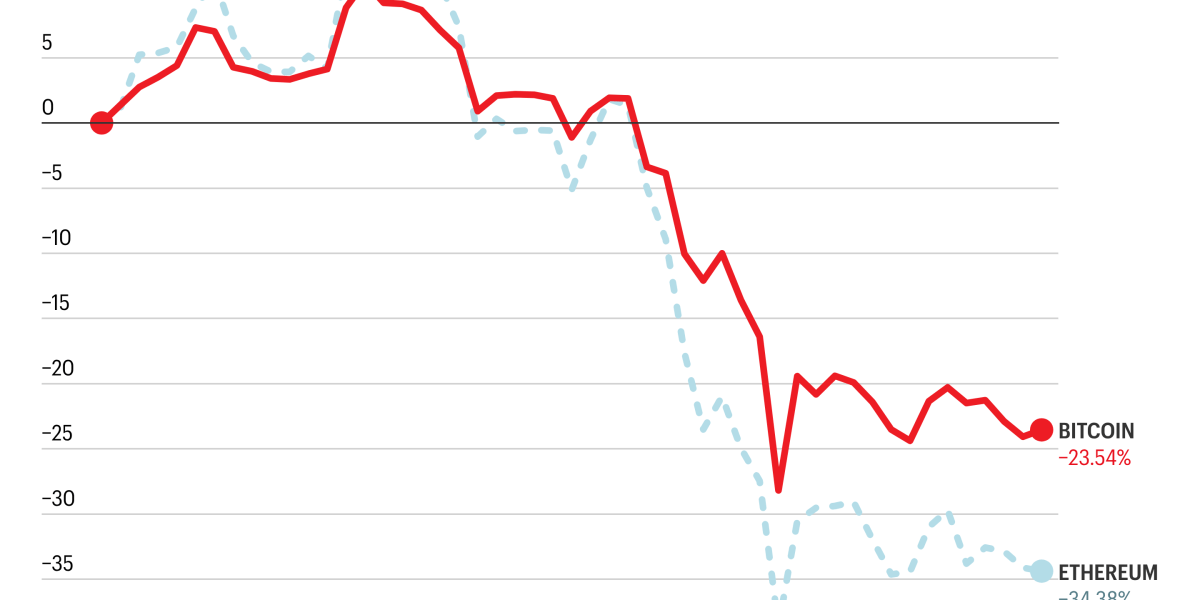

"Although cryptocurrencies' price moves have often tracked the broader equities market, the two asset classes have diverged over the past two months. Since January, the stock market has nudged slightly upward. The S&P 500 is up about 0.4%, and the Dow Jones has risen 2.3%. And even metals, which recorded a sudden drop almost three weeks ago, are also performing well. Gold has rocketed about 17% to start the new year and silver has jumped about 14%."

"The year-to-date plummets in Bitcoin and Ethereum's prices follow what's since been dubbed a "flash crash" on Oct. 10, where traders saw more than $19 billion in leverage evaporate after President Donald Trump issued another set of tariff threats against China. The one-day implosion in the crypto markets was the worst liquidation event ever tracked by the crypto analytics firm Coinglass."

Bitcoin and Ethereum have each declined roughly 24% year-to-date, the worst recorded starts to a year according to CoinGecko historical data. Equity markets have been flat to slightly positive since January, with the S&P 500 up about 0.4% and the Dow Jones up about 2.3%, while gold and silver have surged roughly 17% and 14% respectively. Market participants characterize the recent environment as a "Crypto Winter," noting muted investor responses to positive news. A flash crash on Oct. 10 wiped out over $19 billion in leveraged positions, and Bitcoin is down more than 46% since early October.

Read at Fortune

Unable to calculate read time

Collection

[

|

...

]