"When assessing home price momentum, believes it's important to monitor active listings and months of supply. If active listings start to rapidly increase as homes remain on the market for longer periods, it may indicate pricing softness or weakness. Conversely, a rapid decline in active listings could suggest a market that is tightening or heating up. Since the national Pandemic Housing Boom fizzled out in 2022, the national power dynamic has slowly been shifting directionally from sellers to buyers."

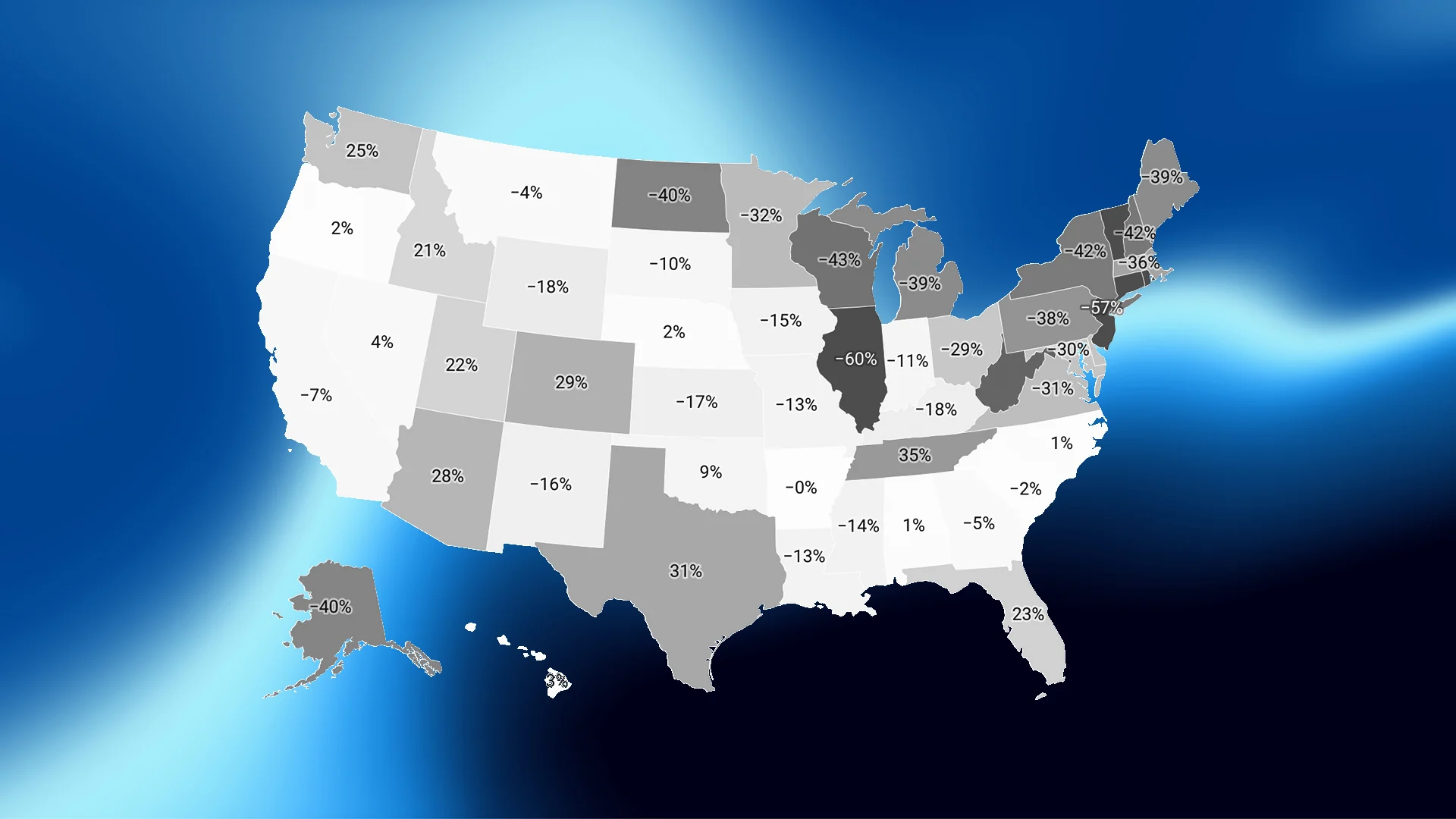

"Generally speaking, local housing markets where active inventory has jumped above pre-pandemic 2019 levels have experienced softer home price growth (or outright price declines) over the past 36 months. Conversely, local housing markets where active inventory remains far below pre-pandemic 2019 levels have, generally speaking, experienced more resilient home price growth over the past 36 months. Where is national active inventory headed? National active listings as tracked by Realtor.com are on the rise on a year-over-year basis (+17% between September 2024 and September 2025)."

Monitoring active listings and months of supply provides signals for home price momentum. Rapid increases in active listings combined with longer market times tend to indicate pricing softness, while rapid declines suggest market tightening. The national dynamic shifted from sellers toward buyers after the Pandemic Housing Boom ended in 2022, with significant regional variation. Markets with active inventory above pre-pandemic 2019 levels generally showed softer price growth or declines over the past 36 months, whereas markets with inventory far below 2019 levels showed more resilient price growth. National active listings rose 17% year-over-year (September 2024–September 2025) but remain about 10% below September 2019, and recent inventory growth has slowed as some sellers delisted.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]