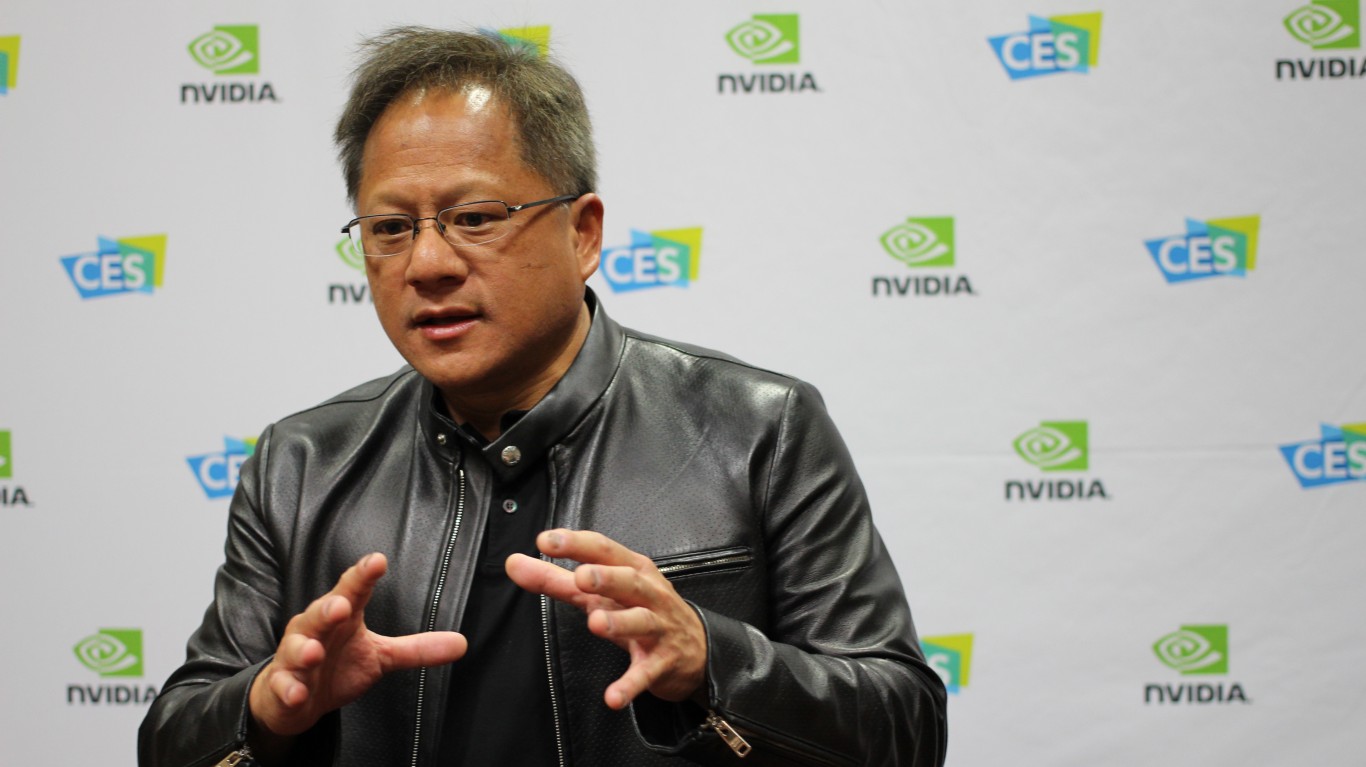

"After a relatively sluggish start to 2026, Nvidia ( NASDAQ:NVDA) shares finally seem ready to pick up traction. Just when it seemed like the GPU titan was about to lead the Magnificent Seven lower, shares went on to gain close to 8% from their past-month lows. With shares now slightly in the green on the year, as CEO Jensen Huang visits China, there's every reason to be optimistic, even if earnings season introduces another layer of volatility to the tech and AI trade."

"it's a very interesting time for Nvidia's top boss to be visiting China, especially amid recent developments regarding the firm's ability to sell the H200 chip there. Undoubtedly, there's been quite a bit of back and forth regarding the matter, with the U.S. allowing for exports while China seemingly flip-flopped, signaling early rejection (whether it's due to the 25% markup or a show of domestic pride, given Huawei chips are an alternative, albeit less powerful one), only to approve after warming up to the idea."

"At this juncture, it seems like tensions have de-escalated in a big way, probably thanks to Huang. With the first H200 chip imports on the way after China's recent green light, which was pretty much a 180-degree pivot from where it stood just last week, Nvidia may very well have enough fuel in the tank for its stock to experience another big leg higher."

Nvidia experienced a sluggish start to 2026 but shares recovered, gaining close to 8% from recent lows and moving slightly into positive territory for the year. CEO Jensen Huang visited China amid fast-changing developments over H200 chip sales, with U.S. export allowances followed by China's initial resistance and subsequent approval. The H200 approval and Huang's visit coincided with a de-escalation of tensions and the first H200 imports are now on the way. Investors may await updated guidance and face earnings-season volatility as markets assess how much Chinese demand is priced into the stock.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]