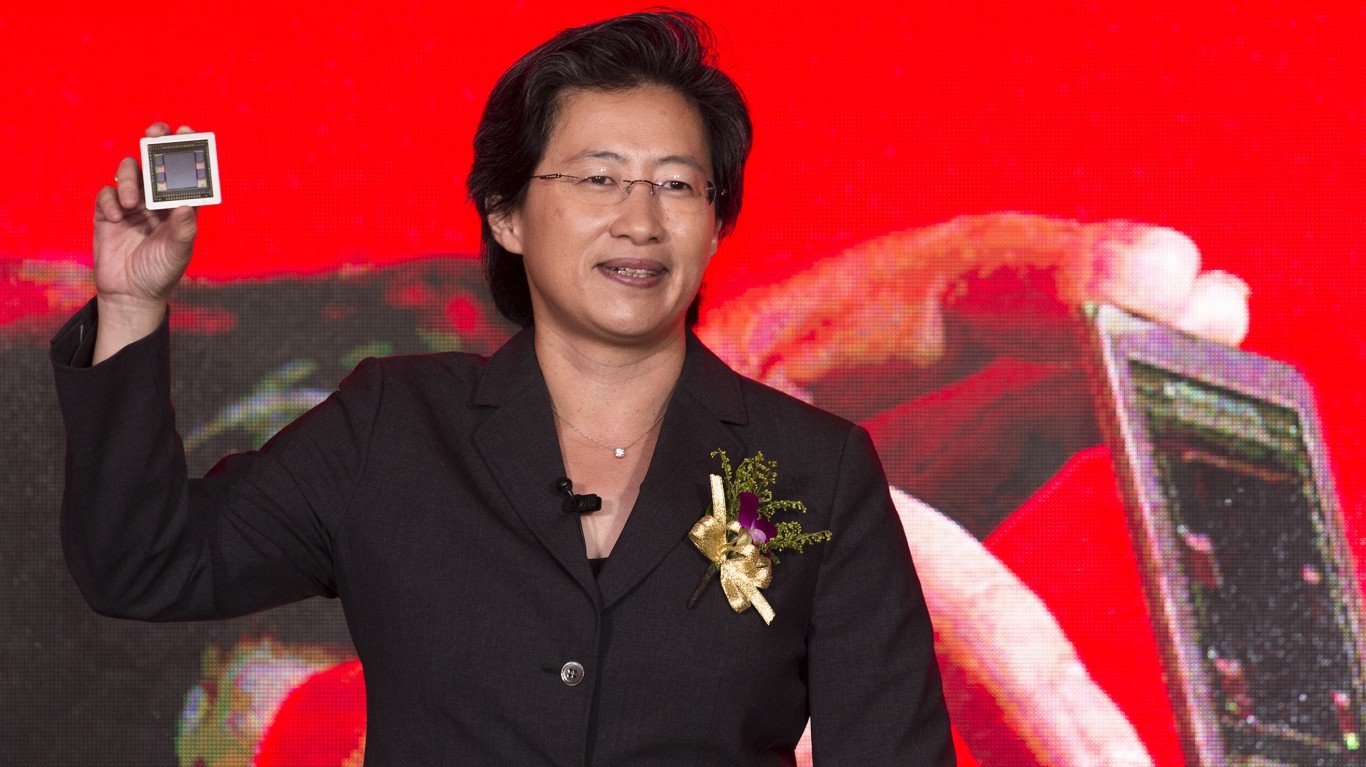

"Advanced Micro Devices ( NASDAQ:AMD) stock is having a pretty easy time outperforming Nvidia ( NASDAQ:NVDA) so far this year, with an impressive 95% gain year to date versus just 31% for NVDA stock. Indeed, the cousin rivalry between the top bosses of the two companies (Lisa Su over at AMD and Jensen Huang at Nvidia) in AI chips could intensify going into the new year. While calling for AMD to outperform NVDA at the start of the year felt so obvious, it certainly wasn't the case way back in December 2024, when AMD stock was getting slapped with downgrades while analysts only hiked the price targets of NVDA. Additionally, NVDA stock still seemed much cheaper than AMD when comparing the price-to-earnings (P/E) multiples side-by-side."

"In any case, it was wise to just go against the herd because the crowd was way too pessimistic over Lisa Su's empire and her firm's ability to do well without having to top Nvidia's latest and greatest AI chips in terms of pound-for-pound performance. In any case, AMD is the new hot horse to bet on, and I think the outperformance versus NVDA could continue, as Lisa Su and company prove to Wall Street what they're really capable of."

"Since the near doubling in shares in 2025, analysts have warmed up to the AI chip innovator in a big way. As it turned out, AI demand has really helped lift the AMD boat higher in the face of lower expectations. With strong margins and even stronger demand for its latest arsenal of AI chips, it certainly feels like AMD has a shot at catching up. The MI400 line of chips looks impressive and could help fuel outsized growth in the second half of 2026. Additionally, with a big vote of confidence given by the folks over at JPMorgan last week, who see AMD as having more sales upside amid the AI boom, I think it's worth staying aboard AMD stock as it soars higher."

AMD delivered a 95% year-to-date gain versus Nvidia's 31%, fueled by growing AI demand and upgraded sentiment after earlier downgrades. Analysts warmed to AMD following a near-doubling of shares in 2025, and strong margins plus demand for new AI chips strengthened revenue prospects. The MI400 chip line is positioned to drive outsized growth in the second half of 2026, and JPMorgan sees additional sales upside amid the AI boom. Partnerships such as the one with OpenAI contribute strategic validation and potential incremental upside for AMD's competitive positioning against Nvidia.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]