"The spark came from Richard Thaler () and Daniel Kahneman (Thinking, Fast and Slow), but the roots run deeper. In 1978, Herbert Simon won the first Nobel Prize for behavioral economics. Thaler later brought the field into public view with his "anomalies" articles in the Journal of Economic Perspectives between 1987 and 1990. The message was clear: People act based on their environments. Psychology had already demonstrated this in clinical practice; economics eventually followed."

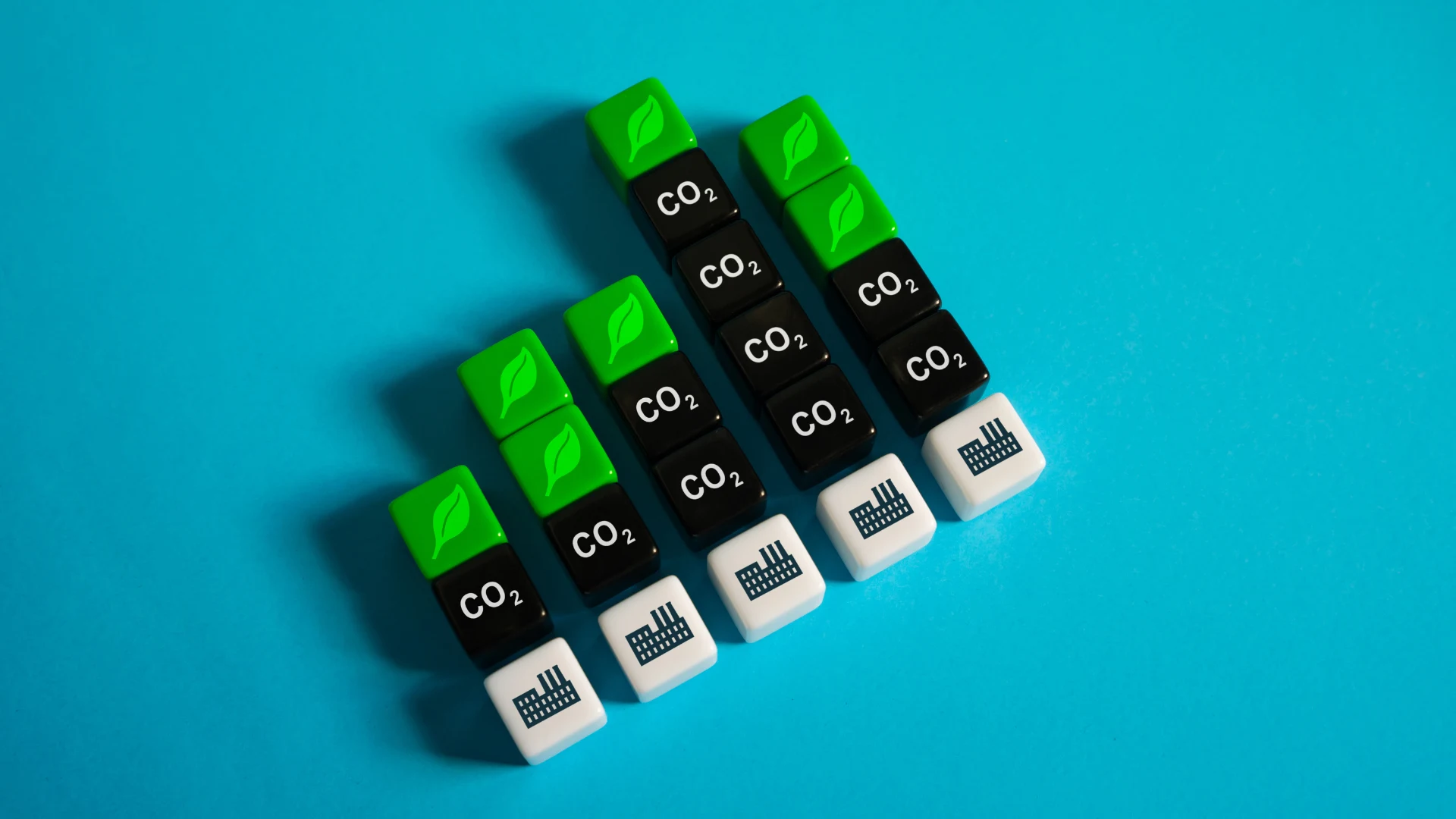

"But the field made a major oversight: It never invited accounting to the conversation. THE ACCOUNTING BLIND SPOT Accounting frameworks from FAF and IFRS are still designed for industrial modernity: Only positive, immediate cash flows count as value. Everything else is classified as a cost. That means the way a company treats suppliers, employees, communities, and the environment is booked as a loss, disconnected from value creation. Even ESG initiatives are paradoxically punished by the very systems that claim to encourage them."

Behavioral economics displaced the hyperrational homo economicus by showing that people act according to environments, culture, institutions, and social dynamics. Service economies increased demand for soft skills, spreading behavioral insights into HR, purpose, gender equality, quotas, and inclusive practices. Accounting frameworks from FAF and IFRS remain rooted in industrial modernity by recognizing only positive, immediate cash flows as value and classifying other outcomes as costs. Supplier, employee, community, and environmental investments are therefore booked as losses and disconnected from value creation. Current accounting rules can paradoxically penalize ESG initiatives. Large voluntary datasets, such as 10,000 Google reviews averaging 4.6 stars, carry statistical and qualitative significance.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]