"Opendoor Technologies ( NASDAQ: OPEN) went public via SPAC merger in December 2020 with a bold vision: use technology to eliminate friction from home buying and selling. The iBuyer model promised homeowners instant cash sales while buyers browsed algorithmically priced homes online. Investors initially loved it. The pandemic housing boom was rocket fuel. Low rates and remote work sent home prices soaring, and Opendoor's tech-forward approach seemed perfectly timed. But the model had a fatal flaw: buying massive inventory with borrowed money,"

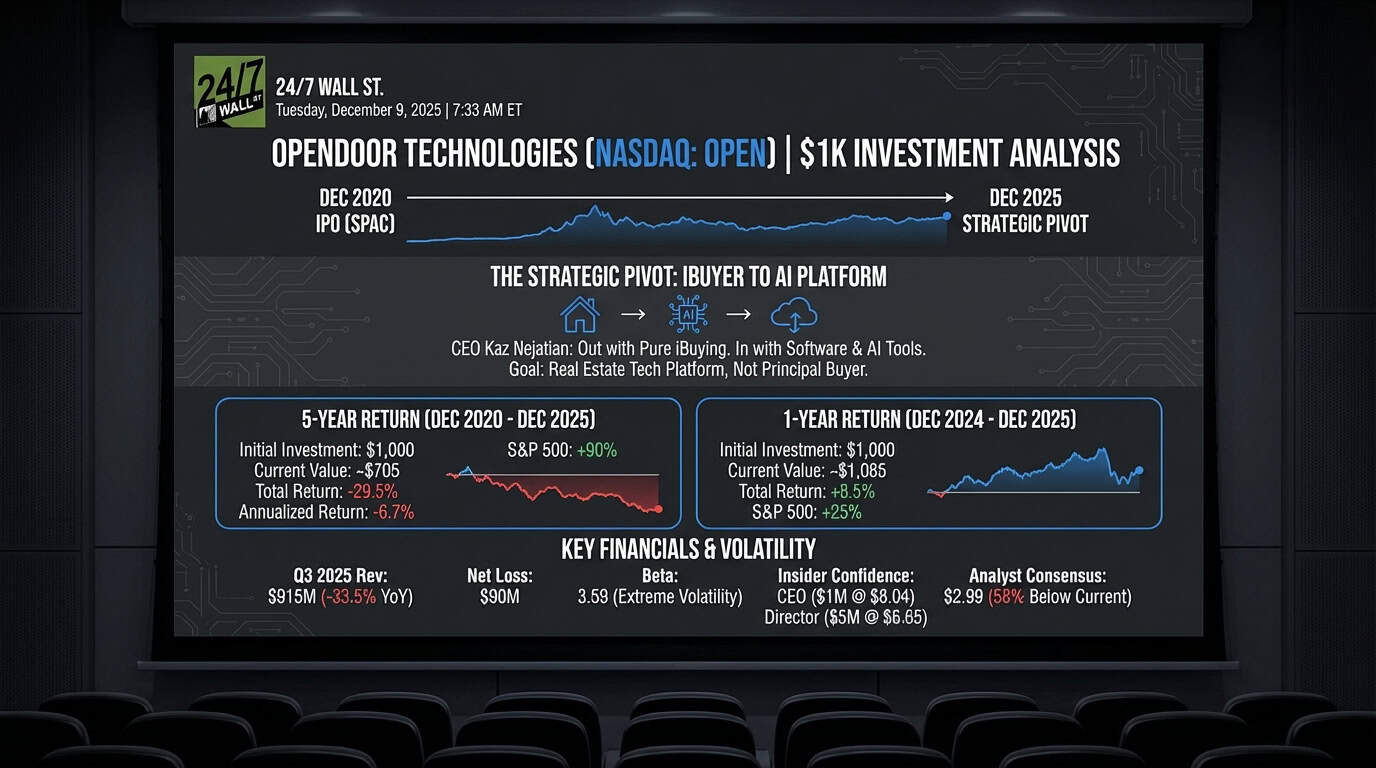

"From $1,000 to What? Because Opendoor only went public in late 2020, we can't calculate 10-year returns. Here's what your $1,000 would look like at different entry points: 1-Year Return (Dec 2024 to Dec 2025)5-Year Return (Dec 2020 IPO to Dec 2025) Initial Investment: $1,000 Estimated IPO Price (adjusted): ~$10.00 Current Value (at $7.05): ~$705 Total Return: -29.5% Annualized Return: -6.7% S&P 500 (same period): ~$1,900 (+90%)"

Opendoor launched via a SPAC in December 2020 to streamline home buying and selling with an iBuyer model offering instant cash sales and algorithmic pricing. The pandemic surge in prices initially boosted growth, but the model required buying large inventories with borrowed money. Rising interest rates in 2022 froze the market and left Opendoor holding depreciating assets, producing annual losses exceeding $1 billion. In October 2025 new CEO Kaz Nejatian shifted strategy from principal iBuying to selling software and AI tools. Q3 2025 revenue fell 33.5% year-over-year to $915 million with a $90 million net loss, and the stock experienced steep declines and high volatility.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]