"The company extended its lead in logic, DRAM, and advanced packaging technologies while competitors struggled to keep pace with rapidly evolving manufacturing requirements. CEO Gary Dickerson has consistently emphasized the company's focus on "the highest value technology inflections in the fastest growing areas of the market." That strategy delivered six consecutive years of growth through fiscal 2025, culminating in record annual revenue of $28.37 billion (up 4% year over year) and non-GAAP EPS of $9.42 (up 9%)."

"The 10-year performance crushed the market by nearly 5x, turning $1,000 into over $11,000. Even the five-year window delivered 185% returns, more than doubling the S&P 500. The recent year shows modest gains as the stock pulled back from October highs near $276, currently trading around $248. That pullback followed a mixed Q4 2025 report. While annual results hit records, quarterly revenue of $6.80 billion missed estimates and declined 3% year over year."

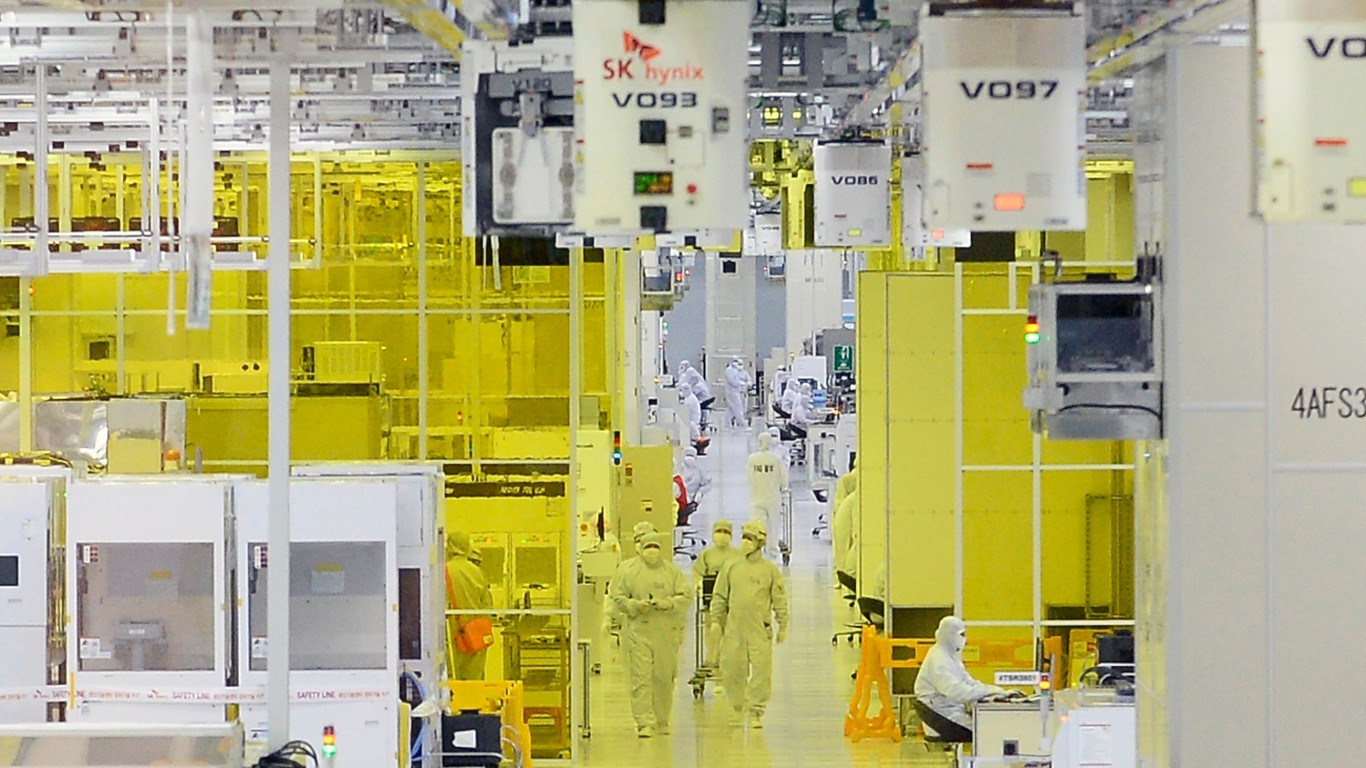

Applied Materials supplies machines and services to semiconductor fabrication facilities, enabling advanced processes such as 7nm, 5nm, and 3nm. Cloud computing, mobile devices, and AI created insatiable demand for advanced semiconductors that accelerated Applied's transformation. The company extended its lead in logic, DRAM, and advanced packaging while competitors struggled to keep pace with rapidly evolving manufacturing requirements. Six consecutive years of growth through fiscal 2025 produced record annual revenue of $28.37 billion (up 4%) and non-GAAP EPS of $9.42 (up 9%). A decade of returns turned $1,000 into over $11,000, though a mixed Q4 2025 with $6.80 billion quarterly revenue that missed estimates caused a pullback.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]