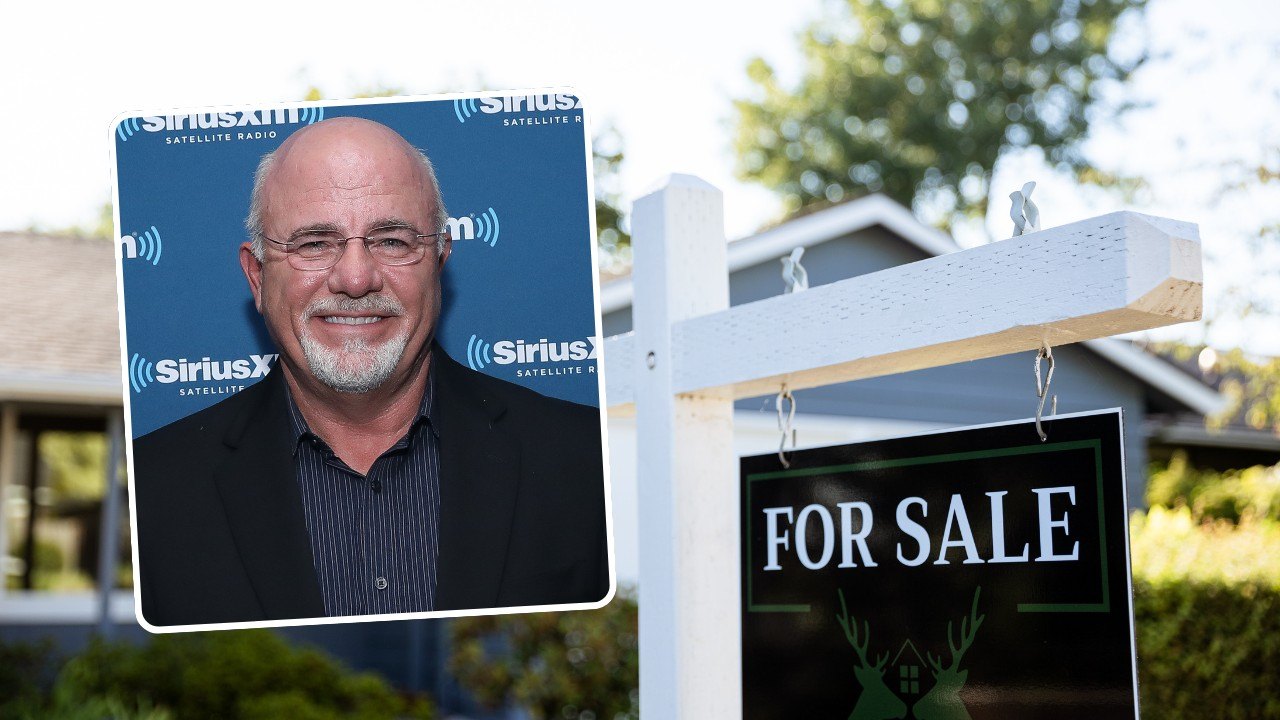

"Dave Ramsey advises potential homebuyers to prioritize financial readiness over chasing lower mortgage rates, highlighting the significance of factors like debt, emergency funds, and down payments. Experts like Brian Shahwan and Kirsten Jordan support Ramsey's view that the current market presents opportunities for homebuyers, with expectations that mortgage rates may align with the Fed's trajectory. Contrary to the optimism, real estate agent Eli Harris cautions about overlooking the practical challenges, such as high living costs, potential additional expenses beyond mortgage rates, and limitations on refinancing eligibility."

"Experts like Brian Shahwan and Kirsten Jordan support Ramsey's view that the current market presents opportunities for homebuyers, with expectations that mortgage rates may align with the Fed's trajectory. Contrary to the optimism, real estate agent Eli Harris cautions about overlooking the practical challenges, such as high living costs, potential additional expenses beyond mortgage rates, and limitations on refinancing eligibility. Harris points out that low or no down-payment options like VA, FHA, and USDA loans might limit the benefits of a slight decrease in interest"

The Federal Reserve's rate cut has influenced mortgage-rate expectations and homebuying decisions. Financial readiness—paying down debt, building emergency savings, and accumulating a down payment—matters more than attempting to time marginal mortgage-rate movements. The current housing market presents purchasing opportunities with potential downward pressure on mortgage rates linked to Fed action. Practical challenges include high living costs, additional expenses beyond the monthly mortgage payment, and reduced refinancing advantages for loans with low or no down payment such as VA, FHA, and USDA.

Read at SFGATE

Unable to calculate read time

Collection

[

|

...

]