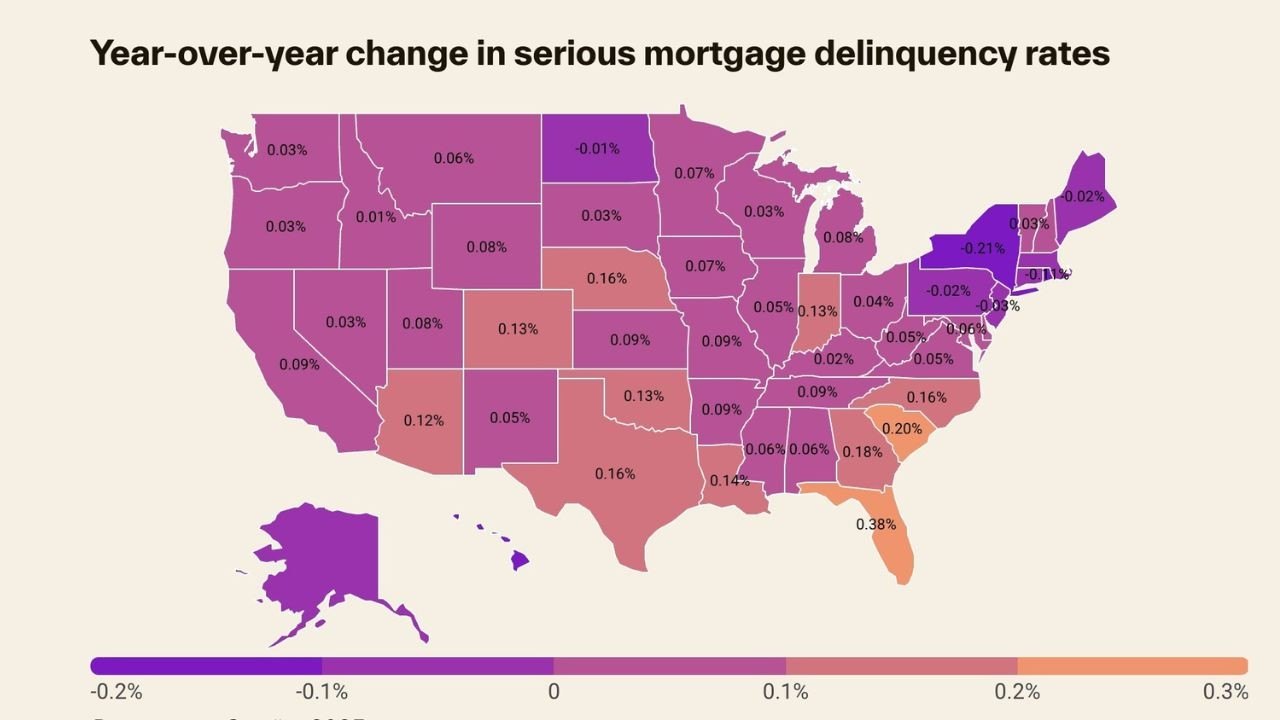

"Rising property taxes, insurance, and maintenance costs are outpacing income growth for most Americans, leading to an increase in serious delinquencies in mortgage payments."

"States hit hardest by natural disasters like floods and hurricanes are experiencing a surge in delinquent mortgages, exacerbated by escalating insurance costs."

"Florida and Louisiana are among the states with the highest mortgage delinquency rates due to factors such as soaring insurance premiums, property taxes, and slow home price appreciation."

"Homeowners facing financial challenges may choose to walk away from mortgages in states where costs outweigh property appreciation, contributing to the rise in foreclosures."

"Factors such as rising unemployment, high HOA fees, and a lack of affordable housing options are also impacting mortgage delinquencies in states like Texas, Colorado, and Georgia."

Rising costs of homeownership, including property taxes, insurance, and maintenance, severely strain Americans financially. This is causing a spike in serious loan payment delinquencies, especially in states affected by extreme weather events. Florida and Louisiana have particularly high mortgage delinquency rates due to soaring insurance premiums and rising property taxes. Additionally, many homeowners may abandon their mortgages when holding them becomes financially unfeasible. Other influencing factors include rising unemployment, high homeowners association fees, and a lack of affordable housing in states like Texas, Colorado, and Georgia.

#homeownership-costs #mortgage-delinquencies #extreme-weather-impact #financial-strain #housing-market-issues

Read at SFGATE

Unable to calculate read time

Collection

[

|

...

]