"Quantum computing stocks were among the hottest investments in 2024, with several pure plays delivering gains opf 1,000% or more as investor excitement peaked around breakthroughs in qubit stability and early commercial contracts. In 2025, however, the sector cooled significantly - hype gave way to scrutiny over timelines, profitability, and technical hurdles. Year-to-date gains in 2026 have been markedly smaller, with most names trading well off their highs."

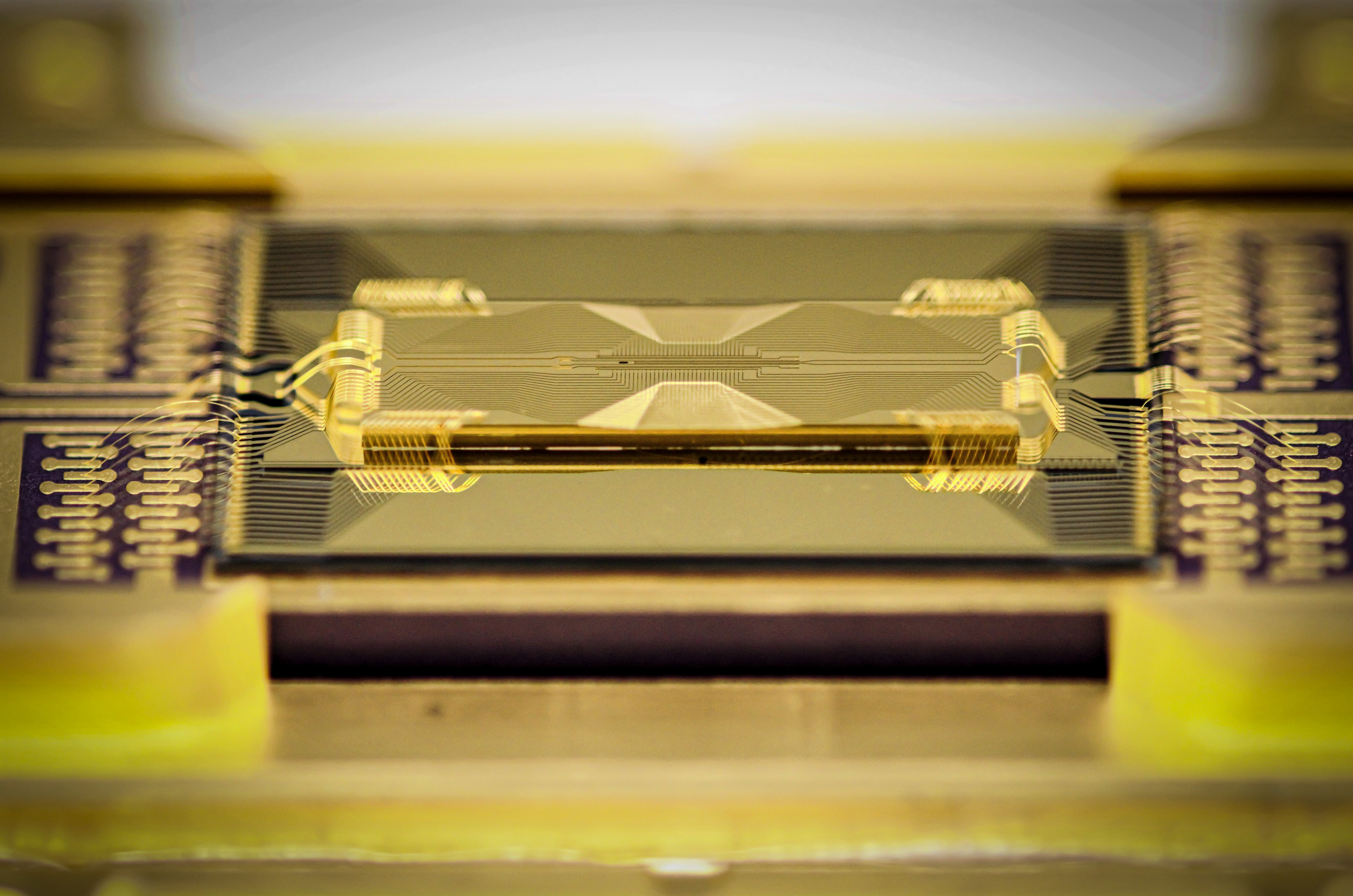

"This morning, IonQ announced it will acquire SkyWater Technology for $35.00 per share in a cash-and-stock transaction valued at approximately $1.8 billion. SkyWater shareholders will receive $15.00 in cash and $20.00 in IonQ stock, representing a 38% premium to SkyWater's 30-day volume-weighted average price as of last Friday. The deal is expected to close in the second or third quarter, pending SkyWater shareholder approval and regulatory clearances."

Quantum computing stocks surged in 2024 with some pure plays rising over 1,000% amid qubit stability breakthroughs and early commercial contracts. The sector cooled in 2025 as investor scrutiny focused on timelines, profitability, and technical hurdles, and 2026 gains are markedly smaller with most names trading well below prior highs. IonQ announced a $1.8 billion acquisition of SkyWater Technology at $35.00 per share, comprising $15 cash and $20 in IonQ stock, a 38% premium to SkyWater's recent VWAP, expected to close in the second or third quarter pending approvals. SkyWater is the largest exclusively U.S.-owned pure-play semiconductor foundry with DMEA Category 1A Trusted Foundry accreditation. The acquisition gives IonQ direct control over chip design, packaging, and fabrication capabilities essential for scaling trapped-ion quantum systems and securing a domestic supply chain, which IonQ's CEO described as transformational and a material accelerator of the quantum roadmap.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]