"For sellers, potential costs may include transfer taxes, title insurance, escrow fees, and other related expenses. Buyers, on the other hand, may be responsible for costs such as appraisal and inspection fees, title and escrow fees, attorney fees, lender charges, and more."

"Closing costs, as a percentage of sales price, is around 0.5% to 3%, with an average percentage of 1.06% and a median of 0.88%."

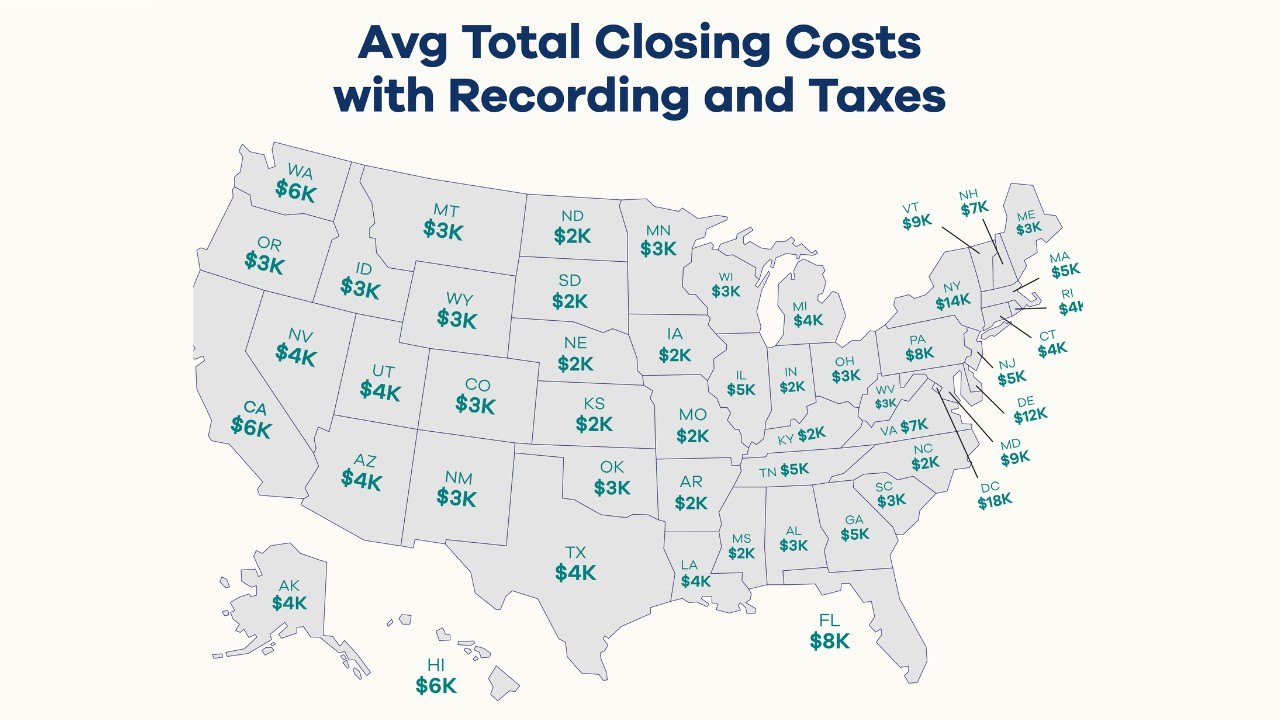

"Delaware leads the way with 2.99% of closing costs based on sale price. Homebuyers in that state are paying closing costs of approximately $12,157."

"People buying property in Washington, D.C., can expect to pay the most at closing: $17,545, based on the $735,243 average sales price."

Despite persistent high mortgage rates nearing 7%, mortgage applications increased by 12.5% for the week ending June 6, showing some resilience in the housing market. However, homebuyers must prepare for significant closing costs, which vary substantially by state. Delaware leads with about 2.99% of the sales price attributed to closing costs, while Washington, D.C. has the highest overall costs at approximately $17,545. The average closing costs percentage hovers around 1.06%, influenced greatly by state-specific transfer taxes that add to the buyer's financial burden.

Read at SFGATE

Unable to calculate read time

Collection

[

|

...

]