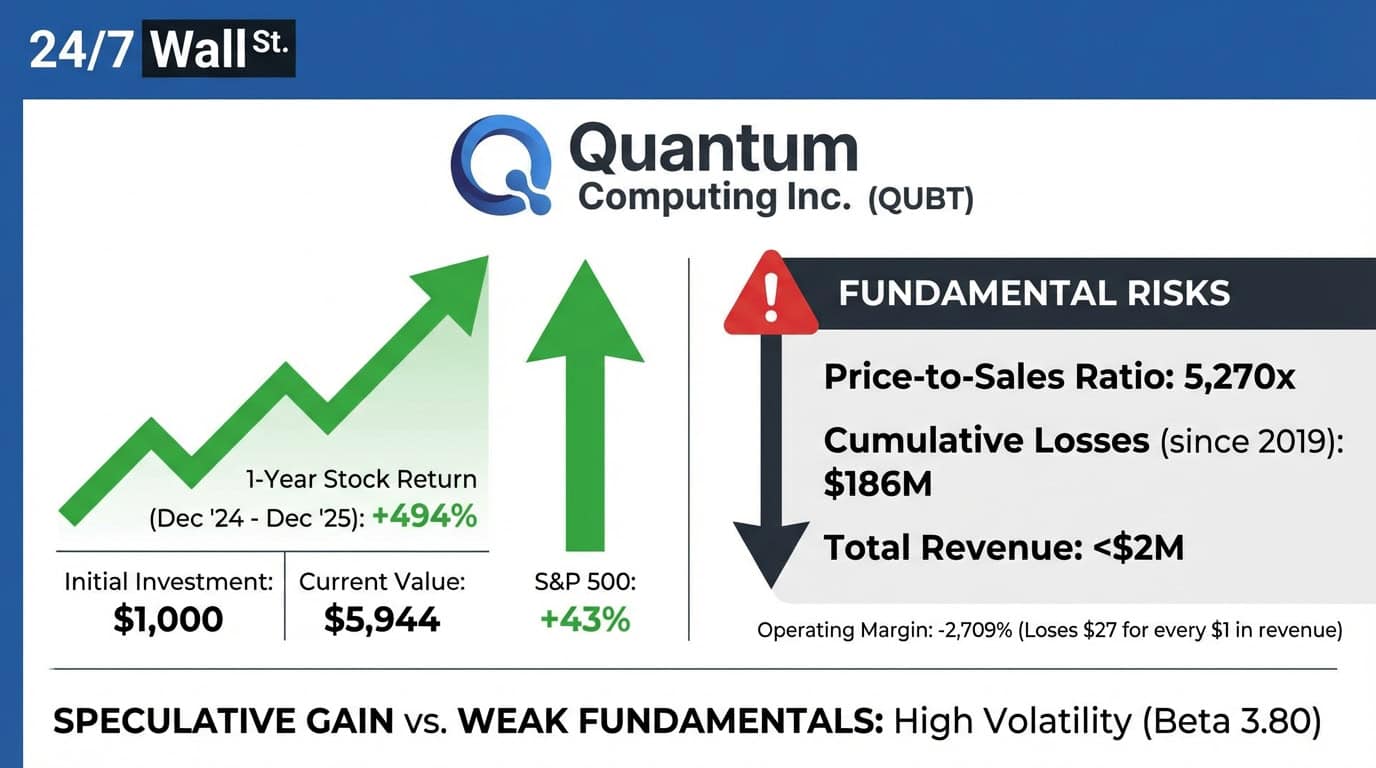

"Quantum Computing Inc. generated $546,000 in trailing revenue while carrying a market cap of $2.88 billion. That puts the price-to-sales ratio at 5,270x. The company would need to grow revenue by more than 5,000 times just to justify a normal 1x sales valuation. It has burned through roughly $186 million in cumulative losses since 2019 while generating less than $2 million in total revenue. The operating margin sits at negative 2,709%, meaning it loses $27 for every $1 it brings in."

"The recent rally was not driven by fundamentals. It was driven by speculation on quantum computing as a sector, retail trading volume that spiked to 71 million shares in a single day, and an earnings surprise in Q3 2025 that flipped expectations. The company posted $0.01 in earnings per share against estimates of a $0.06 loss, a 117% beat. One quarter earlier, it had missed by 333%. The quarter before that, it beat. The quarter before that, it missed by 844%."

Quantum Computing Inc. delivered a roughly 494% one-year gain that turned $1,000 into nearly $6,000 while the S&P 500 gained 43% in the same period. The rally contrasts with weak fundamentals: $546,000 in trailing revenue, $2.88 billion market cap, and a 5,270x price-to-sales ratio. The company has burned about $186 million in cumulative losses since 2019 while generating less than $2 million in total revenue and an operating margin of -2,709%. Momentum appeared driven by sector speculation, huge retail volume spikes, and volatile quarterly earnings surprises, not by predictable cash flows. Investing in the stock is characterized as thematic gambling with pronounced timing risk and large price swings.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]