fromwww.independent.co.uk

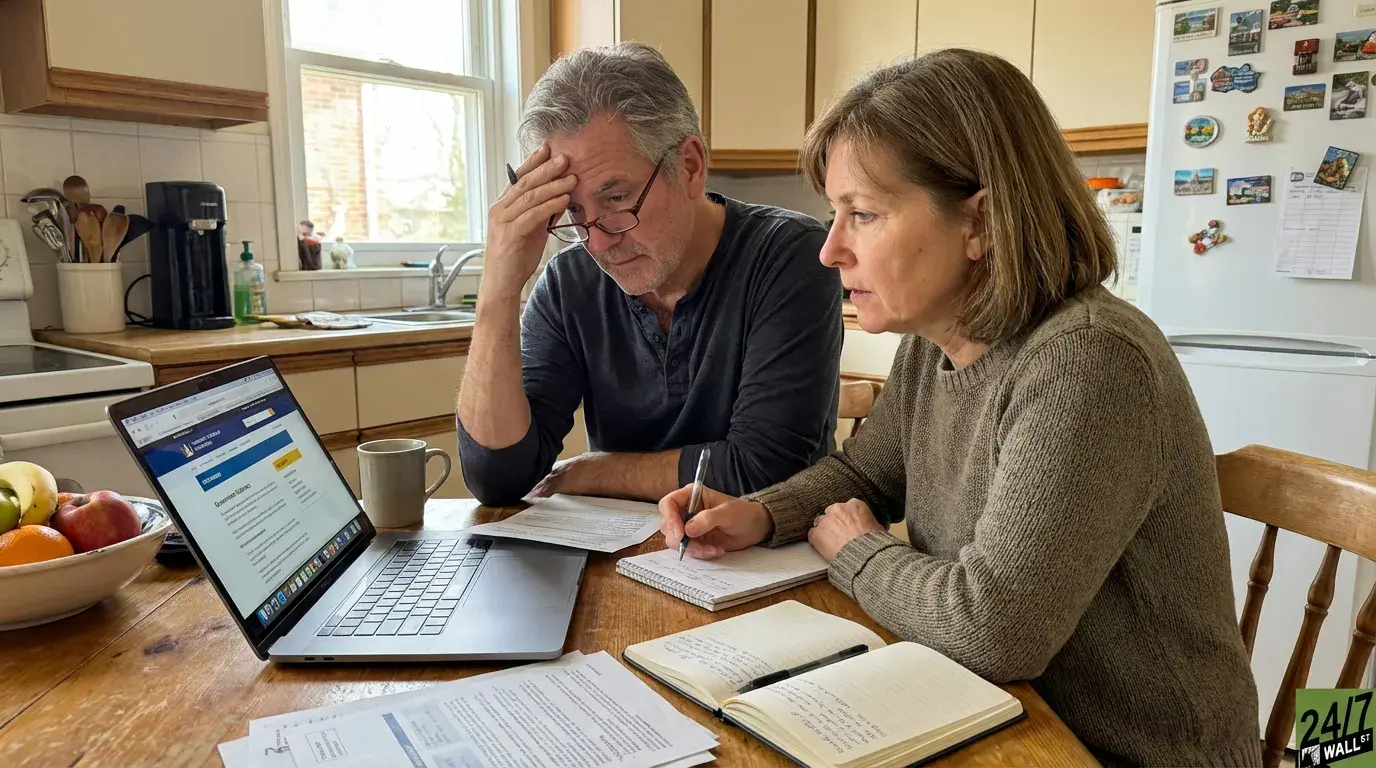

1 day agoHow to prep your pension - and how you use it - against new inheritance tax changes

Currently, pension savings are not used for estate valuations when calculating IHT charges when someone dies. This means money left in a pension can be passed on without worrying about generating a tax bill. But from the new tax year in April 2027, pensions will be included in estate calculations. This creates a higher chance of pushing the value of an estate above the IHT threshold, currently 325,000.

Retirement