"And one could say that he followed through on this one, as the no taxes in tips policy (and we're putting it in quotes for a reason) was indeed part of the so-called One Big Beautiful Bill that Congress passed this summer. And now that the IRS is releasing the rules around no taxes on tips, we find that surprise! tipped employees are still paying taxes on their tips."

"As this post from Moneywise explains, it's not really no taxes. That is, you still pay taxes on these tips, but the tipped employee can deduct up to $25,000 from your taxes on tipped wages. Which means you need to document that amount. Documenting $25,000 worth of tips sounds like a lot of paperwork! (And if you make more than $150,000 per year, you can't deduct tips anyway.)"

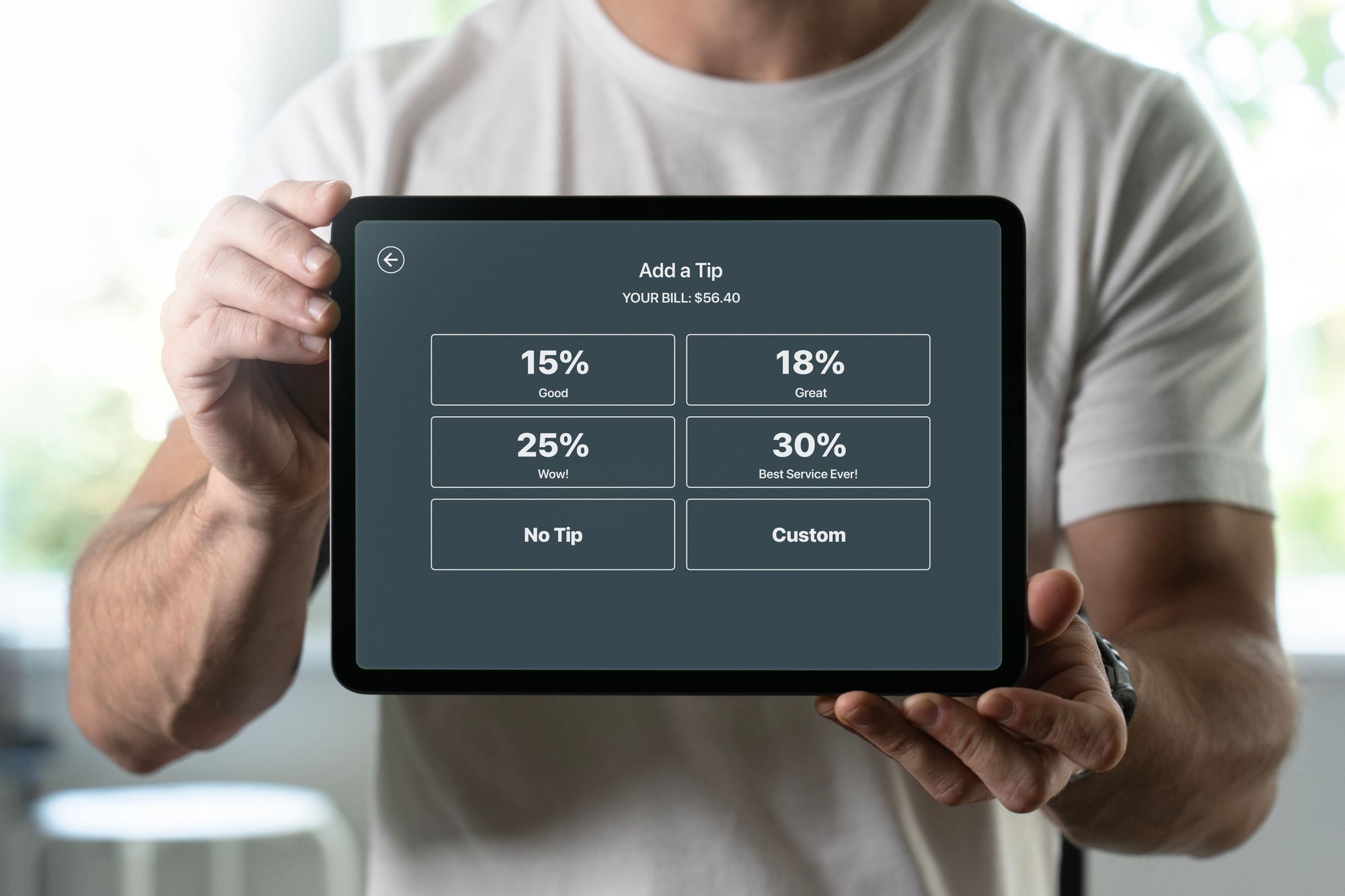

"And the Bay Area News Group finds another significant loophole. The only taxes you can deduct are on tips that are considered voluntary tips, and mandatory tips cannot be deducted. That is to say, flat-percentage service charges the likes of which are now commonplace across the Bay Area, and any mandatory gratuities for parties of six or more cannot be deducted, and tipped employees are still paying full taxes on any tips that the establishment requires the customer to pay."

Donald Trump's pledge of no taxes on tips became law as part of the One Big Beautiful Bill, but rules show tipped workers still pay taxes on tips. The law allows tipped employees to deduct up to $25,000 in voluntary tip income, but deduction requires documentation and is unavailable to earners over $150,000. Mandatory tips and automatic, flat-percentage service charges are excluded from the deduction and remain fully taxable. Federal guidelines define voluntary tips as payments free from compulsion, non-negotiable, and determined by the payor. The policy creates paperwork burdens and leaves loopholes for employer-imposed gratuities.

Read at sfist.com

Unable to calculate read time

Collection

[

|

...

]