"Ray Dalio's recent portfolio adjustments reflect a strategic response to market volatility, positioning for potential downturns while identifying value in less popular investments."

"Dalio's reduction in SPY stake indicates a cautious approach amidst tariff uncertainties, even as he sees potential in companies like Alibaba and investments in gold."

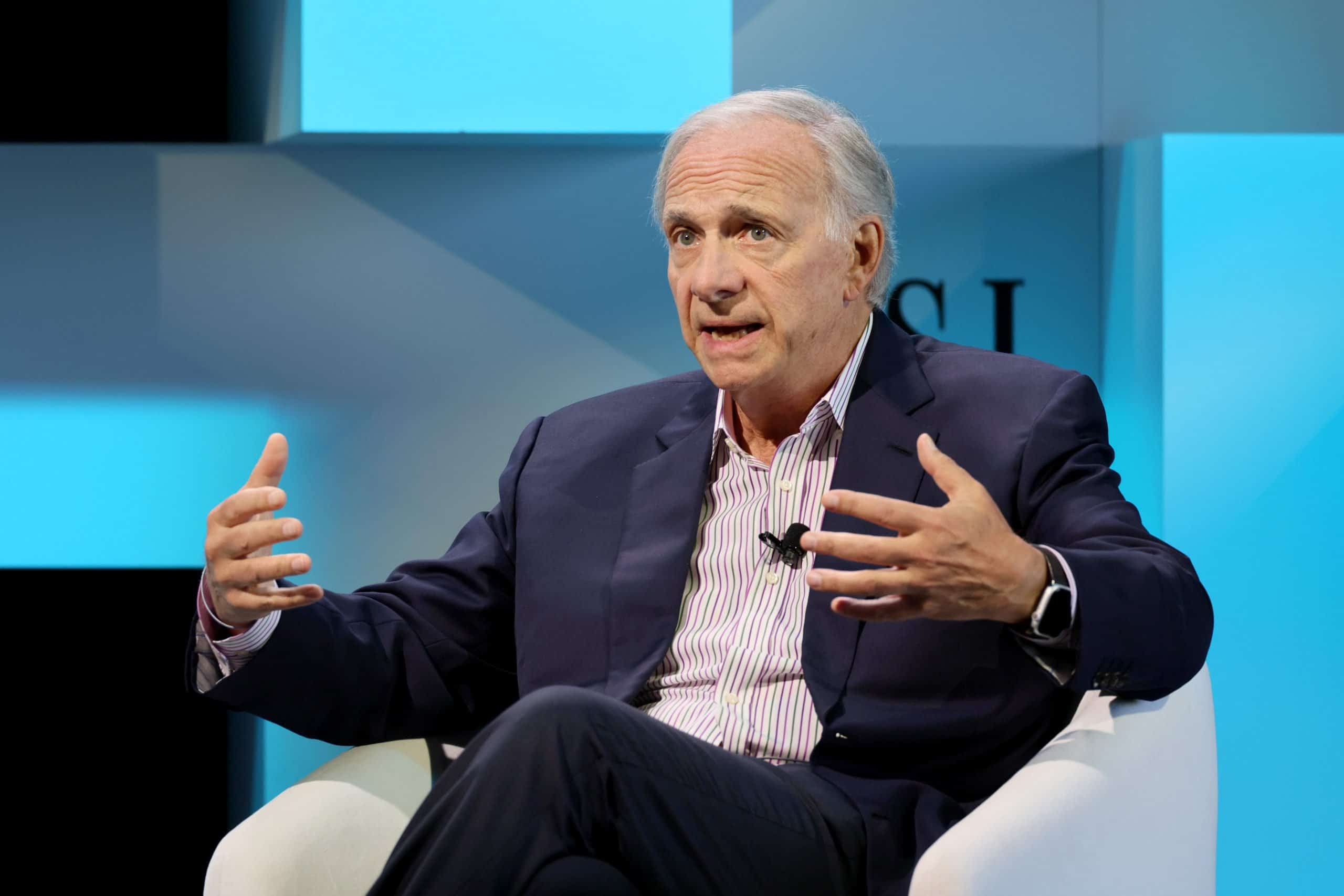

In Q1, Ray Dalio of Bridgewater Associates made significant changes to his investment strategy, reducing his hefty stake in the SPDR S&P 500 ETF by over half. While this indicates a cautious outlook amidst concerns over Trump tariffs, his remaining position still makes SPY the largest holding in his portfolio. Dalio's new investments in gold and Alibaba suggest he sees potential value where others may overlook. These moves highlight his ability to navigate market fluctuations while capitalizing on emerging opportunities as tariffs continue to generate market instability.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]