"AI taking entry-level jobs is a 'when,' not an 'if.' But in venture capital, 70% of the decision is reading the founder and team-and that's something AI can't do. That simple breakdown , 70% people, 30% product-flips the usual narrative about finance. For decades, finance was defined by numbers. Analysts lived and died by the spreadsheets. Today, AI can run discounted cash flows, parse a term sheet, and size a market faster than any junior associate."

"The entry-level finance roles that once trained armies of analysts are increasingly exposed to automation. AI models can scan thousands of comparable companies in seconds, build slide decks, even flag anomalies that a first-year hire would have spent a weekend catching. In fact, McKinsey estimates that nearly half of finance tasks could already be automated by existing AI tools. What was once seen as a rite of passage-the long hours bent over Excel-may soon look as outdated as typewriters in an accounting office."

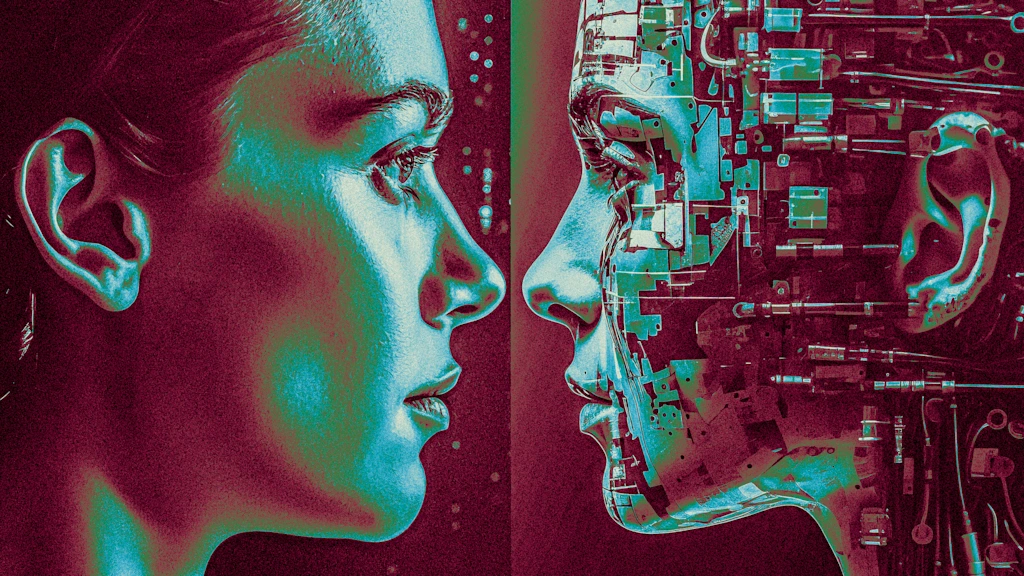

"They assume it already has. The conversation now is how to build careers in finance when machines are better, faster, and cheaper at the very tasks that used to get you in the door. Venture capital, especially at the earliest stages, offers a counterintuitive lesson. The math can only take you so far. Market sizing, revenue projections, even technical due diligence-all of it is valuable, but none of it predicts success the way the founder does."

AI already automates many entry-level finance tasks such as discounted cash flows, term-sheet parsing, market sizing, and slide-deck creation. Nearly half of finance tasks could be automated by existing tools, reducing the traditional analyst training pipeline. Students are preparing for careers where mechanistic work is handled by machines and must develop skills beyond rote analysis. Venture capital places disproportionate weight on assessing founders and teams, so human judgment in reading people remains crucial. Market and technical analysis stay valuable but cannot fully predict startup success without founder evaluation.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]