with a belated jobs report to determine whether the recent market pullback was warranted or overdone."

"Investors are jittery about AI becoming a bubble. After all, Nvidia stock has already ballooned by 35% year-to-date with a market cap in the ballpark of $4.4 trillion. But Wall Street is as bullish as ever on AI stocks. Here's what they're saying on Nvidia stock: For Q3, analysts have set the bar for Nvidia to report revenue of approximately $55 billion with EPS predicted to come in at a ballpark $1.25 per share, driven by roughly $49 billion generated from data centers alone."

Nvidia is rising as investors anticipate another robust quarter led by CEO Jensen Huang, trading up about 1.3% in morning action. Analysts expect roughly $55 billion in Q3 revenue and about $1.25 in EPS, with approximately $49 billion from data-center sales. Nvidia's market capitalization is near $4.4 trillion after a 35% year‑to‑date gain. Bank of America maintains a buy view, UBS holds a $230 target, and DA Davidson projects $250 per share. Major averages are modestly higher, technology and financials are outperforming, while energy and consumer staples trade lower. Lowe's gains after declaring a $1.20 cash dividend.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]