US news

fromLondon Business News | Londonlovesbusiness.com

5 days agoDollar Relatively Stable Amid Economic Uncertainty - London Business News | Londonlovesbusiness.com

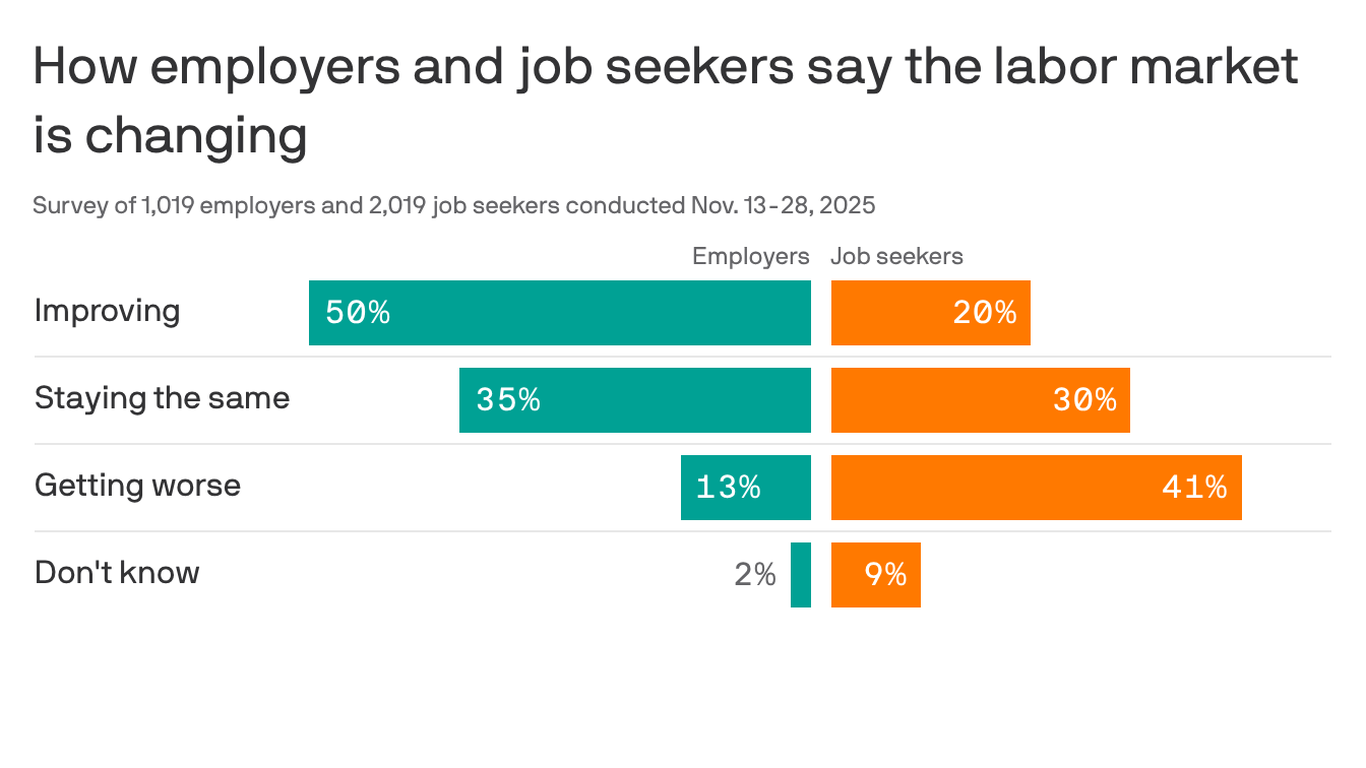

The dollar remains stable within a consolidation range, with its direction dependent on monetary policy expectations, labor market data, and inflation trends.