"A few years ago, life in America's "Zoomtowns" seemed golden. The Sun Belt was booming, home listings sparked bidding wars and cash-flush buyers from New York and San Francisco were snatching up properties in Austin, Tampa and Phoenix like it was a race. But the tide has turned, and fast. The same cities that once symbolized freedom and affordability for pandemic-era movers have become cautionary tales. Homes are sitting longer. Prices are falling. And sellers, once cocky, are cutting deals just to get out."

"Homeownership rates rose from 64.6% in 2019 to 65.8% in 2022, with most gains driven by younger households. Metros like Austin, Tampa, and Charlotte saw significant influxes of newcomers. When the migration frenzy cooled and mortgage rates spiked, all that new supply collided with dwindling demand. Austin's home values have dropped about 20% from their 2022 peak. Dallas and Tampa have seen similar reversals, raising questions that once-feverish "sold over asking" markets are becoming clearance racks."

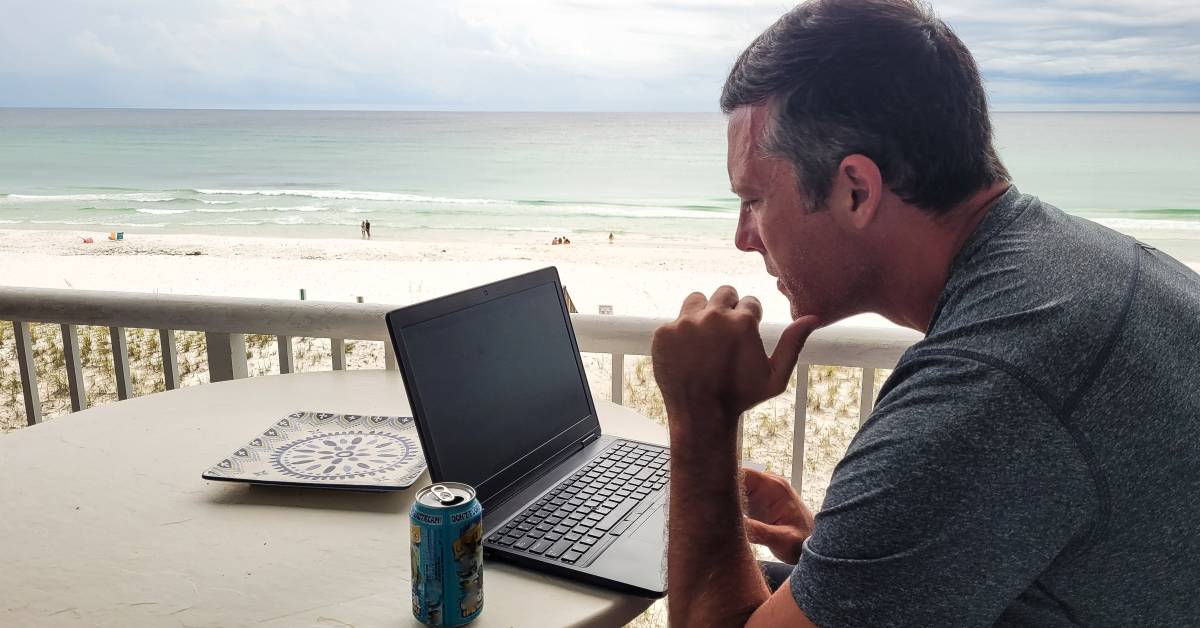

Pandemic-era migration sent remote workers from expensive coastal cities to Sun Belt 'Zoomtowns' such as Austin and Tampa, driving bidding wars and rising homeownership among younger households. Homeownership rates rose from 64.6% in 2019 to 65.8% in 2022. A subsequent spike in mortgage rates reduced demand, leaving excess supply that lengthened listing times and forced sellers to cut prices. Austin's values fell about 20% from their 2022 peak, with Dallas and Tampa showing similar declines. Northern markets including Buffalo, Milwaukee, Cleveland, and Detroit are seeing price gains and quicker sales. Net migration to the South is down almost 40% versus the pandemic's first year, while the Midwest shows modest population retention.

Read at Moneywise

Unable to calculate read time

Collection

[

|

...

]