"The product offers similar functionality to a securities-backed loan or home equity line of credit, but allows users the ability to flexibly borrow using bitcoin as collateral without the monthly payments or term limits common in the bitcoin-backed loans market today. According to a press release shared with Bitcoin Magazine, the $200M financing "includes a combination of venture and debt capital" and brings two new high-profile angels on board: Anthony Pompliano, Bitcoin investor and entrepreneur, and Eric Jackson, activist public markets investor"

"Shehzan and his team are world-class, and they've been incredibly innovative on the product side. Not only is their revolving line of credit a first in the industry, but they've also managed to secure the lowest borrowing rates for their users- beating the rates of much older incumbents in the space. This is hands-down the best product in the market, and Lava is setting a new standard for bitcoin-backed loans."

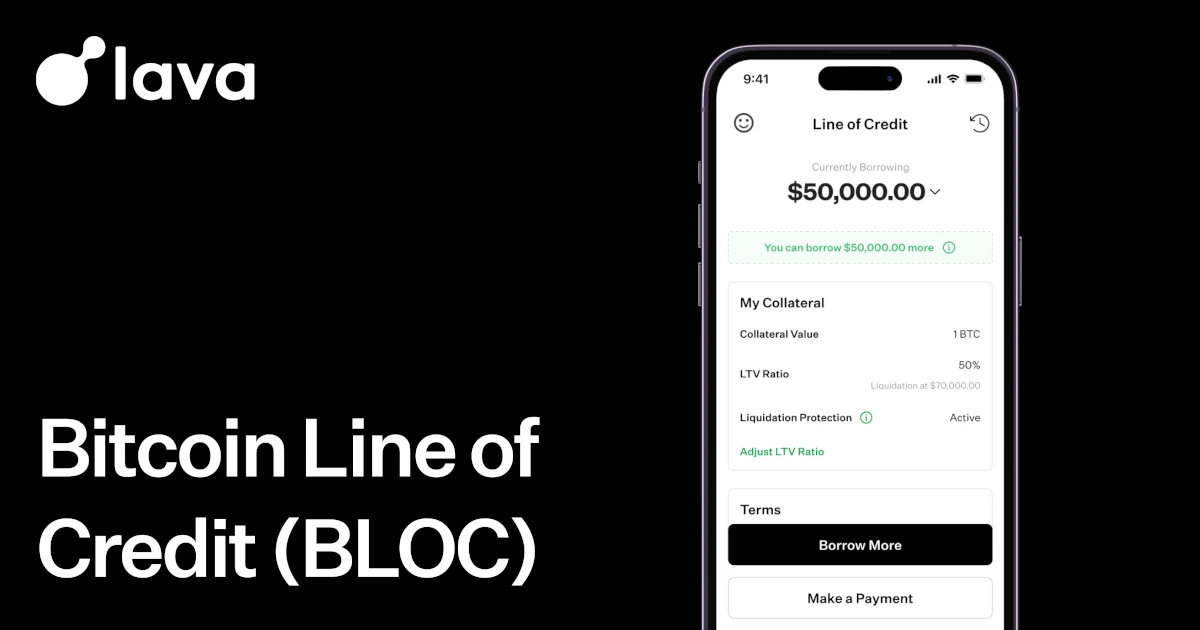

"As a result of the new fundraising, Lava now offers what may be the lowest fixed interest rates available in the bitcoin lending market, "starting at just 5%" for year-long durations. "The interest rate will update yearly, and you can simply leave your line of credit open to refinance at the new rate." Lava's line of credit functions more like a revolving account: users can borrow, repay, and borrow again at any time."

Lava secured $200 million in combined venture and debt financing and launched BLOC, a bitcoin-backed revolving line of credit. The product enables borrowers to use bitcoin as collateral to draw, repay, and redraw funds without monthly payments or fixed term limits. Two new angel investors, Anthony Pompliano and Eric Jackson, joined the capitalization. Lava is offering fixed interest rates starting at 5% for one-year durations, with rates updated yearly and the option to refinance by leaving the line open. Interest accrues only on amounts borrowed, not on unused line capacity, and the product targets lower borrowing rates versus incumbents.

Read at Bitcoin Magazine

Unable to calculate read time

Collection

[

|

...

]