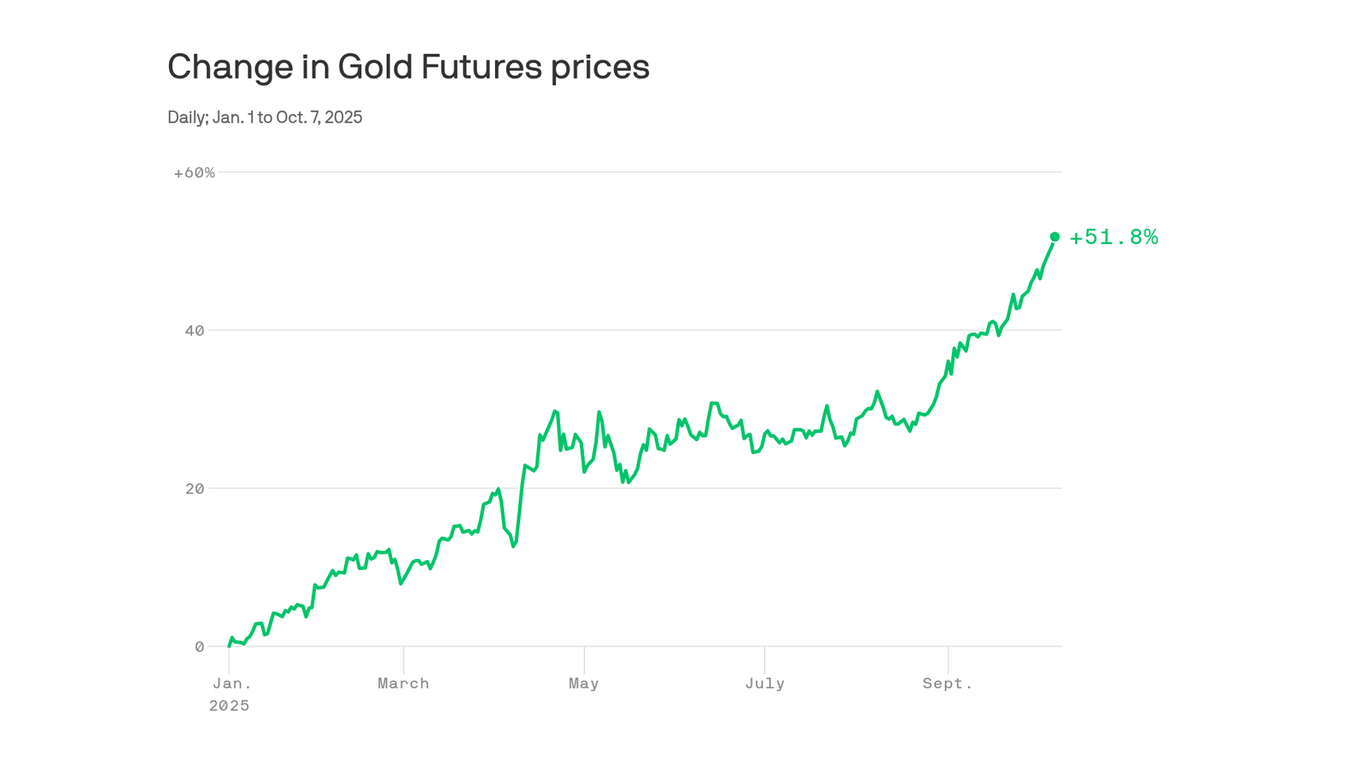

"Driving the news: Gold futures on Tuesday topped a record high of over $4,000 an ounce for the first time, putting the precious metal on track for its best year since 1979 - a year of double-digit inflation, a Mideast oil crisis and the Soviet invasion of Afghanistan. So far this year, the price of gold is up 51%. What they're saying:"

"Gold's rally comes amid President Trump's trade war and, now, a government shutdown. "For the rest of the world, we're weaponizing the tools of economic policy," El-Erian says. The concern is that slowly, over time, the rally in gold starts to indicate an eroding belief in "what makes the U.S. special," he adds. Between the lines: While gold and U.S. stocks are surging, the U.S. dollar is down over 9% against a basket of other currencies so far this year."

Gold futures reached a record above $4,000 an ounce, placing the metal on track for its strongest year since 1979 with a 51% year-to-date gain. Rally drivers include central-bank diversification away from the U.S. dollar, speculative flows, and declining confidence in institutions and sovereign stability. Political tensions, a trade war and a government shutdown have amplified demand for safe-haven assets. The U.S. dollar has fallen more than 9% against a currency basket, prompting investors to seek corporate exposure while reducing perceived sovereign risk.

Read at Axios

Unable to calculate read time

Collection

[

|

...

]