"CoreWeave's IPO pricing reflects growing investor skepticism in an overheated AI market, with major reliance on two customers raising concerns about financial stability."

"The New Jersey-based cloud provider lowered its share price from an expected $47-55 to $40, aiming to raise $1.5 billion with reduced share offerings."

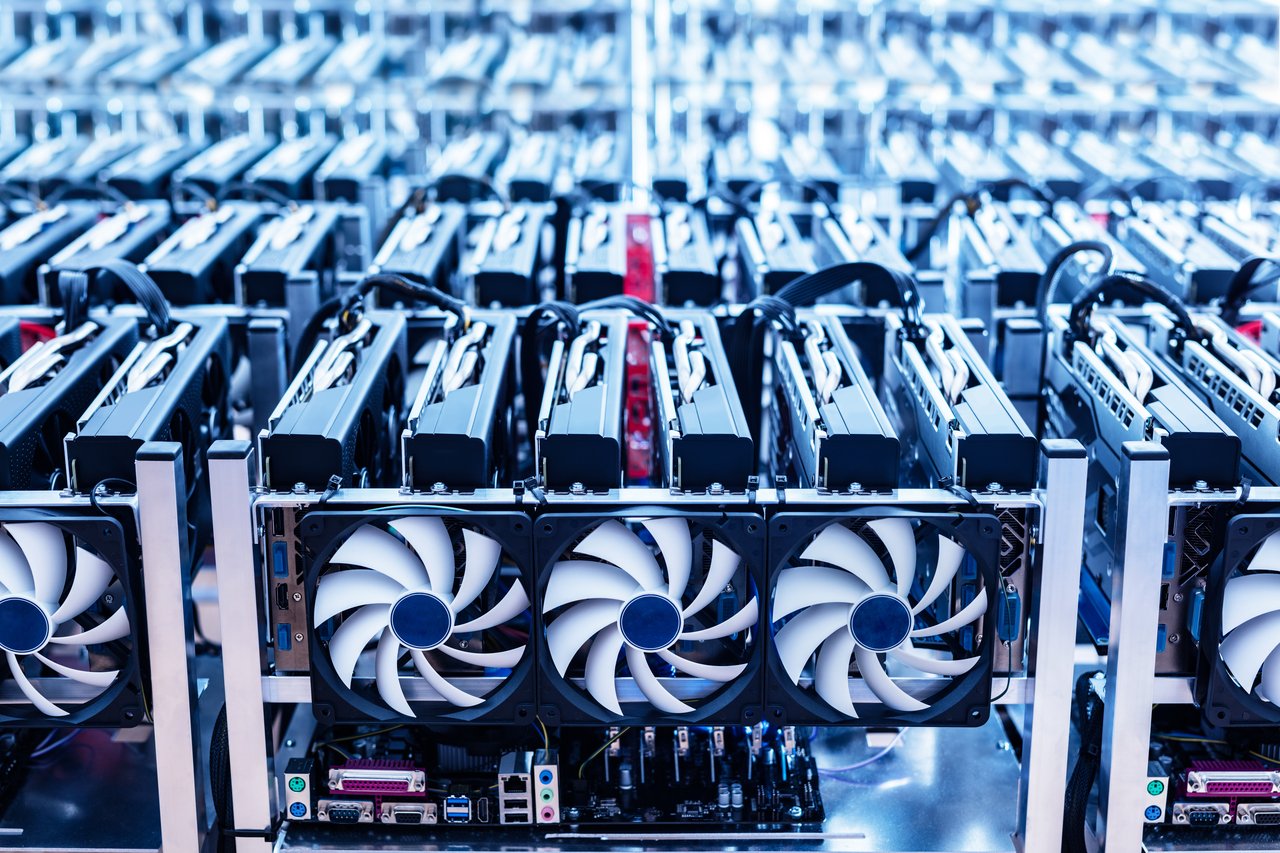

CoreWeave has scaled back its initial public offering (IPO) in response to investor uncertainties in the AI market and its significant reliance on a limited customer base. The company will price its shares at $40, down from the anticipated $47 to $55, and aims to raise $1.5 billion with 37.5 million shares instead of the initially planned 49 million. CoreWeave's revenues are heavily dependent on two customers, primarily Microsoft, which poses risks to financial stability amidst changing market conditions.

Read at Theregister

Unable to calculate read time

Collection

[

|

...

]