""Markets can view equity stakes as a leading indicator of favourable ROIC (return on invested capital)... the incentive for taking equity stakes seem significantly higher than withdrawing funding," said analysts at Jefferies. The loan from the U.S. Energy Department for the Thacker Pass project, a venture with General Motors, was approved by Trump at the end of his first term."

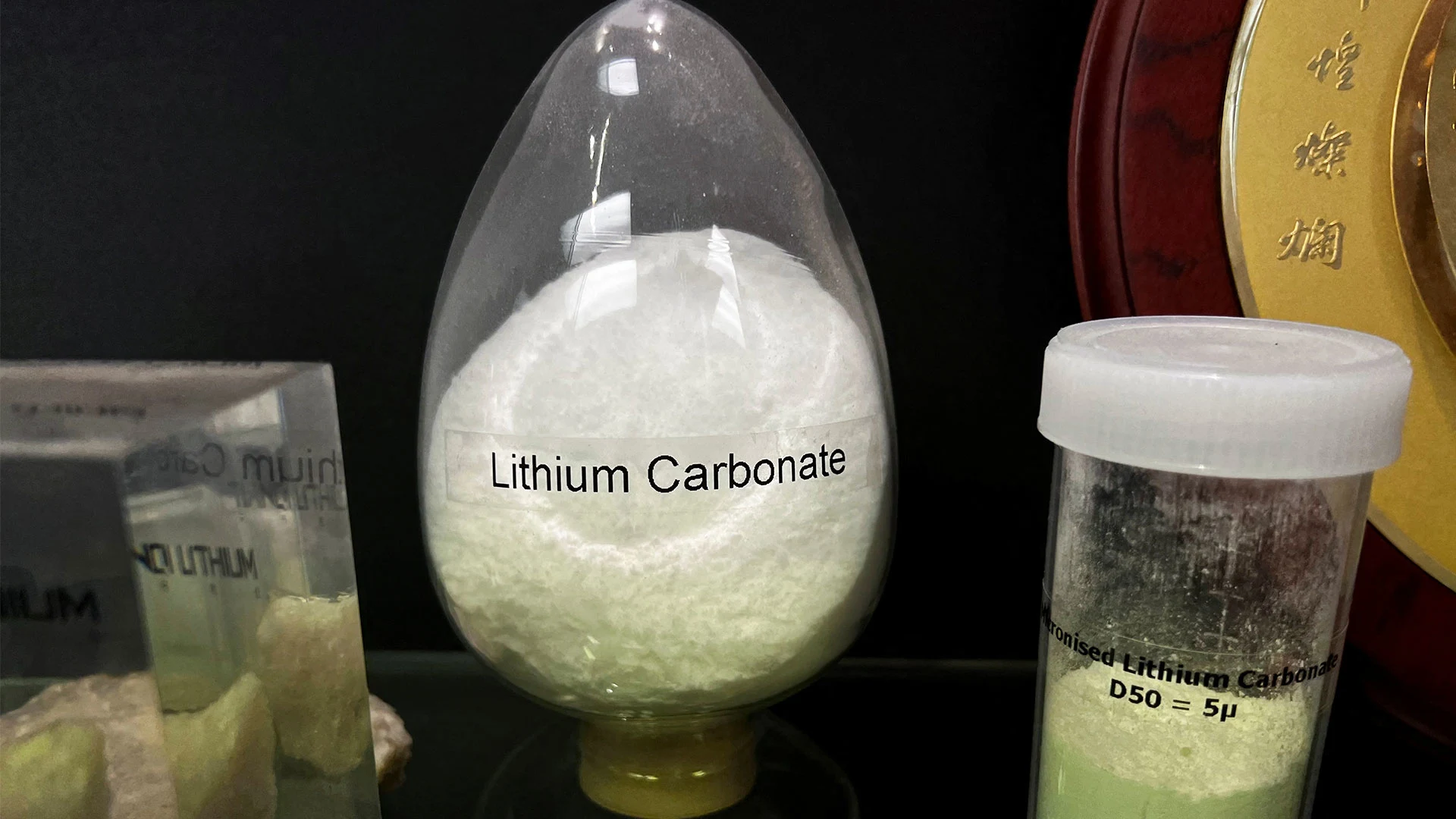

"Shares of the automaker, which owns 38% of the mine, gained 2.9% before the bell. When it opens in 2028, the project is expected to become the Western Hemisphere's largest source of lithium and could far surpass larger peer Albemarle's facility in the region. The project has long been touted as a key way to boost U.S. critical minerals production and cut reliance on China, the world's largest lithium processor."

U.S. officials are reportedly considering an equity stake of up to 10% in Lithium Americas as part of negotiations to renegotiate a $2.26 billion U.S. Energy Department loan for the Thacker Pass lithium mine. The prospect of government ownership sent U.S.-listed Lithium Americas shares sharply higher in premarket trading, and lifted other lithium miners and automaker General Motors, which owns 38% of the mine. Thacker Pass is expected to open in 2028 and become the Western Hemisphere's largest lithium source, intended to boost domestic critical minerals production and reduce reliance on China. The company recently split its North American and Argentine businesses and reported widening quarterly losses.

#lithium-americas #thacker-pass #us-government-equity-stake #critical-minerals #stock-market-reaction

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]