"Homebuying > retiring? Currently, 401(k) participants must pay an additional 10% tax on funds withdrawn from their account before the age of 59-and-a-half-also known as an early distribution-for any number of reasons, including buying a home. Rules are different under Individual Retirement Accounts (IRAs), which allow qualified first-time homebuyers to withdraw up to $10,000 without incurring the 10% penalty."

"Some employers allow workers to take out a loan from their 401(k) account balance in order to purchase a home. Under current IRS regulations, this loan can't exceed 50% of a participant's vested balance, or $50,000. Workers were already taking advantage of such options before Hassett floated this recent policy idea. As of 2024, nearly one-quarter of homebuyers surveyed by Zillow had tapped into their retirement funds (i.e. a 401(k), IRA, or 403(b)) to help finance a down payment."

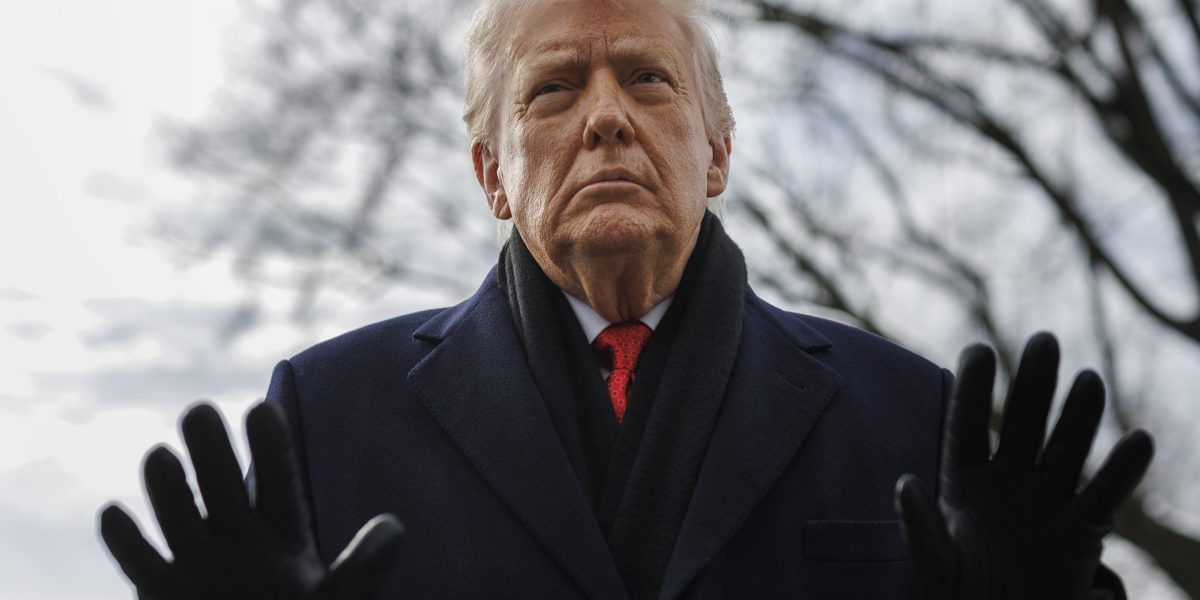

A White House official promoted a plan to let Americans access 401(k) savings for down payments and indicated an intended Davos rollout. The president ultimately opposed allowing 401(k) participants to use savings for home deposits and no formal proposal was presented at Davos. Current 401(k) rules impose a 10% penalty on withdrawals before age 59½, while IRAs permit qualified first-time homebuyers to withdraw up to $10,000 penalty-free. Some employers permit 401(k) loans up to 50% of vested balances or $50,000. Nearly one-quarter of 2024 homebuyers used retirement funds to help finance down payments.

Read at Fortune

Unable to calculate read time

Collection

[

|

...

]